On a Sunday afternoon Sam Pitroda, the man who revolutionized the Indian telecom sector and got STD-ISD booths on almost every road, switches on his phone to demonstrate his latest passion.

He goes to 'Menu' to reach a 'folder' named 'credit card'. He clicks. A plastic card's image fills up his cell phone screen. He then tells rediff.com, "It will change your life. It will change the way you look at money."

He is talking of 'mobile money', a term associated with making payments through your mobile phone that uses your digital plastic card.

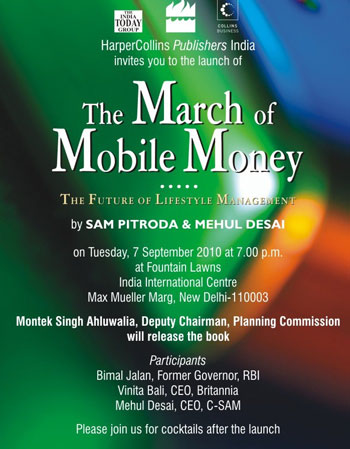

This evening Sam Pitroda, friend of late Rajiv Gandhi and now advisor to the prime minister on public information, infrastructure and innovation, will have lot to cheer about. His book, The March of Mobile Money, jointly authored with his colleague and partner Mehul Desai, will be released by Montek Singh Ahluwalia, Deputy Chairman, Planning Commission.

Harper Collins is publishing the book.

When in New Delhi, these days Sam shares a room next to Ahluwalia's in the Planning Commission.

While talking about his book Sam says: "I saw my wife Anu writing cheques. So I asked her how much time you spend on this? She replied, 'Several hours.' We had different credit cards so she has to spend a lot of time making card payments. I got this idea in 1994 to save time while banking."

Click NEXT to read on . . .

For the last 15 years, Pitroda and Desai's team is working on the technology to pay through mobile phones. Pitroda already has 11 patents with him and some 20 patents related to this technology are pending for registration.

Sam, showing his mobile phone, says: "I got the idea of putting your wallet into the cell phone. As I open the phone, my mobile wallet will come up. That's my bank account. My mobile commerce is just a click away. When I say 'pay', my phone asks 'how do you want to pay?' So I click on my credit card. As opposed to a plastic card sent through post, this digital credit card is issued to you through your mobile. You can plug this phone, pull the card out, print and give me a receipt, too."

Pitroda is an entrepreneur and inventor par excellence. He also heads the newly formed National Innovation Council. He was also the chairman of the National Knowledge Commission from 2005-2008.

In 1999, Sam and Desai's company, C-SAM, commenced operations. Initially, they had a team in Stockholm, which developed the design. Later, it was moved to Manchester, UK.

Pitroda says, "Now our company, C-SAM, works out of Chicago. It's a small company, with offices in Japan, Beijing, Mexico, Chicago, and Baroda of all the places!"

ICICI Bank, India's second largest bank, has got an 'iMobile' service. They claim it is the first of its kind in India and the world's most comprehensive mobile banking solution. It is based on C-Sam's technology called Mobile Transaction Platform (MTP).

Click NEXT to read on . . .

ICICI Bank customers, who are already registered for mobile alerts, can download iMobile by sending an SMS to a short code. Customers who have GPRS connection will receive a WAP link for activation.

Sam Pitroda explains, "There is a slow, but tectonic, shift waiting to occur in the banking world due to the emergence of mobile Internet which will eventually alter the concept of banking, payment and money. With about half the world's population expected to be connected via mobile phones by end of 2010, this is bound to have far-reaching implications on people's social, economic and cultural life the world over. Never has the world been so widely accessible, connected, networked and mobile."

Pitroda's book talks about C-SAM's journey to take this simple idea of mobile money to its destination. It states how the concept of money would change.

"When the plastic card was introduced, the world had more notional money. That means you can borrow through your card, say, $1,000 that you don't even have. If 300 million people borrow $1,000, you get $9 trillion, which doesn't exist, in to the economy!" says Pitroda.

"But plastic money has physical limitations. You can borrow, most times, only if you are there. But with mobile money I can buy from Brazil, pay in rupees, and charge it in my account in Chicago."

Click NEXT to read on . . .

"The jury is still out on how will this change the lives of our people," says Sam, "but, in India, which has more mobile phone subscribers (over 470 million with over 10 million being added every month) than bank account holders, mobile money could go a long way."

However, Pitroda is quick to add: "It will take 10 years, but it will surely change all of us. Now, it is being launched all over the world, including China. The world will adopt it. The plastic card is passive and not active. The plastic card can't tell you anything. It doesn't speak. If you touch it you don't see things coming out. In mobile money, as soon as you open the folder on your screen you can know your balance, your spending, and graphs and charts of your money transactions."

Pitroda says the commercial viability of his idea will depend on three things.

"Banks should be interested in mobile phone technologies for three reasons. One, to provide additional channel for delivery to mobile customers -- for convenience, comfort, control, visibility and security, anywhere, anytime. Two, to acquire new customers at lower acquisition costs, mainly because there are more mobile phone subscribers in the world than bank account holders. And, lastly, to guard their deposit base from eroding due to big merchants offering prepaid cards and Internet players like PayPal."

He adds that mobile money has the user's participation. There is an understanding of the user through technology. There is friendliness. Sam argues, "Mobile is here to stay. However, it won't replace computers, because mobile is a device. Computers are computing in the back."

Click NEXT to read on . . .

Pitroda had an imposing presence during former prime minister Rajiv Gandhi's tenure, but these days he is keeping a slightly lower profile. He, however, hasn't stopped thinking big.

"Nothing excites me anymore," he says. "You get up in the morning and try to attend to big problems. It took 20 years to build a voice platform in this country. Now, this is the country of a billion connected people. You have to think differently while planning development when you have a nation of a billion connected people."

"Nothing much has changed in spite of newly acquired connectivity. People are talking and talking, but what else has changed? How do you strategise and introduce this strength of connectivity into your development related talks? How can you use this strength in education, health governance, expert or trade?" he says.

Pitroda is working on extending the impact of mobile phones in India. "I feel India should build six more platforms on top of the voice platform. One, broadband platform. Two, the unique identification platform. Three, a geographic information system platform so that the leaders or bureaucrats can see every panchayat, every school and every dispensary in remote areas. Then, we should have security platform. And then, an application platform and a payment platform. Application platform would help government plans, like the National Rural Employment Guarantee Scheme (NREGS). These are all vertical silos which should be integrated," he enthuses.

"Nobody has thought through this in even America," Sam Pitroda claims proudly.