"Bank stability and safety are still high on corporate and investor agendas. The sovereign debt crisis in Europe and renewed concerns about the global economic outlook are once again putting the spotlight on bank safety," Global Finance said.

And although Indian banks were hardly affected by the global recession that saw many a global banking giant fall by the wayside, not a single Indian bank finds a place among the world's safest 20 banks' list put out by Global Finance.

Click NEXT to find out the world's 20 safest banks . . .

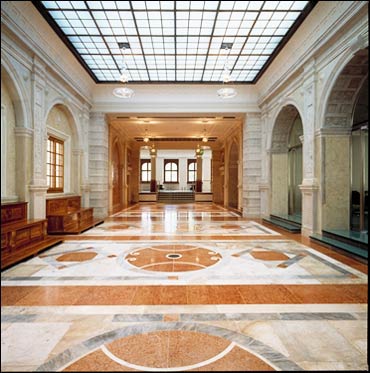

KfW banking group is a German government-owned development bank, based in Frankfurt. Its name originally comes from Kreditanstalt fr Wiederaufbau, meaning Reconstruction Credit Institute. The bank's revenue for the year 2009 stood at 26438.20 million euros.

Click NEXT to read on . . .

BNG provides customised financial services ranging from loans and funds transfers to consultancy, electronic banking and investments Its net profit in 2009 stood at 278 million euros. Its total assets amount to 104,496 million euros.

Click NEXT to read on . . .

Zurcher Kantonalbank provides various banking products and financial services to retail and corporate customers primarily in Zurich, Switzerland. In the first half till June 30, 2010, the bank's net profit dropped 11.2 per cent to CHF 367 million. The total assets amount to CHF 117 billion . The Zurich Cantonal Bank is 100 percent owned by the canton of Zurich.

Click NEXT to read on . . .

Rentenbank, based in Frankfurt is Germany's development agency for agribusiness. Rentenbank provides refinancing to banks within the European Union involved in financing agriculture and rural areas. The net profit for 2009 stands at 11.6 billion euro.

Click NEXT to read on . . .

Rabobank Group is an international financial services offering retail banking, wholesale banking, asset management, leasing and real estate services.

Internationally, the Rabobank Group is focussed on the food and agriculture sector. The total assets of the bank stand at 675,847 million Euros. The net profit in the first half of 2010 stands at 1,661 million euros.

Click NEXT to read on . . .

Landesbank Baden-Wurttemberg (LBBW)is one of the biggest banks in Germany.

LBBW is the central bank of the savings banks in Baden-Wurttemberg, Rhineland Palatinate and Saxony.BW-Bank functions as a savings bank for LBBW in the territory of the state capital, Stuttgart. As of 30 June 2010, LBBW therefore recorded a consolidated loss for the period after taxes of 290 million euros.

Click NEXT to read on . . .

Nederlandse Waterschapsbank N.V provides financial services to the public sector primarily in the Netherlands. It finances water boards, municipal authorities, and provincial authorities, as well as other public sector bodies, such as housing corporations, hospitals, and educational institutions. The bank's net profit for the first half of 2010 stands at 14.6 million euros.

Click NEXT to read on . . .

Click NEXT to read on . . .

The Royal Bank of Canada and its subsidiaries operate under the master brand name RBC. It is one of Canada's largest banks in terms of assets and market capitalisation, the bank offers personal and commercial banking, wealth management services, insurance, corporate and investment banking and transaction processing services on a global basis.

Royal Bank of Canada reported a net income of $1,276 million for the third quarter ended July 31, 2010.

Click NEXT to read on . . .

With more than 1800 branches and service centres, the bank offers products and services through major Australian franchisees and businesses in the United Kingdom, New Zealand, the United States and Asia. It has over 10.93 million customers.

Click NEXT to read on . . .

The Westpac Group has branches and affiliates throughout Australia, New Zealand and the near Pacific region and maintains offices in key financial centres around the world including London, New York, Hong Kong and Singapore. As of 31 March 2010, The Westpac Group had global assets of $601 billion.

Westpac is ranked among the top 5 listed companies by market capitalisation on the Australian Securities Exchange Limited (ASX). For the six months till 31 March 2010, The Westpac Group's reported net profit was $2,875 million.

Click NEXT to read on . . .

The net profit after tax on statutory basis increased 36 percent to $2,914 million and on cash basis, 54 percent to $2,943 million (as at 31 December 2009).

Click NEXT to read on . . .

In 2009, ordinary attributable profit reached 8.943 million euros, a 1 per cent increase over the previous year, and distributed 4.919 million euros in dividends. The attributable profit from January-June 2010 stood at 4,445 million euros.

Click NEXT to read on . . .

Headquartered in Toronto, the TD Bank Financial Group offers a full range of financial products and services to 18 million customers worldwide.

As of July 31, 2010, TD Bank Financial Group had CDN $603 billion in assets. The Toronto-Dominion Bank trades on the Toronto and New York stock exchanges.

Click NEXT to read on . . .

For the ANZ group as a whole, underlying profit after tax for the nine months was approximately A$3.6 billion, up 26 per cent as compared to corresponding period in the previous year, driven by growth in business earnings.

Click NEXT to read on . . .

17. ASB Bank (New Zealand)

ASB is an Australian-owned bank operating in New Zealand. It is one of the largest banks in New Zealand. It operates BankDirect, a branchless banking service that provides service via phone, Internet, and ATMs only. The bank reported a full-year net profit after tax of $236 million in August 2010.Click NEXT to read on . . .

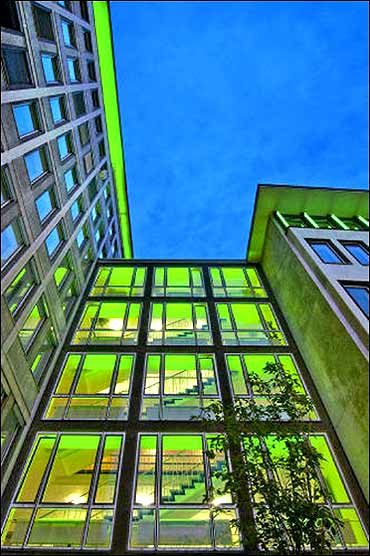

BNP Paribas is a global banking and financial services major and one of the six strongest banks in the world (Rated AA by Standard & Poor's, 3rd on a scale of 22).

The group has four domestic retail banking markets in France, Italy, Belgium and Luxembourg. It has one of the largest international networks with operations in 84 countries. The bank's net profit rose by 31 per cent in the second quarter to US$2.7 billion.

Click NEXT to read on . . .

HSBC is one of the largest banking and financial services organisations in the world.

With listings on the London, Hong Kong, New York, Paris and Bermuda stock exchanges, shares in HSBC Holdings plc are held by around 220,000 shareholders in 119 countries. HSBC's international network comprises around 8,000 offices in 87 countries.

HSBC Holdings's net profit for the first half of the year doubled to $6.76 billion, up from $3.35 billion a year earlier.

Click NEXT to read on . . .

Credit Agricole is France's third-largest bank in terms of market capitalisation, with 59 million customers worldwide and 11,500 branches in 15 countries.

The bank reported a 89 per cent jump in second-quarter net profit. Its net profit for rose to 379 million euros from 201 million euros during the same period in the previous year.