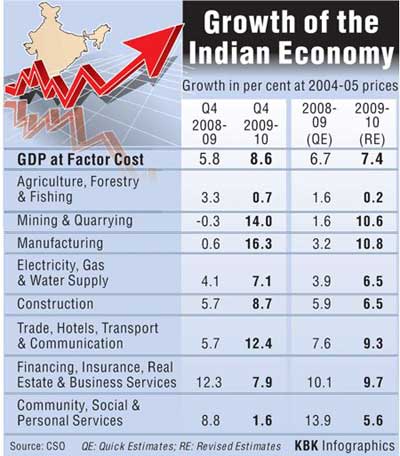

The economy is likely to grow around 8.5 per cent in the current fiscal if the country gets a normal monsoon, Prime Minister's economic advisory council chairman C Rangarajan said on Friday.

Rangarajan further said the growth in the manufacturing sector is likely to be over 10 per cent this fiscal. "One could expect the average rate of growth achieved during 2009-10 to be achieved this year also," he said.

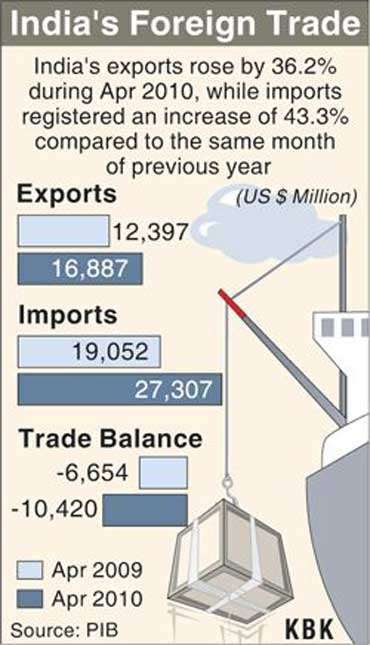

India's merchandise shipments rose over 36 per cent to $16.8 billion in April, marking the sixth straight month of growth for exports but prospects of a European debt crisis hitting order books once again is robbing sheen off the sector's performance.

Last April, exports had shrunk nearly 30 per cent to $12.4 billion as orders from the West and other major markets dried up in the wake of the worst recession in 60 years.

Click on NEXT for more...

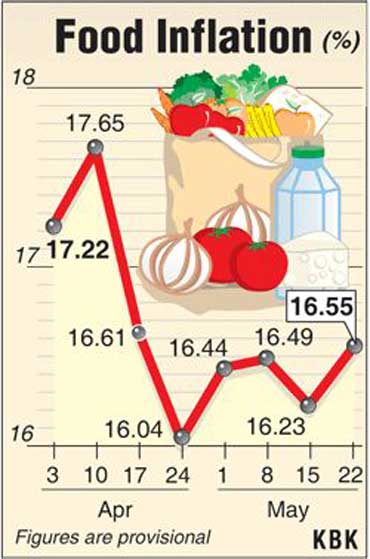

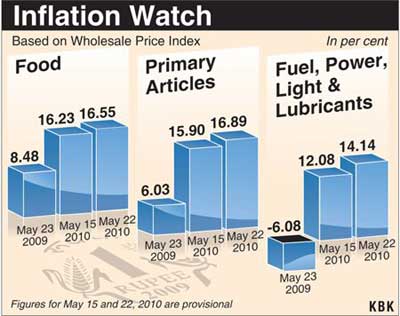

Food inflation rose to 16.55 per cent for the week ended May 22 on account of high prices of pulses, fruits and vegetables.

The uptick was mainly due to a 7 per cent increase in fish marine prices, 5 per cent rise in prices of poultry chicken, 2 per cent in prices of barley and masur each and one per cent increase in prices for fruits and vegetables.

However, coffee turned cheaper by 5 per cent while wheat prices eased by 1 per cent.

Click on NEXT to read more...

Inflation is still higher than the central bank's comfort level and the country's 7.4 per cent expansion seen in the fiscal year 2009/10 is encouraging but not surprising, Reserve Bank of India Governor Duvvuri Subbarao said.

Click on NEXT for more..

There has been no slackening in pace. The Sensex established itself comfortably above the 17k summit to end at 17,117, higher by 95 points and the Nifty ended at 5,135, up 25 points.

The midcap index ended higher by 14 points at 6890 and the smallcap index gained 12 points at 8640.

The day had started on a rather sober note. With Wall Street ending virtually unchanged and Asia in no mood to press on the accelerator, we seemed to be heading for a quiet session.

No one would grudge that, for our bourses had moved higher in six of the seven previous trading sessions and accumulated gains of 6.2 per cent in the process.

Moreover, the impending weekend would have postponed further buying. But Europe seemingly had other ideas.

The FTSE, DAX and CAC added upto a per cent each and this was enough to rouse our indices from their self-imposed stupor.