Ram Prasad Sahu in Mumbai

After being among the biggest undperformers over the last year, realty scrips are looking up with leading players such as DLF and Unitech moving 10-12 per cent over the last month.

High debt and demand concerns in the past were the key reasons why the BSE Realty index lost 16 per cent over the last one year while the Sensex is up 17 per cent during the period.

While the demand trend across the metros is mixed, increasing prices, lower inventory and fund raising efforts are likely to have a positive impact on the sector, believe analysts.

Companies are banking on the festival demand to spruce up sales and improve cashflows.

The recent bout of successful fund raising efforts and the realty IPOs also indicate rising investor interest in the sector.

. . .

Realty: Some light at the end of the tunnel

Image: Unitech Heights, Greater NoidaMixed bag

HDIL, Ansal Property and Parsvnath raised over Rs 1,500 crore (Rs 15 billion) in the last one month to fund their existing ventures, expand and repay debt.

Given the rising prices, the QIPs are being done at good valuations and are a positive for the players, feel analysts.

Another indicator of investor interest -- realty IPOs (over Rs 2,000 crore or Rs 20 billion raised, Rs 10,000 crore or 100 billion IPOs in the offing) -- has however been a mixed bag.

Says Gautam Hora, senior vice president, Capital Markets, Jones Lang Lasalle India, "The response to the recent realty IPOs has more to do with the euphoria in the Indian equity markets in general, and is not really specific to the real estate sector."

However, Amar Ambani, head of research, India Private Clients, IIFL, says that of the recent IPOs while Oberoi Realty with zero debt and healthy cash appeared a good bet, Prestige Estate, which had huge debt, was offered at premium valuations to its regional peers.

Analysts advise that investors take the upcoming offers on a case-by-case basis, focusing on the execution ability, quantum of debt, cashflows and margins.

. . .

Realty: Some light at the end of the tunnel

Image: Tata Housing residential complex at Thane, Greater Mumbai.Prices, volumes up

While there are still issues related to the inventory levels and working capital, the overall demand seems to be picking up, with the exception of markets such as Mumbai.

Says Ambani, "Despite the sharp surge in real estate prices over the past 2-3 quarters, the volumes, too, have gained significant traction.

"The upcoming festive season, promotional schemes (pay 10 per cent upfront, balance at possession) and attractive mortgage schemes offered by financial institutions, too, would support volume growth." Increasing incomes are also helping demand growth, especially in markets such as Bengaluru.

Says Ajay D'Souza, head, Crisil Research, "Improved job security, increased hiring as well as pay hikes in the IT-ITeS sector continue to be a key demand driver for residential real estate."

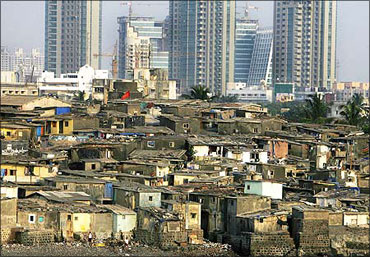

In Mumbai, while the builders are launching a slew of projects for the festival season, Edelweiss believes that the conversion of enquiries into transactions will be the critical thing to watch out for given that residential prices in thecity have crossed the 2008 peak levels.

. . .

Realty: Some light at the end of the tunnel

Image: A worker at a gas station counts currency notes.Photographs: Amit Gupta/Reuters

Commercial, retail lag

While the demand is strong for residential property, analysts are of the view that the commercial segment could take time to recover due to oversupply issues.

Says D'Souza, "There has been an increased level of enquiries but there has not been much improvement in the rentals due to substantial oversupply."

Crisil Research expects the rentals for the commercial and retail sector to be stable over the next three-six months.

Given the issues in the commercial space, D'Souza says that realty companies that have a higher share of their revenues from residential sales are better placed with respect to working capital management than those with a higher exposure to the commercial space.

. . .

Realty: Some light at the end of the tunnel

Interest rates, pricing key

Rising interest rates could be another hurdle for realty players that have high debt and are constrained by interest payments, which are impacting margins.

Given the RBI's focus on containing inflation there is unlikely to be a let-up on this front, which would impact both developers and buyers.

Says Hora, "The higher interest costs for realty players have resulted in decreased profit margins for developers, as well as a slight increase in final product pricing."

An Edelweiss report says the impact of rising borrowing costs for home buyers will be balanced to an extent by factors such as the positive hiring outlook and salary hikes.

Analysts, however, believe that pricing is key if the sector has to sustain its growth.

Says Hora, "If the pricing is maintained at the current levels, then the volumes should be robust enough for the developers to generate a sufficient cash flow."

Among the realty pack, analysts are bullish on DLF, Ananta Raj Industries, Brigade Enterprises, Ackruti City and HDIL.

article