| « Back to article | Print this article |

Indian economy: The highs and the lows

Indian demand can be a bit of a balancing factor in the gold equation, showing strength when the price is seen to stabilise - even at higher levels - and weakness when the price surges.

Click on NEXT for more...

Indian economy: The highs and the lows

The Reserve Bank will have to continue to tighten its monetary policy stance to arrest the runaway inflation numbers, which is expected to harden further in the medium-term on account of the rising commodity prices in international markets.

The pace of tightening, however, should not be aggressive as it may hamper the economic recovery, Societe Generale's thematic research head Veronique Riches-Flores told reporters in Mumbai on Friday.

Click on NEXT to read more...

Indian economy: The highs and the lows

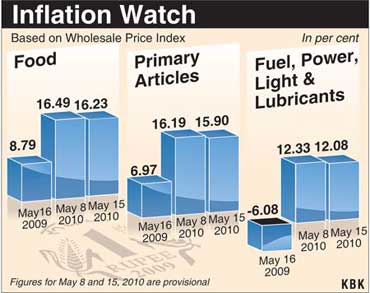

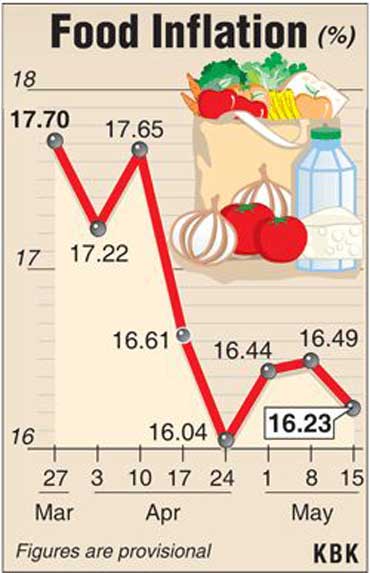

Food inflation eased to 16.23 per cent for the week ended May 15 on account of a fall in prices of masur, fruits and vegetables.

Inflation declined by 0.26 percentage point from 16.49 per cent in the previous week.

The fall was mainly owing to a 4 per cent slide in masur prices, 2 per cent fall in prices of fruits and vegetable each, and 0.20 per decline in prices of cereals and pulses over the week.

Non-food articles also saw a decline in prices. Cotton seed prices fell 2 per cent and raw rubber and mustard seed by 1 per cent each.

However, the prices of tea rose by 9 per cent, that of mutton by 5 per cent, and urad and spices by 1 per cent each.

The overall inflation for April stood at 9.59 per cent, moderating slightly from 9.90 per cent in March.

Click on NEXT for more...

Indian economy: The highs and the lows

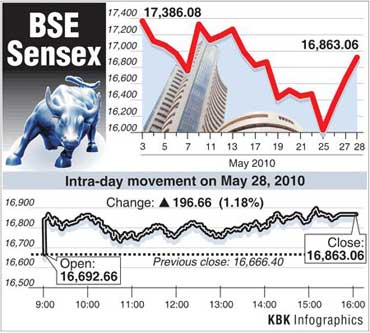

The BSE benchmark index has gained 841 points in the last three trading days; metals, realty shine today.

The Indian markets signed the day off on a good note helped by the global peers and good performance of metal and realty stocks in our domestic markets.

The Sensex opened at 16,692, tracking strong global cues. US markets advanced on Thursday as investor worry eased after China refuted a report that it was reviewing its euro-zone bond holdings due to the region's debt crisis. The Dow Jones added 284.61 points or 2.85% to close at 10,259 and the Nasdaq Composite Index gained 81.80 points or 3.73% at 2,277.

The BSE benchmark index advanced on the back of buying in metal scrips. The index pared some partial gains and continued to move sideways for the major part of the trading session. Extensive buying in the realty, metal and FMCG stocks saw the Sensex zoom to a high of 16,891 towards the end.

The Sensex finally ended at 16,863, up 196 points, in the process the Sensex has gained 841 points in the last three trading days. The NSE Nifty settled at 5,066, higher by 63 points.

Shree Renuka Sugars rose around 10% on reports the company's billion-dollar acquisition of the world's largest sugar producer is on the verge of collapsing. The stock surged as concerns of assuming huge debt in the books of the firm arising from the large acquisition, receded.

Six stocks in which trading began in the derivatives segment from today, 28 May 2010, were mixed. Exide Industries (up 0.3%), Sobha Developers (up 2.24%) and Ruchi Soya added 4.5%. On the other hand Jindal Southwest Holdings (down 0.25%), Gujarat Mineral Development Corporation (down 2%) and Hexaware Technologies declined 1%.

The midcap and the smallcap indices added 1.6% and 1.3%, respectively on the BSE. Parsvnath Developers zoomed 11% to Rs 124 and Pipavavshipyard added 8%, respectively on the midcap index. While Sakti Sugars surged 15% to Rs 54 and Andhra Cements added 10% among the smallcap space.

All the sectoral indices ended in the green, realty and metal indices advanced 4% each. The other major sectoral gainers were FMCG, auto, power and TECk, up 1-2% each. Parsvnath Developers and HDIL were the major gainers on the realty index, up 8-10% each. Sesa Goa was the top gainer on the metal index, up 11% at Rs 373 on the metal index.

The market breadth was positive, out of 2,929 shares traded, 1,923 shares advanced and 892 declined.

Index gainers...

Reliance Communications and Sterlite Industries added 6% each to Rs 147 and Rs 681, respectively. The other prominent gainers were Jindal Steel, DLF, Mahindra & Mahindra, ITC and Jaiprakash Associates, up 2-5% each.

Tata Power, NTPC, Hindalco Industries, Infosys, ACC and Reliance Industries, up 1-2%, respectively.

...and the losers

Maruti slipped 1% to Rs 1,223 and HDFC Bank was down 0.5%, respectively.

Value & volume toppers

Sesa Goa topped the value chart on the BSE with a turnover of Rs 255.37 crore. It was followed by Amtek India (Rs 231.19 crore), Tata Steel (Rs 176.16 crore), Tata Motors (Rs 122.76 crore) and SBI (Rs 91.73 crore).

Amtek India led the volumes chart on the BSE with trades of 35.62 million shares. It was followed by Birla Power (22.39 million), Pipavav Shipyard (8.93 million), Sesa Goa (6.98 million) and Shree Ashtavinayak Cement (6.83 million).

Click on NEXT for more...

Indian economy: The highs and the lows

Six core infrastructure industries grew 5.1 per cent in April against 3.7 per cent in the same month last year.

However on a monthly basis, the key sectors -- crude, petroleum refinery products, coal, electricity, cement and finished steel -- showed a decline in growth as they had expanded by 7.2 per cent in March 2010.

Finished steel sector grew by 4.7 per cent in April, an official statement said today. The sector had contracted by 1.3 per cent in April last year. Crude oil production went up by 5.2 per cent in the month against a negative growth of 3.1 per cent in April 2009.

Petroleum refinery products output too grew by 5.3 per cent in April 2010, against a negative 4.5 per cent in the year-ago month.

Coal production, however, contracted by 2.3 per cent in April against 14.2 per cent expansion in the year ago period.

The growth in electricity generation and cement production was lower at 6 per cent and 8.7 per cent in April this year compared to 6.7 per cent and 11.9 per cent in April 2009 respectively.

For the financial year 2009-10, the six core sectors, which have 26.7 per cent combined weightage on the overall industrial production, registered a growth 5.5 per cent against 3 per cent in the same period last year.

Indian economy: The highs and the lows

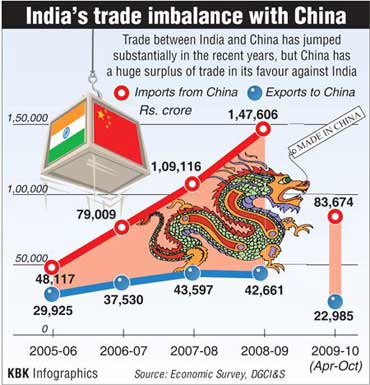

Although hers is only a goodwill visit, President Pratibha Patil did not lose the opportunity of reminding the Chinese leadership of the huge trade imbalance between the two sides and pressed it to open up the market and give access to Indian pharmaceutical industry, IT and engineering companies.

Patil, the first Indian Head of State to visit China in a decade, took up the issue of the growing trade imbalance between India and China during her talks here yesterday, which included separate meetings with President Hu Jintao and Premier Wen Jiabao.

In 2009, the trade imbalance tilted heavily against India. China enjoyed trade surplus of $16 billion out of the total $44 billion bilateral trade and its exports to India nearly touched $30 billion last year.

During her talks, Patil sought access for Indian pharmaceuticals companies, engineering goods, IT-enabled services and agricultural products to the huge Chinese market, official sources said.

India, which is otherwise competitive in manufacturing and services, finds that 75 per cent f its exports to China comprises commodities and raw materials like iron ore.

Click on NEXT for more...

Indian economy: The highs and the lows

In its circular issued to banks, the Reserve Bank has stated that there has been a spate of fictitious offers of cheap funds in recent times from fraudsters.

These came through letters, e-mails, mobile phones, SMS, etc. Detailing the modalities of the fraudsters, the Reserve Bank stated that communication was being sent on fake letterheads of the Reserve Bank and purportedly signed by its top executives to targetted people.

Many residents have been victims of such teasing offers and have lost huge sums of money in the process.

Click on NEXT to read more...

Indian economy: The highs and the lows

Lenders have urged Reserve bank of India to give priority sector status to loans for projects that emit lower carbon.

Bankers have argued that in the absence of any policy initiatives from the government and the banking regulator, this move could work as an incentive for banks to finance environmental-friendly projects.

All PSU and private banks have to give 40 per cent of their loans to farmers, the weaker section of the society and as home loans and education loans.

Click on NEXT to read more...

Indian economy: The highs and the lows

Over 200 years of economic experience tells us that hyper-debt-fuelled-investment creates a bubble and ends in a dreadful collapse.

Click on NEXT for more...

Indian economy: The highs and the lows

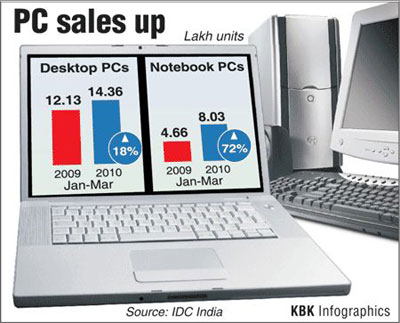

India's personal computer sales touched 2.2 million in the first quarter of this year, registering a growth of an impressive 33 per cent, says IDC, a leading technology consultancy and think tank.

Among the various segments, desktop computers accounted for nearly two-thirds of the total sales at 1.44 million units, representing an 18 per cent growth, while notebook sales were up 72 per cent with 803,000 thousand.

Overall, the impressive performance in the January-March quarter saw the sales of personal computers during fiscal 2009-10 log a 7.6 percent growth, on the back of a 8.1-per cent decline in the previous fiscal.