| « Back to article | Print this article |

A miracle called Tirupur!

One look at the unruly traffic, the noise, the pollution and the dusty, dug-up roads and you could be forgiven for wondering if you are in one of the many such small towns that dot the Indian landscape. But you couldn't be more wrong.

This place is pretty special, although there is no indication to the fact that it is one of the largest foreign exchange earners for India. Or that the biggest global brands get their garments made in this small city and that the garments made here are sold in the largest retail stores across the world.

Welcome to Tirupur (occasionally spelled Tiruppur), a city of around 600,000 people in Tamil Nadu. It has a population of over a million in the urban agglomeration and has been registering an annual growth of 30 per cent since 1998.

This city exports knitwear worth Rs 11,000 crore (Rs billion) (Rs 110 billion) a year but it has no airport -- the nearest one is in Coimbatore (50 km away) and the nearest seaport is in Chennai.

The first stop for any international buyer of Indian garments is Tirupur. Buyers from 35 countries frequently visit Tirupur. Tirupur can deliver customised samples in less than 12 hours; half a million pieces in a matter of days.

Click NEXT to read on. . .

A miracle called Tirupur

There is a nondescript railway station at Tirupur and all the trains that go to Coimbatore stop here for less than 10 minutes. However, there is an inland rail container depot at Tirupur.

How it all began

The amazing growth of Tirupur as the Indian hub of garment exports started only in the late seventies. Before that, this small town was the manufacturing hub of white knit inner wear (the first knitwear unit in Tirupur was set up in 1925 and it emerged as the prominent centre for knitwear in South India in the 1940s) thanks to the Noyyal river and the cotton belt all around the city. With the Manchester of India -- Coimbatore -- next to Tirupur, it was only natural that the city should evolve as the garment manufacturing powerhouse of the country.

Initially, knitwear from Tirupur went to suppliers and exporters in Kolkata and Mumbai. But in the late seventies, Italian garment importer Verona chose to go directly to Tirupur to buy white T-shirts, and that was the beginning of the rise of a new Tirupur.

In short, Verona was the man who brought European business directly to Tirupur. In 1981, European retail chain C&A also came to Tirupur. In no time, other international stores too started approaching the garment manufacturers in Tirupur.

Click NEXT to read on. . .

A miracle called Tirupur

Only a handful of manufacturers exported garments then and the total garment export turnover was about Rs 15 crore (Rs 150 million) in 1985. By 1990, exports had shot up to Rs 300 crore (Rs 3 billion). Today, almost 80 per cent of India's cotton knitwear exports happen from Tirupur. There are 6,250 units involved in various operations of the textile industry here. And the exports stand at Rs 11,000 crore (Rs 110 billion)!

Initially, direct garment exports from Tirupur were only to Europe. The market in the United States always demanded huge volumes which most of the exporters in Tirupur were scared to touch. The European market was more fashion-conscious and demanded goods in only thousands of pieces that Tirupur could comfortably serve.

Those who made Tirupur the export hub

The yarn going around the town is that the very air in Tirupur turns everyone into, first, a garment manufacturer and then an exporter.

Take for example, Rajan of Rajsujee International, who was a banker once. The success of many exporters that he dealt with while being in the bank made him set up his own unit in 1995 with only Rs 200,000 by way of capital and 20 employees. In the first year, his turnover was Rs 650,000. Today it is Rs 20 crore (Rs 200 million) and 450 people work for him now. This is not an isolated case; there are many, many such amazing transitions and rags-to-riches stories in Tirupur.

Click NEXT to read on. . .

A miracle called Tirupur

S Dhandapani of Sreenidhi Apparels Pvt Ltd, a native of Tirupur, decided to start the company in 1991 because he saw 'everyone' getting into garments exports! "So I also jumped into this," he reminisces.

He started operations with Rs 400,000, 15 employees and 10 machines. He was first a garment supplier to an exporter and then began exporting directly to Canada, France, Spain and the United States. Today, his turnover is Rs 20 crore (Rs 200 million) and 300 employees work for him.

Raja Shanmugam, another native of Tirupur, started Warsaw International in 1989 with a capital of Rs 500,000 and 20 people. In the first year, he did not go for direct exports. And the turnover after the agent's cut was Rs 20 lakh (Rs 2 million). Next year, he doubled his turnover. In 1993, he decided to venture into the European market directly and the turnover grew to Rs 2 crore (Rs 20 million). Today, Warsaw International has a turnover of Rs 60 crore (Rs 600 million) and employs 1,500 people.

According to Shanmugam, there is no way a manufacturer cannot turn in a profit. "This is the only industry which has a 60- to 90-day cycle. So we can turn our investment over four to six times a year."

Click NEXT to read on. . .

A miracle called Tirupur

Haresh N Badani of Paras Apparels was one who entered the fray as early as in 1989. He started his company with Rs 200,000, six sewing machines and 20 workers. The market was so good that he had a turnover of Rs 30 lakh (Rs 3 million) in the first year. In ten years, he grew at a rate of 70 per cent annually, and by 2008, his turnover had touched Rs 8.5 crore (Rs 85 million).

Another success story is that of Vijaya Kumar, who started CBC Fashions. He started his company in 2004 with Rs 1 crore (Rs 10 million), 50 machines and 60 employees as an exporting unit though his father's parent company had been manufacturing and supplying innerwear to some of the major brands in India for 34 years.

His first customer was an importer from Belgium, and in the first year, his turnover was around Rs 4 crore (Rs 40 million) which grew to Rs 6 crore (Rs 60 million) the next year.

Today, CBC Fashions deals directly with retailers in seven countries in Europe and also in the United States. The current sales are Rs 40 crore (Rs 400 million). Almost 600 people work for the company.

Click NEXT to read on. . .

A miracle called Tirupur

Since there are many manufacturers in Tirupur, there also are many trading agents who act as intermediaries between the importers and the manufacturers. Vishal Kumar of International Trading Inc has seen only growth ever since he came from Delhi to Tirupur to start his trading office 14 years ago.

Soon after college, he decided to shift base to Tirupur because "it was the place where the last word in textiles was." If it was 20-25 per cent annual growth till recession hit the global economy; it has been moderated down to 5-10 per cent now.

V S Balraj, managing director of Lea Cool India, has been a buying agent in Tirupur for the last 20 years. His clients are based in Finland, Sweden, Germany and a few Scandinavian countries.

The US market and the recession

If Tirupur was growing at 30 per cent every year, the exporters too were growing at an annual rate of 20-25 per cent. Then recession hit the global economy and exports earnings to the tune of Rs 11,000 crore in 2007 dropped to Rs 9,500 crore (Rs 95 billion) the next year, a drop of more than 10 per cent. Almost 40 per cent of Tirupur's exports are to the US, 30 per cent to Europe and the rest to other parts of the world.

Click NEXT to read on. . .

A miracle called Tirupur

Unlike the fashion-conscious European market, the US market is voluminous and imports cheap garments in millions of units. However, the margin from the European market is double that of the US market. Buying agent Balraj says that the US market is as big as Europe and the United Kingdom together.

With exports dropping, many a textile unit in Tirupur started to gasp for survival. Thousands of people lost their jobs and returned to their native places. Those who decided to remain had to work on sharply reduced salaries, and production was down in many units by almost half.

There is unanimity in the opinion is that units that suffered the most were the companies that exported only to the US as compared to those who had European customers.

Shaktivel, president, Tirupur Exporters Association (TEA), corroborates that recession in the global economy affected exports from Tirupur by around 30 per cent. "There were huge job losses and there were few enquiries from the US. But now, slowly, we are getting queries for garments. Things are getting better."

Click NEXT to read on. . .

A miracle called Tirupur

But one man's poison is another man's meat. So it was with Tirupur and the global economic slowdown as well. Take, for example, people like Rajan of Rajsujee International. Rajan benefited a great deal from the recession. As he was exporting mainly to a discount store in the UK, his turnover actually went up as during a recession times, people prefer to shop in discount stores!

Rajan believes that the global market has recovered by 40-45 per cent already.

Another exporter who saw his turnover increase by as much as 50 per cent, when many other units were facing closure due to the recession, was Badani of Paras Apparels. As he was involved in supplying cheap garments to the US, he never felt the impact of recession. "Because my garments were as cheap as two to three dollars apiece, they were in real demand. Recession was a good time for me. The US market is huge and the price is low. If you don't achieve the target, you are finished, but business with the US can bail you out. That's for sure!"

On the other hand, Dhandapani's business profits went down by 25 per cent during the recession although his turnover grew.

Click NEXT to read on. . .

A miracle called Tirupur

Two years ago, 40 per cent of the turnover of Raju Shanmugam's CBC Fashions was from one customer in the US market. If he had exported 700,000-800,000 pieces annually in the last two years, the orders came down to 500,000 last year. There was a more than 20 per cent dip in the revenues in 2008-09. "Now business has slowly started to pick up. Enquiries are coming in but what is worrying the exporters is the strengthening of the rupee and the weakening of the Euro and the Dollar," said he.

Cheap goods demand, but Tirupur is getting costly

Although the recessionary trend is now abating and things have begun to look up, what is worrying the exporters in Tirupur most is the spiralling cost of production. With the hike in prices of yarn, electricity and the dyeing cost, the huge increase in the labour cost has made the garments from Tirupur costlier.

Vijayakumar of CBC Fashions admits that the orders are coming from the US but the rates they offer are very low which do not offer him, and others like him, much profit margin.

While the cost of making a garment in India has doubled, the US importer offers the same price that he had offered three years ago! Even the buyers in Europe who were not bothered about the price till recently and looked only for quality and fashion want only cheap goods now.

Click NEXT to read on. . .

A miracle called Tirupur

Badani's advice to those eyeing the US market is, "Innovate on cheap garments and you will be a winner."

Labour shortage

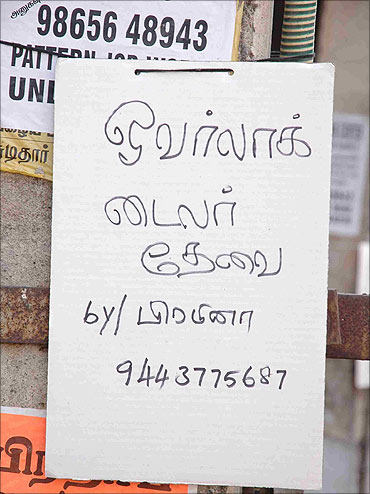

Apart from the rising costs, the biggest challenge Tirupur faces today is labour shortage. On lamp posts, tree trunks, gates, walls, almost everywhere, you see handwritten posters asking for people to work in garment factories.

Perhaps you see these images only in Tirupur and nowhere else in India. There is a labour shortage of almost 40 per cent, which is alarming!

Textiles is one industry that is so labour-intensive that to make one garment, you need the services of ten people. After agriculture, the textile sector is the second largest employer in India.

Click NEXT to read on. . .

A miracle called Tirupur

On the gate of the S Dhandapani's Sreenidhi Apparels, you can see a board asking for people to join as workers. "Now we have a 20 per cent labour shortage which will go up to 30-40 per cent once the recession gets over fully," says Dhandapani.

Most of the exporters feel that a majority of their workforce who used to come from the southern part of Tamil Nadu have gone back to their villages because of the NREG scheme and the Re 1 pre kilo rice that the ruling Dravida Munnetra Kazagham government offers. "With free TVs given to all, most of them have become lazy," S Dhandapani adds.

Bangladesh, the competitor

The next formidable challenge facing Tirupur is Bangladesh which is snatching away most of the bulk orders from the US. India faces tough competition from Vietnam and Cambodia, too. Almost 60 per cent of the world's cotton garment market has been taken over by Bangladesh as their products are 30 per cent cheaper and qualitatively, they are as good as what India produces!

The underdeveloped tag of the country gives them the additional advantage of the waiver of import duty in Europe.

Click NEXT to read on. . .

A miracle called Tirupur

Ivan Raffaini, sales manager of MCS Group of Italy, has been doing business with Tirupur for the last ten years. His job is to supply dyeing and finishing machines. He also does business with Bangladesh.

"There is a quality difference in the machines that India and Bangladesh use. They (Bangladesh) use better, technologically advanced machines. So they produce more garments faster. They have the desire to get new machines unlike many in India."

Balraj, who also buys goods from Bangladesh, has seen the changes that have taken place in 20 years. "The golden period for India was the nineties. At that time, we were exporting mainly to Europe, and we had only China as our competitor. There was no talk of Bangladesh then. Almost 60 per cent of world's cotton garments were exported from India, while China dominated the synthetic garment scene. Nobody was price-conscious then; quality was more important. But price is the major factor today, and India's dominance is over. Every country now prefers to buy from Bangladesh."

Sensing the importance of Bangladesh, Vishal Kumar of International Trading Inc has opened an office there and started sourcing from there too. "Labour is cheap. Energy is cheap. All the machines are run by gas. They have advanced technology because the government concentrates on textiles exports."

Click NEXT to read on. . .

A miracle called Tirupur

Unless Indian companies add more value to their products, it will be tough for them to survive, Vishal Kumar feels.

"Textile exports being the major industry in the Bangladesh, the government there has given all the facilities to exporters by technologically upgrading all the machines and setting up huge establishments. Though textile is the second-largest job provider in India after agriculture, we don't get focussed attention from the government as textiles exports is only one of the many businesses in India," he adds.

Cost of cotton

Although India is the second largest producer of cotton in the world, the country has less than 3 per cent share in the textile market internationally. Indian textiles also account for 38 per cent of the country's total exports, but Bangladesh which is dependent on India for cotton has 6 per cent market share. China, meanwhile, enjoys a 26-28 per cent in the world market.

Many people feel that if India had worked on its strengths, it could have had a 10-12 per cent share in the international market. They also complain that the Indian government exports most of the cotton that is produced in the country and that the minimum support price of cotton has gone up by 30 per cent in the last two years.

Click NEXT to read on. . .

A miracle called Tirupur

Consequently, the manufacturing price of yarn too went up by 30 per cent and dyeing costs went up by 20 per cent. On the whole, there is a 20 per cent increase in the cost of a garment.

Another problem that exporters face is the firming up of the Indian rupee against the US Dollar and the Euro.

Future of Tirupur

So is the future of Tirupur bleak? Yes, according to some exporters like Vijayakumar. "Tirupur will be wiped out if the cost in producing garments increases like this," he says.

According to Badani, "Tirupur grew because of the hard working skilled labour force and if the labour shortage continues like this, I see the importance of Tirupur waning." Dhandapani and S Sreethar add their support to this view.

Click NEXT to read on. . .

A miracle called Tirupur

But Tirupur Exporters Association chief Shaktivel sees no challenge to the supremacy of Tirupur in the near future as he expects exports of around Rs 10,000-20,000 crore (Rs 100-200 billion) this year too, despite the competition from China and Bangladesh, the dearth of workers, and the escalating costs of making garments.

Raja Shanmugam and Vishal Kumar also see only growth for Tirupur. "Tirupur is only going to grow. There is no doubt about it. Products coming from here will change; value-added items with stress on fashion will become Tirupur's strength."

Like Rajan says, the recession has filtered the all-and-sundry in the field and only the toughest survived. "So I see only bright future for Tirupur."

For India's sake, one hopes the miracle of Tirupur continues to dazzle the world in the future too.