Arijit Barman & Kalpana Pathak in Mumbai

Will they, won't they? Will Brothers Ambani make a joint appearance at the Reliance Industries Limited annual general meeting on Friday in Mumbai?

That's the question on every shareholder's mind as RIL convenes for its first AGM after the famous rapprochement between the brothers.

If they do, culminating a process which began with the junking of the non-compete agreements on May 23, no one can fault them on the timing; Friday will be exactly five years to the day they formally split the empire they had built with their father Dhirubhai Ambani.

A coming together of the brothers will combine their separate, complementary and equally formidable strengths: Mukesh can execute mega projects in record time and derive value from scale; Anil is deft with finance and all things related to consumers and brands.

. . .

Will the Ambani brothers tango for synergy?

Image: Dhirubhai Ambani along with then US President Bill CLinton. Dhirubhai is flanked by his sons.Photographs: Rediff.com library

"Both are much more than your normal person," said Gita Piramal, business historian.

"What amazes me about Anil is how fast-paced he is and how sophisticated is his reading of the consumer's psyche, while I am in awe of Mukesh's note-taking abilities. It shows how methodical he is, and his ability to listen, distill knowledge and break it down for the entire organisation."

While they did complement each other famously when the empire was intact, the two have grown at a scorching pace even separately.

Soon after Kokilaben brokered the split of the group between her sons on June 18, 2005, the Sensitive Index of the Bombay Stock Exchange, which had until then remained depressed by the seven-month feud, soared to a record high. That, in retrospect, was just the flag-off.

. . .

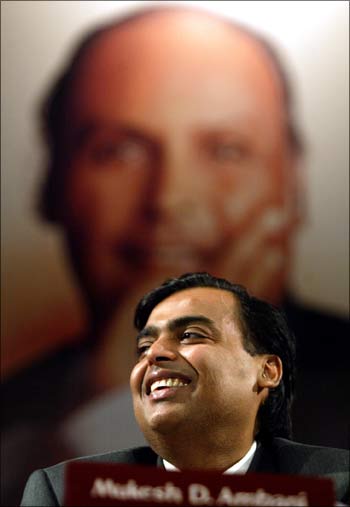

Will the Ambani brothers tango for synergy?

Image: RIL chairman Mukesh Ambani.Photographs: Reuters

From 2006-07 to 2008-09, for which audited data is available, the net worth of Mukesh's listed entities, flagship RIL and Reliance Industrial Infrastructure Limited, has gone up by 49 per cent.

The total assets have grown 59 per cent in the same period. The latest unaudited numbers for 2009-10 point to a phenomenal 79 per cent jump in turnover and a 32 per cent rise in net profit.

The current market capitalisation of RIL (as on June 17) has seen a 52 per cent jump since March 2007.

Some may say it is unfair to compare Anil's achievements with Mukesh's, as most of the younger brother's businesses are start-ups of sorts and five years is nothing for a young group.

But his growth has been no less enviable. His Reliance Anil Dhirubhai Ambani Group has emerged as one of the Top 3 business houses in India in the five years since its inception.

. . .

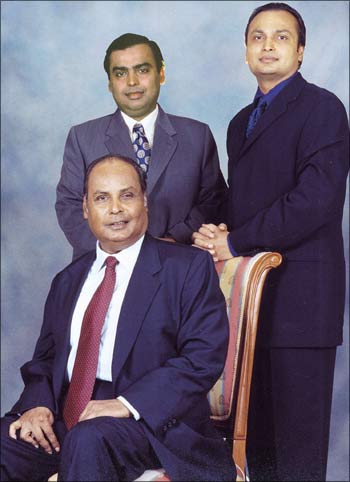

Will the Ambani brothers tango for synergy?

Image: Mukesh and Anil Ambani with their father Dhirubhai.Photographs: Reuters

Today, it is a family of 150,000 professionals dabbling in five key businesses: Financial services, power, infrastructure, entertainment and telecom. In all these, except life insurance, its group companies are among the Top 3.

ADAG currently has eight listed entities.

Riding on the high growth of its telecom and power businesses, ADAG's net worth has seen a phenomenal 111 per cent jump in four financial years starting 2006-07.

Its current turnover, at Rs 42,267 crore or Rs 422.67 billion (unaudited 2009-10), is 60 per cent higher than what it was in 2006-07.

Its market capitalisation, though, has not kept pace, rising 20 per cent.

The brothers have also gone global: Mukesh has shale gas acquisitions and gas station safaris in the US and Africa, while Anil has gone to Hollywood.

RIL, along with its subsidiaries, has in the last half a decade outgrown its peers in India Inc.

. . .

Will the Ambani brothers tango for synergy?

Image: Mukesh Ambani.Photographs: Reuters

Gas flowing from the deepwater blocks in the Krishna Godavari basin is poised to change the energy map of India.

The second refinery is ready in Jamnagar. Retail has a new expat boss who is set to re-engineer the business.

Next in queue is a $5-billion thrust in telecommunications. Power and pharmaceuticals are also on the anvil.

ADAG's growth, however, has come at a price. As its cash-hungry businesses of telecom, power, and insurance have grown, debt has burgeoned.

The recent decisions to hive off the telecom tower business, which carries debt of over Rs 15,000 crore (Rs 150 billion), and sell up to 26 per cent equity in Reliance Communications will ease the situation.

There have been speed bumps along the way for both. RIL had to tweak its farm-to-fork retail strategy and get a new top deck.

Its estimates of crude oil prices came a cropper, leading to temporary setback to the bottom line.

. . .

Will the Ambani brothers tango for synergy?

Image: ADAG chairman Anil Ambani.Photographs: Reuters

Globally, too, RIL is yet to establish its dominance with at least two failed attempts to buy big petrochemical assets.

Anil, the financial whiz kid, has had to realign his portfolio, especially offerings in consumer and retail finance.

RCom, like its peers, has been a victim of low margins, falling average revenue per user and rising subscriber acquisition costs.

"Anil should deliver on the big power projects he has undertaken," said Nitish Sengupta, chairman of the Board for Reconstruction of Public Sector Enterprises. Sengupta has seen the two brothers grow up very closely since the 1980's.

"I would have expected more growth in power. . . Entertainment he has gone in more deeply and telecom is doing very well on the foundation laid by his brother.

Mukesh, on the other hand, is going the Dhirubhai way.

Step by step, building projects of tomorrow in a synchronised fashion. Retail, however, is going on in a modest scale," he said.

That is why the new-found bonhomie may be just what the doctor ordered. Team Ambani, unimaginable two months ago, is a reality.

And Friday's AGM may raise the curtains on a new era. At the same time, it also makes the mind wander.

For instance, now that they are together in telecom, will they join hands for power? What about financial services and infrastructure? One can go on ruminating.

. . .

Will the Ambani brothers tango for synergy?

Image: Anil Ambani seeks the blessings of his mother, Kokilaben. Also seen is Anil's wife Tina.Photographs: Courtesy: Reliance Communications Ltd

"Both these groups have sizeable presence in strong and emerging sectors like power, telecom, finance and infrastructure.

"The next decade belongs to these sectors, and companies that have invested in them will see impressive growth," said veteran Reliance watcher Deven Choksey of KR Choksey Securities.

Another Reliance observer, who did not want to be named, said: "Both the brothers had to come together if Reliance as a brand had to be salvaged and Mukesh Ambani had to finance most of the businesses.

Every business that Anil Ambani entered into in the past five years, it was never the leader and the sectors have had better players.

With Mukesh Ambani eyeing new sectors, expect the rules of the games to change . . . The erosion of market share that the Ambanis saw in the last few years, particularly in power and telecom, may get arrested to some extent."

article