| « Back to article | Print this article |

India Inc's Operation Desert Storm

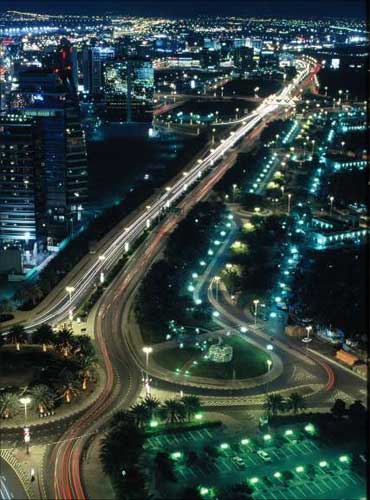

The global Indian company has hit gold in the Emirates of the Gulf. Closer to home, a sizeable diaspora and a market that is hungry for infrastructure. No, we are not just talking about energy or oil blocks. We are talking steel to cement, FMCG to airports.

First you had Dabur, Marico or a Godrej set up shop across the Middle East via new projects and distribution chains.

Then, Larsen & Toubro decided to make it a hub and the rules of the game changed overnight. The great Indian takeover tycoon set sail for the Red Sea.

In the past month, two big buyouts involving Indian companies hogged the headlines. Both had targets in the Middle East.

First, Ultratech acquired ETA Star Cement in Dubai for an enterprise value of $380 million. A fortnight after, Jindal Steel & Power picked up Shaheed Iron & Steel for $462 million.

Click on NEXT to read more...

India Inc's Operation Desert Storm

"Till recently, the flow of capital was from the Gulf. It was the obvious fund raising destination, be it private equity or hedge funds. Then, lending agencies got in the game.

Then the crisis swept the Gulf, especially Dubai. And, now, capital is going from India to the Sultanates," quips Rajarshi Dutta, Principal, Shrine India Advisors, a Delhi-based advisory services and asset management firm.

"Governments in the Middle East countries are trying to bring down their dependence on oil by creating growth centres of private industries," said Sushil Maroo, deputy managing director of JSPL.

"And, to attract private industry, the government is boosting infrastructure growth where we see a market for ourselves," he said. JSPL had recently also unsuccessfully bid for a 500-Mw independent water and power project in Oman.

At first glance, these assets are small compared to the expansion happening in India. But, the scope of the market offers tremendous growth opportunity.

Click on NEXT to read more...

India Inc's Operation Desert Storm

Companies such as Ultratech Cement that acquired ETA Star Cement in Dubai have been successful in exploiting this opportunity.

"They have massive investment plans and there would be significant growth in infrastructure, so in the long run we see an opportunity for ourselves in that market," said D Muthukumaran, head, group corporate finance of the A V Birla Group.

ETA Star has its operations spread across Bahrain, UAE and Bangladesh.

Immense pulls for India Inc

Across the region, countries are planning to attract investment from Indian companies beyond the physical infrastructure.

"We plan investments in infrastructure to ensure everything that business needs to grow is there," said Humaid Almaani, ambassador of Oman to India.

"We would like to see Indian investment in fields as diversified as information technology, education, tourism and chemicals."

Click on NEXT to read more...

India Inc's Operation Desert Storm

Valuations of Gulf-based companies are also extremely attractive, post the Dubai crisis.

"It impacted the valuations in the Middle East; it has thrown a short-term opportunity for the Indian companies, as assets are available at attractive valuation," said Sourav Mallik, executive director, mergers and acquisitions, Kotak Mahindra Capital Company.

A significant amount of privatisation is also happening in this region. "So, a lot more merger and acquisition activity is expected to happen from India to this region, as doing business here is also attractive from the tax perspective," said Sanjeev Krishan, executive director, PricewaterhouseCoopers.

GMR and L&T had seen the opportunity early. Three years earlier, GMR won the bid for Istanbul Sabiha Gokcen International Airport in Turkey and the company officials will vouch that the international exposure is coming handy to bid for other similar projects in the neighbourhood. GMR is now looking at a Maldives airport project.

Click on NEXT to read more...

India Inc's Operation Desert Storm

Larsen & Toubro in 2010 alone got close to Rs 2,500-crore (Rs 25 billion) of orders from the Gulf.

About a month before, it won a contract worth $81.6 million (Rs 366 core) from Abu Dhabi Ports Company for power supply to the first phase of the Halifax Port.

In February, the Electrical & Gulf Projects Operating Company - a part of L&T's Construction Division - had got orders worth Rs 582 core (Rs 5.82 billion) from various customers for four electrical projects; besides, it got three projects worth Rs 741 core (Rs 7.41 billion) from Abu Dhabi and Oman in March.

Larsen & Toubro (Oman) LLC, another subsidiary of L&T in Muscat, also got Rs 668-crore (Rs 6.68 billion) of orders for various buildings and infrastructure projects in the Sultanate of Oman. But, this has been largely through the organic growth. However, now bankers predict more action on the deal front.

A new Operation Desert Storm has indeed begun.