| « Back to article | Print this article |

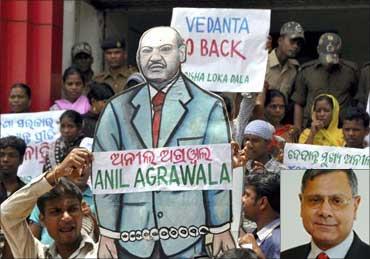

Vedanta mess: The role these people played

Given the serious allegations against the firm, did these members of the board fail in their duty to safeguard the interests of stakeholders?

Vedanta Resources had environment clearance to set up a 1-million tonne alumina refinery at Lanjigarh in Orissa. But, it went ahead with expanding its capacity six-fold without any approvals.

The N C Saxena Committee report, which chronicles a series of such violations by the company, raises the role of independent directors and sustainability development reports in protecting the interests of stakeholders.

This is particularly pertinent when Vedanta's board is packed with well-respected members like former Cabinet secretary and eminent corporate governance expert Naresh Chandra, senior banker and former HSBC CEO Aman Mehta and Euan Macdonald, who spent over two decades with investment bank S G Warburg and, interestingly, is also a trustee for Save the Elephants.

Vedanta's listed subsidiary, Sterlite Industries, which owns 30 per cent stake in Vedanta Aluminium that owns the alumina refinery, has luminaries like senior auditor Gautam Bhailal Doshi and senior corporate lawyers Berjis Minoo Desai and Sandeep H Junnarkar as independent directors.

Other worthies within the group include former L&T chairman Sudhakar D Kulkarni and former Vedanta CEO Kuldip K Kaura, both independent directors at Sesa Goa.

Click on NEXT to read more...

Vedanta mess: The role these people played

Given the seriousness of the allegations against Vedanta, was the board aware of these violations and turned a blind eye?

Did the independent directors fail in their role, as they were all members of Vedanta's audit committee that oversaw the activities of the risk management team, reviewed the risk register and provided leadership to risk mitigation strategies?

"One would expect high-profile independent directors like Chandra - who is an expert on corporate governance, knows the laws of the land, and held responsible positions in government - to play devil's advocate and ensure checks and balances," says a Bangalore-based independent director.

Chandra, when contacted by Business Standard, refused to comment, saying all questions should be directed to Vedanta Aluminium CEO Mukesh Kumar and that independent directors should not be responding individually to such queries.

Chandra, Mehta and Macdonald did not respond to an email questionnaire on how they saw their role in Vedanta's violations of environmental laws. They have all been associated with the company for the last five to six years.

Click on NEXT to read more...

Vedanta mess: The role these people played

Subodh Bhargava, chairman emeritus with Eicher Group and who is an independent director on the board of at least 10 companies, says it is the role of independent directors to ask questions and satisfy themselves that all statutory approvals and environmental issues have been addressed, especially in greenfield projects and in sectors like mining that involve permissions and issues of land acquisition and displacement.

If the management says all approvals are in place, directors usually don't ask for a copy of the permission, but they need to ask if there are displaced people, and if they have been taken care of.

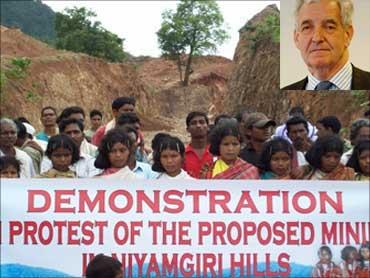

"If there are issues of higher gravity (like in the case of Lanjigarh or the Niyamgiri hills), the board could set up a sub-committee to review the situation in depth," says Bhargava.

The board is accountable and responsible, to ensure that the laws of the land are adhered to, and that all stakeholders are taken care of.

Click on NEXT to read more...

Vedanta mess: The role these people played

So, would a company's board, in the normal course, be aware of such violations?

It's tough to say. Often, management presents the board with an internal assurance statement, which states the company is in compliance with Section 302 of the Sarbanes-Oxley Act - which means there has been no misrepresentation and it complies with all the laws of the land.

"If the management says so, there's nothing you can fault independent directors with," says Shankar Jagannathan, a researcher in corporate governance and author of Corporate Disclosures 1553-2007.

Yet, independent directors could still have asked more questions. "When you know a company is into mining and needs three to four permissions, a board must satisfy itself that the permissions have been obtained and all obligations are fulfilled," adds Bhargava.

But there's little independent directors can do if a company misrepresents facts or misguides them.

Vedanta says there have been no violations, and would soon respond to a show-cause notice issued by the Ministry of Environment and Forests.

"There's no violation of environment and forest laws by Vedanta. Orissa wanted to develop its bauxite reserves and invited us to set up a refinery.

The mine (Niyamgiri) belongs to the government of Orissa and Orissa Mining Corporation (OMC), not Vedanta. It is OMC, which had applied for approvals from the ministry of environment. I am not an applicant. I just have an off-take arrangement with OMC," said a senior Vedanta executive.

Click on NEXT to read more...

Vedanta mess: The role these people played

The company declined to state anything officially before it replies to the ministry.

Keeping other shareholders in mind, many large corporations like Vedanta have started issuing sustainability development reports according to global reporting initiatives.

The GRI's idea is that disclosures on economic, environmental and social performance should become as commonplace and comparable as financial statements and equally important for organisational success.

Vedanta put out an impressive 51-page sustainability development report for 2008-09 (the latest available), which includes an assurance statement from audit firm KPMG.

This assurance statement, say experts, is like an auditor's report in the annual report, albeit limited in scope.

In complete contrast to the NC Saxena report, neither Vedanta's sustainability development report for 2009 nor KPMG's assurance opinion has reference to protests or opposition.

So much so, that it appears Vedanta's sustainability development report and the NC Saxena report appear to be talking about two different companies.

Click on NEXT to read more...

Vedanta mess: The role these people played

"How come there's nothing reported on this, when KPMG is reported to have visited Lanjigarh. As opposition to the mining project was so vocal, the absence of any reference to this in KPMG's assurance report seems to elicit more questions than answers," points out a governance expert.

Arvind Mahajan, executive director, KPMG, who signed the statement, said he could not comment on the matter.

But, auditors say such a study is limited in scope and is more to check if a company has the systems and processes in place to adhere to GRI norms.

"Checking compliance with regulations is not part of the study. It checks the maturity level of the company in reporting according to GRI norms in terms of processes and systems. It doesn't verify the veracity of the underlying data," clarifies an auditor.

However, this position seems only to comply with the letter of law, losing the spirit of sustainability reports completely.

If this is the position the assurance providers take, why should a compliance audit, especially for companies that operate in environmentally vulnerable areas, not be mandated to prevent Vedanta-like issues from taking place?