| « Back to article | Print this article |

Who are the biggest tax evaders in India?

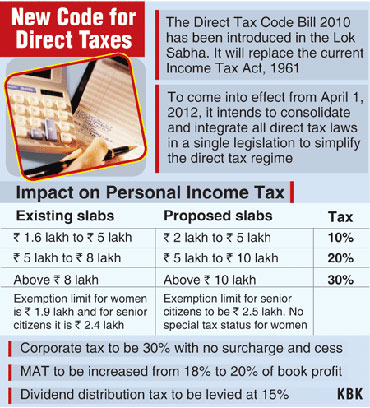

The government gave out some interesting numbers on Monday. The revenue secretary told a news conference that nearly 96 per cent of the 32.5 million who pay income tax reported a taxable income of under Rs 5 lakh (Rs 500,000); and only 2.2 per cent (i.e. 715,000 people) reported taxable income of over Rs 8 lakh (Rs 800,000).

Why is this interesting? Because when you match these with the income numbers put out by the National Council of Applied Economic Research (NCAER), on the basis of its household surveys, some numbers make sense while others don't.

For instance, NCAER projected for 2009-10 that some 32.3 million households would have annual incomes of over Rs 2 lakh (Rs 200,000) -- which is a reasonably good fit with the total number of people paying income tax (the threshold being taxable income of Rs 1.6 lakh -- Rs 160,000).

Click NEXT to read more . . .

Who are the biggest tax evaders?

When you look at the high-income category, however, the numbers diverge hugely.

NCAER says that in 2009-10, there should have been 3.8 million families with annual income of over Rs 10 lakh (Rs 1 million), a figure that is more than five times the 715,000 people who report income over Rs 8 lakh (on the plausible assumption that taxable income of Rs 8 lakh is broadly compatible with total income of Rs 10 lakh, because of the various tax exemptions available).

Admittedly, some households have more than one income-earner, so it could be a case of clubbing the incomes of husband and wife. Still, it would appear that, while there is probably not much tax evasion by the middle class, those in the upper income reaches continue to be predominantly tax evaders.Click NEXT to read more . . .

Who are the biggest tax evaders?

While incomes have been rising rapidly at the top of the pyramid, few would have expected that India's highest earners would multiply so rapidly over five years.

In other words, tax compliance has improved dramatically - but even then, the scope for much greater compliance exists.

Click NEXT to read more . . .

Who are the biggest tax evaders?

He has used National Sample Survey data to contend that there were 250,000 people with incomes over Rs 10 lakh in 2004-05 (when there were only 122,000 people reporting that amount of tax income), and that the population of high-income earners would have gone up to 360,000 in 2006-07.

On that kind of track, the number by 2009-10 should have been about 620,000. But since we have 715,000 reporting taxable income of Rs 8 lakh and more, it looks like 100 per cent tax compliance by the high-rollers - which strains credulity.

Click NEXT to read more . . .

Who are the biggest tax evaders?

But if one were to assume that three-box cars are bought by only those in this income bracket, there is another data point worth looking at - because 350,000 three-box cars were sold in the country last year.

On the assumption that most people buy a new car after five years, this figure too suggests many more high-income people than exist in the tax records.

The point of focusing on this group is that 60 per cent of all income tax revenue (Rs 72,000 crore or Rs 720 billion) comes from these 715,000 people! If the number coming into this category were to double, income tax collections would go through the roof.