| « Back to article | Print this article |

10 things NOT to do with your money

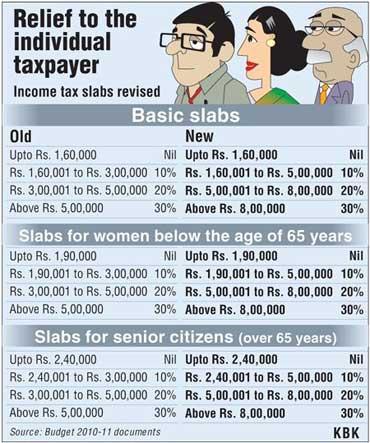

Budget 2010 has brought good news to the salaried class. With the increase in the income tax slab limits, people with income up to Rs 1.6 lakh* will pay zero tax. People with income between Rs 1.6 lakh and Rs 5 lakh will pay 10 per cent tax. So if you earn between Rs 3 lakh to Rs 5 lakh currently, you can save around Rs 20,000.

If you earn between Rs 5 lakh and Rs 8 lakh, you can save up to around Rs 30,000. This is great news for the taxpayers as it comes after a recessionary period when pay hikes were frozen and jobs slashed.

But with more money in hand, we tend to spend more. However, with rising inflation, one has to be very prudent about every penny spent. Here are some tips on what you must NOT do with your hard earned money.

Click NEXT to read further...

* 1 lakh = Rs 100,000

10 things NOT to do with your money

1. Don't spend on impulse, make a budget

You need to calculate how much money you need every month. You should have a clear idea as to where your money goes. A good planning and budgeting on household and other expenses will help you control your finances. Identify your your wants and needs and make a clear choice. Always keep an account of what you are spending on.

2. Don't invest all your savings in one basket

Stocks could help you reap huge profits in a short period of time but it is always advisable to be careful about the allocation. You must opt for a mix of cash, bonds, equities, gold and property to be safe. Do not invest money only on the basis of what your friends or relatives say. You must identify your priorities and set realistic goals.

10 things NOT to do with your money

3. Don't panic if prices fall or markets crash

Markets go through ups and downs but that should not get you worried. Keep a balanced portfolio. If realty or gold prices fall, don't go for a panic selling. Wait and watch and try to get the best from your investment whether it is stocks, gold or real estate.

4. Don't forget to keep a tab on the investments

You must keep a watch on interest rate changes and market fluctuations. If it is stocks you have invested in, check out how the companies are performing, read up, be alert.

You have to be proactive to the changes and be actively involved to make your money grow. Invest in plans that offer you tax exemption like Life insurance payments, contributions to Employees Provident Fund (EPF), Public Provident Fund, Nattional Saving Certificates including accrued interest, Unit Linked Insurance Plan, 5-Year fixed deposits with banks and Post Office, Repayment of Housing Loan, National Pension Scheme (NPS) and Infrastructure Bonds.

10 things NOT to do with your money

When you are investing, forget about short-term goals. Set investment goals for at least 5-10 years so as to make the most of your investment. Equities can offer returns ranging between 15-20 per cent annually. Rather than leaving your money idle in savings account, you can opt for flexi-deposits, where banks transfer the idle money to the term deposit. However, if you are looking at short term savings, you can opt for postal saving plans, government bonds, mutual funds. For long term plans, public provident funds (PPF ), life insurance, long term bank deposits will be beneficial.

6. Don't go for too many loans

When you don't have money to upgrade your lifestyle, you may opt for a car or home loan. Ideally, you must not go for too many loans at the same time. Buy things one at a time so that you have enough money for yourself and to save and you are not too indebted. Don't spend too much with your credit cards. Try and pay your credit card dues as soon as you can. If you carry forward the outstanding dues, it will turn out to be a huge burden.

10 things NOT to do with your money

7. Don't join any scheme without verifying the credentials

Innocent investors get duped easily. You must be careful about taking advice from crooks who pose as smart investors or advisors. They may lure you with all kinds of schemes of getting higher returns at the shortest possible time. Always cross-check facts and figures and their credentials before you invest in any plan. You must also be aware of the fine print. While doing banking transactions online, one must be extremely careful. 8. Don't invest your money in risky plansHigh-risk plans may seem enticing but one must be very cautious. It is not advisable not to indulge in risky investment plans. You must start saving with smaller amounts and try to save more as you go along. You must seek the advice of a good financial planner or choose low-risk plans.

10 things NOT to do with your money

Most people are very bad at remembering dates of maturity of their fixed deposits, or savings schemes or dates of paying premium. Make sure you keep a diary of all the saving plans, their maturity dates and remember to either reinvest the money or go ahead with any plan that you have in mind when the plan matures. All the papers must be safely kept in either a bank locker or any safe place. You must also keep a photocopy of all the important papers incase you lose the original.

10. Don't spend money on frivolous things

Calculate your monthly expenses and see how much you can save every month. Make a list of things you can and cannot avoid. Learn to strictly stick to you plans. Look out for cheaper options, the most expensive product may not necessarily be the best. Buy products as per your need, make a list of things when you go out shopping. This will help you spend less.