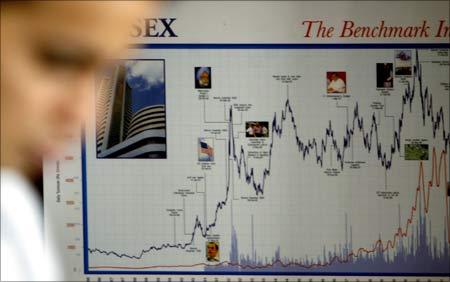

It is just a matter of time that the Indian market will mark an all-time high for itself, as it managed to cross the psychological mark of 20,000 on the benchmark Sensex this September, powered by the fund flows from foreign institutional investors.

FIIs have been net buyers to the extent of $5 billion, or Rs 25,000 crore (Rs 250 billion), in the month of September alone, pushing the Sensex by about 11 per cent during the month.

FIIs have also broken all pervious records by committing in excess of $18 billion, or Rs 84,000 crore (Rs 840 billion), in Indian markets in a single calendar year, though we still have a full quarter to go in 2010.

Click NEXT to read further. . .

Interestingly, till the beginning of September, markets were stuck in a range and were not doing too much for themselves.

So, what explains this sudden breakout? When FII buying started, explains Rajesh Jain, head of retail research at Religare Securities, 'there was huge amount of short-covering in the market'.

This helped the markets move even higher.

However, at these levels, where prices seem to have lost touch with the fundamentals, can the markets sustain, or is a deeper correction due?

Says Nandip Vaidya, president (broking), India Infoline, a Mumbai-based financial services firm: "We are in a secular upturn. Even if the markets correct a bit, it will not be a trend reversal."

Click NEXT to read further. . .

Primary moves. Taking leads from the secondary market, the primary markets are also witnessing heightened activity. In September alone, 12 companies have closed their public issue.

"Primary markets always mirror secondary markets. If markets are not doing well, even good issues don't do well," adds Jain.

The contradiction. Even though markets have gained most of the ground lost, the rally has not been kind to all. Half of the stocks in the BSE Sensex are still trading at much lower levels compared to the highs seen in January 2008.

For example, stocks such as Reliance Communications, Reliance Infrastructure, and DLF are trailing by over 50 per cent.

On the other hand, the likes of Hero Honda Motors, Tata Consultancy Services and Infosys Technologies have moved way ahead of highs seen in 2008.

Click NEXT to read further. . .

The dynamics. Despite different internal dynamics, there is little doubt that the actions in our markets are clearly led by FIIs. But what explains the level of activity, not seen ever before, by the FIIs?

In the global context, emerging markets in general and, India in particular, are being used as a deflation hedge.

In simple terms, deflation means a situation where general price level is constantly falling.

Therefore, in a situation where prices are falling, production and consumption also go down, leading to lower stock prices.

So, when opportunities are fading fast in a near deflation kind of a situation in the developed world, money is being directed to markets like India where there is a clear visibility on growth.

Click NEXT to read further. . .

Further, in order to avert deflation and reduce the value of their own currency to boost exports, some developed countries have started -- while others are planning -- to inject huge amount of liquidity into the system, part of which is being, and will be, directed to equity markets, fuelling the rally.

What next. There is ample suggestion that liquidity will remain abundant in the global financial system.

Therefore, markets may not see any significant cut in the near term.

However, with every step forward, markets would lose sight of the fundamentals and investors need to be very careful about what they are buying and their time horizon for holding a particular stock.

On initial public offers, look at offerings on their merit and not because some other issues had a gainful listing.