| « Back to article | Print this article |

New tax code: Why you must opt for higher basic salary

If the Direct Taxes Code Bill does not undergo further changes, employees in the lower tax bracket will get more retirement benefits, provided they opt for a higher basic salary.

"Contributions made towards retirement benefits are linked to the basic salary. And the Bill has removed the existing cap on employers' contribution towards the superannuation fund," says Mayur Shah, associate director, Ernst & Young.

However, those in the 30 per cent tax bracket need not bother about a higher basic pay for retirement benefits. Their salary structure depends more on perquisites provided by the employer.

Here's how it works: Employers buy an annuity plan for employees from insurance companies and contribute money towards this fund annually. After retirement, the employees receive the annuity money as pension.

However, the employer's contribution towards the superannuation fund is part of your salary, as it is contributed on your behalf. At present, if employers contribute over Rs 1 lakh (Rs 100,000) in a year towards superannuation, employees need to pay tax on the amount exceeding the capped limit.

Click NEXT to read on . . .

New tax code: Why you must opt for higher basic salary

The Bill, however, has removed this limit. Tax experts feel more and more companies will now use this option.

Most companies keep superannuation at 15 per cent of the basic pay. According to the current income tax laws, the approved fund must be 27 per cent of the basic salary. But 12 per cent goes towards the Employees' Provident Fund.

The money received on annuity is considered as income and taxed according to your slab rate.

An individual who wants to save more for retirement can keep the basic at 50-60 per cent of the overall salary.

This will be advantageous for people in 10 per cent and 20 per cent tax brackets, as their mandatory contribution towards EPF may not provide enough money after the retirement.

Click NEXT to read on . . .

New tax code: Why you must opt for higher basic salary

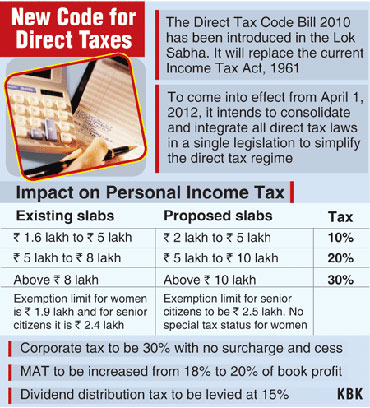

According to the Bill, men and women earning up to Rs 2 lakh (Rs 200,000) do not need to pay any tax on their salary. The tax rate is 10 per cent for those earning Rs 2-5 lakh (Rs 200,000-500,000).

Those earning Rs 5-10 lakh (Rs 500,000-1 million) need to pay a 20 per cent tax. Any income above Rs 10 lakh will attract a 30 per cent tax.

Higher basic will not just ensure more saving in superannuation but also a higher EPF corpus and gratuity.

Tax experts say according to the Bill, the salaried will also need to pay a tax on leave travel allowance (LTA). At present, a person gets full tax exemption on LTA twice in four years. There are views that the government wants to make LTA a part of the salary. So, a person can claim deduction during the year he travels.

Tax experts say discussions are in the pipeline, and there is no clarity if it will be implemented. "As the Bill stands today, LTA is out," says Vikas Vasal, executive director, KPMG.

Click NEXT to read on . . .

New tax code: Why you must opt for higher basic salary

"If LTA is taxed, a person now has the benefit of higher medical allowance," says Kuldip Kumar, executive director, PricewaterhouseCoopers.

Medical allowance increased to Rs 50,000: The DTC Bill has increased the yearly medical allowance from existing Rs 15,000 to Rs 50,000.

Other benefits like car, employee stock option, restricted stock units and club memberships are part of the benefits and will remain taxable.

However, the government is yet to provide the valuations or the method of computing tax on these components of the salary.

For the fixed components of salary, which include basic, house rent allowance (HRA), conveyance and LTA, the Bill has prescribed it will provide deduction for actual expense incurred on HRA.

Click NEXT to read on . . .

New tax code: Why you must opt for higher basic salary

But their computation will be known only later, when the government specifies valuation norms for perquisites.

"The finance ministry will prescribe the valuations once the Bill is cleared by Parliament," says Vasal.

Tax experts believe the conveyance allowance will see an increase from the current Rs 800 a month. For variable components of your salary -- incentives, bonuses and commissions -- the taxation remains the same.

This means these will be added to the overall salary and taxed according to the income slab.

"Overall, the DTC Bill has retained most of the current provisions. This requires only a little tinkering with salary components," adds Shah.