The Reserve Bank of India raised its short-term lending and borrowing rates by 0.25 per cent and 0.50 per cent respectively to bring inflation to six per cent by March 2011 from double digits now, but the move would put pressure on banks' interest rates.

In its monetary review, the central bank, however, kept its cash reserve ratio, the cash which banks are required to keep with RBI, unchanged.

The RBI raised upwards the inflation target from 5.5 per cent to six per cent and said that economy will grow by 8.5 per cent, up from earlier projection of 8 per cent, this fiscal.

The increase in short-term lending rate (repo) to 5.75 per cent and short-term borrowing rate (reverse repo) to 4.5 per cent will be effective immediately.

Earlier this month, RBI had hiked repo and reverse repo rates by 0.25 per cent as inflation remained above 10 per cent for the fifth month in succession. Prior to this, RBI had raised thrice its key rates, since January.

"Inflationary pressures have exacerbated and become generalised with demand side pressures clearly visible given the spread and persistence of inflation, demand-side inflationary pressures need to be contained," the RBI said.

The Monetary Policy intends to:

Click on NEXT for more...

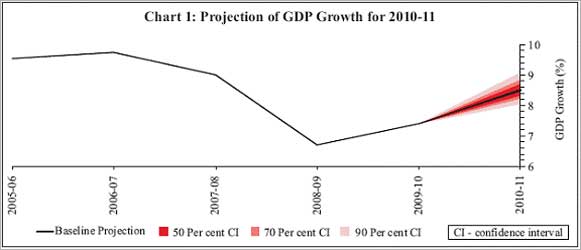

Taking into account the progress of monsoon so far and the prevailing global macroeconomic scenario, for policy purposes, the baseline projection of real GDP growth for 2010-11 is revised to 8.5 per cent, up from 8.0 per cent with an upside bias as indicated in April 2010 policy statement.

This upward revision is primarily based on better industrial production and its favourable impact on the services sector, giving due consideration to the global scenario.

The Reserve Bank's growth projection for 2010-11 is consistent with the median growth forecast from its professional forecasters' survey and other agencies.

It must be noted that the International Monetary Fund growth forecast for India at 9.4 per cent for calendar 2010 is based on GDP at market prices, whereas other projections, including that of the Reserve Bank, are based on GDP at factor cost. Adjusting for this, the IMF projections are in line with others.

Revising upwards the GDP target for this fiscal, the RBI said that indications are that the economy is steadily reverting to its pre-crisis growth trajectory.

However, uncertainty over global recovery could have possible adverse consequences for India, the apex bank said.

If the global recovery slows down, it will affect all emerging market economies, including India, through the usual exports, financing and confidence channels, the RBI said.

A global slowdown also carries the significant risk of a potential slowdown in capital inflows, it said, adding that it may act as constraint to domestic investment.

Click on NEXT for more...

RBI's projection of a higher inflation than the earlier estimate could partly be attributed to the government's move of raising fuel prices.

The central bank said there can be an up to one per cent impact on WPI-inflation owing to fuel price hike.

In June, the government raised petrol prices by Rs 3.5 a litre while decontrolling them and hiked diesel prices by Rs 2 a litre, LPG by Rs 35 a cylinder and kerosene by 3 a litre.

The RBI said that the monetary policy stance would be aimed at containing inflation while it will be prepared to respond to any further build-up of inflationary pressures.

On liquidity pressures in the system due to payment for spectrum, the RBI said though current market conditions indicate that liquidity pressures will ease, the system is likely to remain in deficit mode "for now".

In another significant move, the RBI said it will now undertake mid-quarter policy reviews, on the lines of major central banks abroad, "to take the surprise element out of the off-cycle actions."

These reviews will be conducted at an interval of about one and a half months, after each quarterly review, the central bank said.

Going forward, the outlook on inflation will be shaped by the following factors. First, the spatial and temporal distribution of rainfall in the remaining period of south-west monsoon 2010 is critical.

A good kharif harvest will act as a major dampener on short-term food price inflation. Second, global energy and commodity prices have been showing distinct signs of softening over the past few weeks as expectations of global growth have moderated.

If energy prices continue to decline, this will offset the inflationary impact of the recent fuel price hike.

Further, idle global capacity in a range of sectors will allow competitive imports to reduce the momentum in domestic prices. Third, consequent on the strengthening of domestic growth drivers, demand-side pressures are building up.