It's that time of the year again. July is the month that most of us come up with excuses, either at work or at home, to spend time with that person who assumes special importance this month. You guessed it right: it's your chartered accountant!

But if you have all the papers intact, why wait for him, just get started. Yes, tax filing could be as simple as that, thanks to the Internet and tax norms getting simpler every year.

This simplicity, clubbed with a little understanding of how the process works, could save you from those long, winding queues and last-minute tension outside Aayakar Bhavan.

Here are some tips on how you can help yourself with just a few clicks and be a responsible citizen of the country. Read on . . .

Due date

July 31 is the deadline for filing tax returns if you don't have to get your account audited. In other words, people whose income is not subjected to tax audit under the Income Tax (IT) Act, have just a month to file tax returns.

Other assessees have that bit of extra time. They will have to get it done by 30 September. Now that you have figured out the applicable due date, let's get started with the calculations. Don't sweat. It's not that tough a task.

Click NEXT to read on . . .

Heads of Income

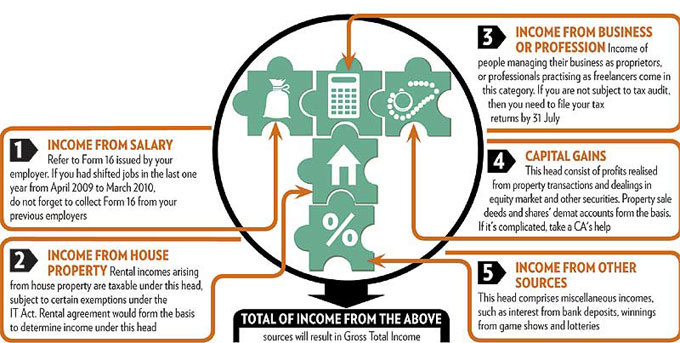

The Income Tax Act broadly recognises five heads of income, viz., income from salary, income from house property, income from business or profession, capital gains and income from other sources, such as interest from bank deposits, winnings from game shows, lotteries.

The total of income from the these sources will result in the gross total income. Form 16 issued by your employer(s), Form 16A issued by banks for interest on bank deposits, home loan certificates, papers for donation made and insurance premium payments and those relating to share transactions are the basic documents you must be ready with before you get started with the process.

Net taxable income

Certain categories of investments, savings and spending earn tax reliefs. These components, when adjusted against gross total income, leave you with the net taxable income, or the income upon which you pay taxes.

Proper documentation of these exemptions may free you of a big burden. Remember, you can claim exemptions only on those expenses that have been incurred between 1 April 2009 and 31 March 2010.

Exemptions under this head are broadly called Chapter VI-A deductions, which can further be split into 80C (see table) and non-80C deductions.

| Net it up |

| Certain categories of investments, savings and spending earn tax reliefs. So, what are you waiting for. Proper documentation of these exemptions may free you of a big burden: |

| *** Provident funds, voluntary provident fund |

| *** Public Provident Fund |

| *** Life insurance premium |

| *** Equity-linked savings scheme |

| *** Unit-linked insurance plan |

| *** Home loan principal repayment, stamp duty, registration charges |

| *** National Savings Scheme |

| *** Infrastructure bonds (subject to a maximum of Rs 20,000) |

| *** NABARD Rural Bonds |

| *** Pension funds |

| *** 5-year notified bank fixed deposits |

| *** 5-year post office time deposits |

| *** Senior Citizens Saving Scheme |

| * Maximum exemption under this section is restricted to Rs 1 lakh (Rs 100,000). |

Click NEXT to read on . . .

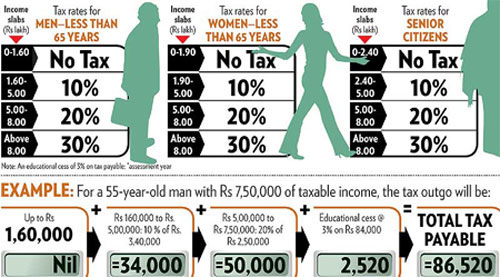

Choose your rates

Once you get an idea of your taxable income, the next logical step would be to find out which slab you fall under and compute taxes accordingly. (See Income Tax Slabs 2010-2011)

So now, you have the rough tax estimates. Next, you need to take credit for the taxes that have already been deducted from your income, for example, tax deducted at source (TDS) on salary and interest from bank.

If your tenant has paid rent after deducting the TDS, you can take credit for that also. After making adjustments for TDS, you arrive at the net tax to be paid.

If taxes have been excessively deducted from income, you need to file a return to claim refund for the same. On the other hand, if your tax liability is more than the TDS portion, you have to remit it to the IT department.

To pay taxes online, visit https://onlineservices.tin.nsdl.com/etaxnew/PopServlet?rKey=1512721343. Otherwise, you may download the challan from http://www.incometaxindia.gov.in/challans.asp and remit the same in an authorised bank. These forms would also be available in the income-tax office located in your city, or, alternatively, you can seek your tax consultant's help to do so.

Once the payment is made, the actual process of filing the return starts.

Click NEXT to read on . . .

Filing process

The traditional and time-tested method of filing your returns is to just hand over the papers to your auditor and he shall get the job done. If you don't have an auditor, you may seek the assistance of Tax Return preparers, who can be spotted in IT offices.

The second, or rather the new-age way, would be to file it online. "Filing tax returns online was a laborious task a few years ago. Not any more. Technology has developed quite rapidly and the government has taken good initiatives to make the portal easy to use," says Ravi Jagannathan, managing director and CEO, 3i Infotech Consumer Services, which has an online tax return filing portal taxsmile.com.

Would you give it shot? Go to Easy As It Comes and figure out which form you need to fill. The format of Saral II or ITR 1, ITR 2 and ITR 3 are quite similar and pretty easy to fill up, too. ITR 4, which needs to be filed by those earning business or professional income, requires a bit of extra attention to details, as information about profit and loss account and balance sheet are required to be provided in this form.

| Easy As It Comes | |

| Saral-II or ITR 1 | For individuals having income from salary / pension / income from single house property (excluding loss brought forward from previous years) / income from other sources (excluding incomes from lottery and from horse racing. |

| ITR 2 | For individuals and HUFs not having income from business or profession |

| ITR 3 | For individuals/HUFs being partners in firm sand not carrying our business or profession under nay proprietorship |

| ITR 4 | For individuals and HUFs having income from a proprietary business or profession |

If you feel you may find this procedure difficult, it is best you either take assistance from your auditor or online tax filing portals.

Click NEXT to read on . . .

But if these forms are too intimidating and make you feel more stressed out, don't panic, you can seek help from online tax-filing portals. A Google search will throw up many options. But remember you are going to be sharing some of your personal money details in the Web domain. So, bear in mind some critical pointers while selecting the website for tax filing:

Says Manoj Yadav, co-founder, www.taxspanner.com: "Some of these sites resort to using the data provided by you for other purposes and even sell your information to other persons." In some organisations, the finance departments may offer to file tax returns on behalf of their employees. In those cases, employees may be asked to sign on blank ITR forms. It's best not to do so. Insist on signing a properly filled form. Remember, once the return is filed the responsibility of any mistake lies with you.

There are two ways of filing your returns online -- e-filing using digital signature, or e-filing without a digital signature.

Click NEXT to read on . . .

Digital signature: It is a private key which ensures the authenticity of an electronic document, which may be an e-mail, spreadsheet or a text file.

In India, digital signature is issued by the Ministry of Corporate Affairs. So, if you have a digital signature, go to https://incometaxindiaefiling.gov.in/portal/individual_huf.do.

Choose the respective form, read the instructions mentioned in the excel file. Fill the sheets and save it on your computer.

To upload it, go to https://incometaxindiaefiling.gov.in/portal/uploadXML.do?assyr=2010. Create a user ID and follow the instructions that come on the screen.

If you don't hold a digital signature, don't worry. It's not mandatory that all tax filers possess a digital signature. In fact, for those who don't have one, the process is more or less the same as above, except that it would not be completely paper-free.

Once you are done with uploading the excel file from the income tax department's site, you need to submit ITR-V (or income tax verification form).

This can be downloaded from http://law.incometaxindia.gov.in/DITTaxmann/IncomeTaxRules/pdf/ay2008-09/FormITR-V.pdf). ITR V acts like a proof of filing. Fill in the form and mail it in an envelope to "Income Tax Department -- CPC, Post Box No.1, Electronic City Post Office, Bangalore -- 560100, Karnataka" within 30 days of e-filing.

You can expect to receive an e-mail from the income tax department, acknowledging the receipt of ITR-V. This is the final acknowledgement and concludes the e-filing process.

Click NEXT to read on . . .

Points to note

Why is PAN important? You do not require to submit any annexure with the tax form. Instead, you need to quote your PAN (Permanent Account Number), wherever required. While filling up details about TDS, check if the TDS receipt has the correct PAN. If not, insist that you get it corrected.

Sometimes, people unintentionally tend to conceal their incomes while filing the return. For example, many people generally forget to disclose the income earned from interest on bank deposits.

Remember, your bank accounts are linked through PAN. In case of scrutiny, such income will automatically show up and you may be penalised for not disclosing income from this source in your IT return, on a later date.

To avoid this situation, it is best you spend adequate time pooling in all your sources of income. You could also try and recollect instances where you were required to quote your PAN in the last one year.

Click NEXT to read on . . .

Filling the Excel Sheet. Filling the excel sheet on the I-T department's website is an easy task. Here is how you can excel at it:

So here you are, relieved of a major task, without having to request for the permission to go late to office or sacrifice some nice adventure treks or skip those family Sunday lunches. Hope this helps.