Apart from raising key rates, RBI has increased the standard asset provisioning by commercial banks for teaser home loans from 0.4 per cent to two per cent, capped the loan to value (LTV) ratio to 80 per cent and increased the risk weight on loans of more than Rs 75 lakh to above 125 per cent.

Good news! Home prices may fall soon

Image: Builders will be forced to cut prices.At present, the teaser rate is around eight per cent. Experts say developers are also likely to discontinue the '10/90' schemes, where buyers pay 10 per cent at booking and 90 per cent after possession, as the LTV ratio has been capped at 80 per cent.

Indiabulls Real Estate and the Lodha group are among the developers which have such a scheme.

Good news! Home prices may fall soon

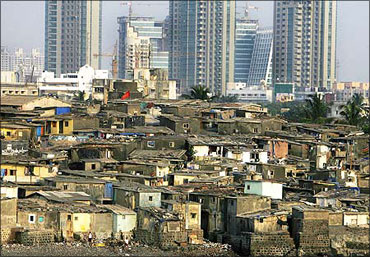

Image: Prices will fall by 15-20 per cent."If rates rise and affordability falls, you can see the impact on property sales in the next three months," says Sunil Rohokale, executive director, ASK Group, a financial services firm with exposure to real estate.

Pankaj Kapoor, managing director of realty research firm Liases Foras, expects that prices will fall by 15-20 per cent due to lower sales in the next two to three months.

Barring new projects, residential sales are stagnant in Mumbai and the National Capital Region (NCR) due to the steep increase in prices compared to last year's levels, according to Liases Foras. Home prices in Mumbai have crossed their earlier peak of 2007-08.

Good news! Home prices may fall soon

Image: Drop in sales.Mixed signals

The measures are expected to curtail speculation in real estate, say experts. Investors account for over half the sales of residential projects in places such as NCR, consultants say.

Good news! Home prices may fall soon

Image: DLF.But some property developers say RBI's steps may not curb demand for homes, given the buoyancy in the economy and rising salaries.

Says Rajeev Talwar, executive director of DLF, the country's largest property developer: "RBI has got it wrong this time. The real problem of rising asset prices cannot be contained this way. By decreasing housing supply, these measures will fail in the long run. This is a short-term measure."

Good news! Home prices may fall soon

Image: More takers for homes.RBI's proposals also impacted the stock market. The BSE Realty Index was the biggest loser among sectoral indices, with a fall of 2.6 per cent. Indiabulls Real Estate (5.03 per cent), DLF (3.28 per cent) and Unitech (3.31 per cent) were the major losers today.

article