| « Back to article | Print this article |

We can't afford staff attrition: TCS chief

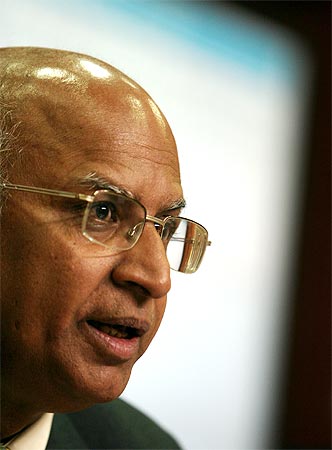

N Chandrasekaran, chief operating officer and managing director of India's largest information technology company, Tata Consultancy Services, is quick to say the smile on his face, after posting one of the best quarters since September 2006 (in constant currency), does not mean the business environment is back on track.

He remains watchful on the macro environment.

In an interview to Shivani Shinde, Chandrasekaran spoke on the general business environment, European crisis and growing concerns on staff attrition. Edited excerpts:

TCS registered an 8.1 per cent volume growth. Is growth back?

It is difficult to comment if this can be sustained and for how long. You have to keep in mind that this industry is very fragmented.

And, we continue to build capabilities and look at increasing the addressable space.

We are expanding into new markets, new services and into new industries.

As a result, there are more opportunities we go after, year after year. To that extent, there is definitely opportunity.

If the current environment is anything to go by, I think there is a lot of traction. But you have to worry about the macro-environment. It is very dynamic.

Click NEXT to read further. . .

We can't afford staff attrition: TCS chief

Managing costs has been a key focus area. How much headroom do you have to protect your margins?

We have improved our margins over the past four-five quarters by about 400-500 basis points.

We have done that with no pricing increase.

Rather, we have seen a dip in pricing. Going forward, managing the margins at the current level might be difficult and I do think there will be some pricing uptake.

Our focus will be to keep the selling, general and administrative expense under check. We will, though, continue to invest in sales and be frugal in G&A.

When do you see pricing moving up?

We are seeing good demand, discretionary spending is coming in and there is also the people pressure (supply side constraint), so given all these, there will be pricing uptake.

I would think the end of this fiscal (year) could be the time when we might see pricing uptake but, then, the macro environment could change.

Click NEXT to read further. . .

We can't afford staff attrition: TCS chief

What has changed in this one quarter for this sudden growth? Is it due to increase in discretionary spends?

That's precisely why we are talking about growth. As for manufacturing and hi-tech, we are yet to see an increase in discretionary spend.

Projects in these sectors are still about cost efficiency. It is in the banking, financial services and insurance, retail consumer goods, government, and utilities that discretionary spend is returning.

Of the 15 large deals we are pursuing, one-third is discretionary. I would still wait for another quarter to say discretionary spend is back.

There have been concerns that some of the large clients in Europe could renegotiate pricing.

I think from here, Europe will grow. But it will be slow.

As for the Personal Accounts Delivery Authority deal (in the UK, to be reviewed by the new government), we are interacting with clients, the project is on track. We will work with the government. I am not overly concerned.

As for BP, it's business as usual. With regard to Diligenta, we had to roll out a major release and migrate two million policies, which we did in this quarter.

We have a true state-of-the-art life, pensions and annuity platform on the cloud, fully operational.

More important, this can scale. We are in talks with prospective clients. There will be a few deals. I think this will give us a good kick-off in the non-linear initiative.

Click NEXT to read further. . .

We can't afford staff attrition: TCS chief

How do you plan to arrest (staff) attrition?

I don't like this number (13.1 per cent overall attrition in Q1 of 2011) and we certainly want to reduce this.

There are a number of initiatives we have put in place that focuses on retention. We cannot afford attrition at these levels.

The anti-outsourcing noise is certainly not reducing.

Regulatory pressures will be there. Especially when the economy is still under pressure and employment is still a concern.

If there are regulatory changes we will have to comply.We have to stay close and engage. We already have development centres, we are recruiting locals, we are trying to create a business model in which we benefit and stay relevant.

Click NEXT to read further. . .

We can't afford staff attrition: TCS chief

Does that mean work will shift to onshore or nearshore centres?

That could be one of the initiatives.

As for local presence, we are trying to scale Germany, France, Japan and China. As for the Cincinnati centre, this year the numbers should go up.

All the people whom we have hired are trained.

We will look at further hiring this year.

What would be your priorities or concern for the immediate future?

Focus on retention, get the non-linear model to deliver and innovation. I have said that by Q4 of FY2012, 10 per cent of our incremental revenue will come from non-linear initiatives.

For those who ask me if the regulatory change is a concern, my reply is, this is something we will have to do. It is part of our business model.