Photographs: Reuters

Finance Minister Pranab Mukherjee on Thursday asked banks, foreign institutional investors and insurance companies to look into their exposure in companies named by CBI in housing loan scam.

Meanwhile, the Planning Commission termed the housing finance racket, involving the chief of LIC Housing Finance and several other officials of PSU banks, as a 'very small' incident as far as banking system as a whole was concerned.

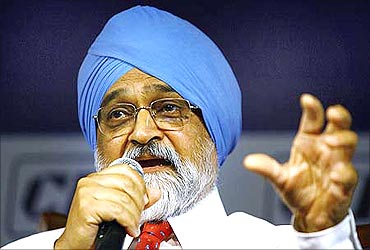

The reaction from Planning Commission Deputy Chairman Montek Singh Ahluwalia comes a day after the Central Bureau of Investigation arrested LIC Housing Finance CEO Ramachandran Nair and seven other senior bankers on charges of corruption and criminal conspiracy.

"I do not think we should make too much of a particular incident (housing scam)...the scale (size of the scam) we are talking about. . . is very small as far as banking system as a whole is concerned," Ahluwalia said.

. . .

Housing scam a very small incident: Montek

Image: (Inset) R R Nair, LIC Housing Finance CEO.He said he was sure that the authorities concerned have taken steps against the involved party and the banking system to send out the right signals.

"I think our banking system is pretty well regulated. Both the Reserve Bank of India and the ministry of Finance, I am sure, are doing whatever is necessary to sent the right signal," he said.

On Wednesday, the finance ministry had said that the housing finance racket was a bribery case involving some individuals and not a large-scale scam and that the banking system was sound.

"The NPAs (non-performing assets) are minimal in housing loans -- less than one per cent. There is no impact on asset quality of banks," Minister of State for Finance Namo Narain Meena had said.

. . .

Housing scam a very small incident: Montek

Photographs: Reuters

The finance ministry had sought details of housing finance racket from LICHFL, Bank of India , and Punjab National Bank .

As per the reports, LICHFL assured its investors, customers and business associates that all necessary steps would be taken to ensure that interests of various stake holders are fully protected.

The Central Bank has said there was no impact of the development on its asset quality. According to the CBI, the bank officials allegedly colluded with Mumbai-based firm Money Matters Ltd to sanction large scale corporate loans, overriding mandatory conditions for such approvals along with other irregularities.

Rajesh Sharma, CMD of Money Matters and two of its employees -- Suresh Gattani and Sanjay Sharma-- were also among those arrested.

. . .

Housing scam a very small incident: Montek

Photographs: Reuters

Those others arrested by the CBI include Naresh K Chopra, secretary (investment), LIC; R N Tayal, general manager of Bank of India (Delhi); Maninder Singh Johar, director (chartered accountant) of Central Bank of India, Venkoba Gujjal, deputy general manager of Punjab National Bank (Delhi).

IT dept to look into loan bribery case: Finmin

The government on Thursday said the income tax department would look into the tax issues relating to the housing loan scam racket.

When asked if the IT department would be looking into the multi-crore housing scam, revenue secretary Sunil Mitra said, "As of now no, but they (IT department) would be (looking into the scam)."

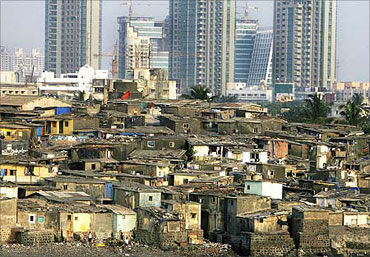

CBI has named several real estate developers in the first report. They include Mantri Realty, Kumar Developers, DB Realty, Emaar MGF and Lavasa Corporation.

. . .

Housing scam a very small incident: Montek

Photographs: Uttam Ghosh/Rediff.com

17 companies under lens

Media reports on Thursday said that the CBI is now training its guns at some 17 companies who had received loans in this case.

These firms have been sent notices in the multi-crore scam and told to furnish details of the loans they received today itself.

Racket not to hit lending to real estate: SBI

The country's largest lender State Bank of India said the housing finance racket, involving CEO of LIC Housing Finance and several senior bankers, will not hit disbursements to the real estate sector and there was no need for alarm.

"We are always cautious when we lend and you know there are always bad loans... why should it impact (lending to real estate sector)," SBI chairman O P Bhatt said.

"I won't say that (the current system) is perfect. But there is no need for any alarm. I don't think there is any systemic risk that we are talking about. These are individual cases," he added.

. . .

Housing scam a very small incident: Montek

Photographs: Reuters

Shares plummet

Meanwhile, shares of Money Matters Financial Services nosedived by 20 per cent, hitting a lower circuit on the Bombay Stock Exchange on Thursday on allegations that the firm bribed senior officials of public sector financial institutions for procuring loans for corporates.

The Mumbai-based investment bank's shares had on Wednesday tumbled by 20 per cent on emergence of a real estate scam involving it and several state-owned institutions like Life Insurance Corporation, LIC Housing Finance, Central Bank of India, Bank of India and Punjab National Bank.

Extending last session's losses, share of Money Matters on Thursday too opened weak and tanked by 19.99 per cent to Rs 425 on the Bombay Stock Exchange.

The counter witnessed a similar plunge on the National Stock Exchange, where it was quoting at Rs 427.05, reflecting a fall of 19.99 per cent from the previous close.

Besides, share of Punjab National Bank was also trading 3.9 per cent lower at Rs 1,215.10.

In contrast, shares of LIC Housing Finance and Central Bank of India rebounded with a gain of 3.97 per cent and 7.98 per cent, respectively, on BSE in the morning trade, on buying at lower levels.

article