| « Back to article | Print this article |

How affordable housing can avert urban disaster

The slump in the residential property market saw established Indian property developers turning to affordable housing, prompting immediate buyer interest. Thereafter, traditional buyers who had withdrawn first started returning to the luxury end of the market.

This created a novel phenomenon -- a market with a bottom and top but no middle, the Rs 30-75 lakh (Rs 3-7.5 million) segment.

More recently, there has been a revival in this segment too, but this has been accompanied by a decline in activity in the affordable segment. Thus the housing scenario may be going back to what it always was with the affordable segment losing its brief moment in the sun as a result of waning interest of both buyer and seller.

Low absorption rates are apparently causing builders to pay attention to traditional areas, helped by revival of buyer interest. The period when builders had to innovate to remain in business seems to be ending.

If this development were to take root, then it would be a setback. As the economy has grown rapidly in recent years, there has been a rise in interest in the bottom of the pyramid on the part of the corporate and organised sectors.

Click NEXT to read on . . .

How affordable housing can avert urban disaster

The semi-urban and rural markets have been a continuing source of opportunity for not just FMCG firms but, more recently, consumer durables producers too. This has meant better value for money and access to well-established brands for those outside urban centres.

An extension of this phenomenon to housing for the urban poor is vital in view of the rapid urbanisation taking place and likely to continue indefinitely.

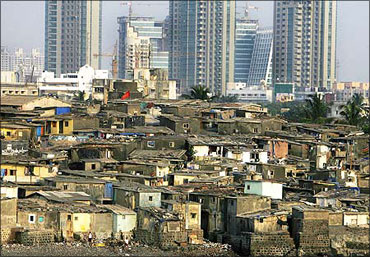

Unless affordable housing becomes a viable and attractive business proposition, the quality of life in urban India will not improve but get worse. Around half of those in some metros currently live in slums. It is frightening to think what will happen were this ratio to worsen.

Low absorption in affordable housing means that those who live in slums under horrible conditions are not able to live better because the products on offer are not suitable.

Click NEXT to read on . . .

How affordable housing can avert urban disaster

Builders have mostly gone to extreme outskirts of cities, cut down on floor space and frills to make housing affordable. But the product has to be evolved bottom upwards, by looking at the needs of a driver, an office peon or a vegetable seller with a family, what he can afford and how long he can commute given his income and the universal need to cut carbon footprints.

A beginning needs to be made with intensive redevelopment of slums, according to standardised specifications, by contractors on a cost-plus basis. Handing them over to builders with a quota for affordable housing will not work.

Housing finance firms have to come forward to serve those who wish to own such property. When Jerry Rao, the technology entrepreneur, decided to go into affordable housing, he also sought to rope in housing finance interests.

Supply of urban land has to increase by making the abolition of land ceiling work and changing master plans to convert agricultural to urban land on the periphery. All this -- and a lot more -- has to happen.