| « Back to article | Print this article |

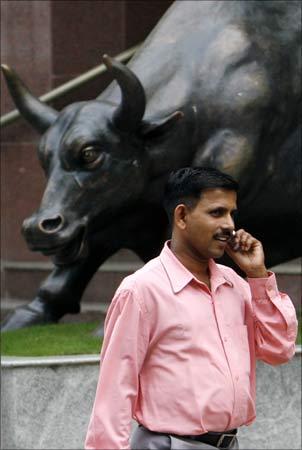

Sensex on Mount 20k; Nifty scales 6000

The markets had a landmark session of trade, with the Sensex surpassing the much anticipated 20k mark and the Nifty scaling the 6000 level for the first time since January 2008 at the very onset of trade.

The Sensex ended at 20,001, higher by 95 points and the Nifty ended at 6009, up 28 points.

The global cues were supportive. Wall Street had jumped on Monday, with the Dow adding 1.3% to 10,754 and Nasdaq jumping 1.7% to 2,356. Asian markets had a cautiously optimistic session, while Europe has bounced back ahead of the Fed meet scheduled later in the day.

The Federal Reserve is widely expected to keep monetary policy unchanged and market players are watching for any hints that the regulator is shifting from targeting low interest rates to focussing on its own balance sheet.

FM happy: Cheering the stock market rally that pushed the benchmark Sensex above 20,000 points, Finance Minister Pranab Mukherjee said on Tuesday that he was happy about the milestone.

"We all know that the Sensex is always a little bit unpredictable. (But) I am happy that for the first time after January 2008, it has crossed 20,000," Mukherjee said in New Delhi.

The minister was replying to reporters' query about his views on the stock market benchmark's new milestone.

The index last traded above 20,000 level on January 17, 2008. Prior to that, the index had scaled its life-time peak of 21,206.77 points on January 10, 2008.

However, a meltdown on the bourses, in line with a global downturn, led to a sharp plunge in the index, pushing it to near 8,000 level in October 2008.

Click NEXT to read further. . .

Sensex on Mount 20k; Nifty scales 6000

There was a discordant note though. On a day when the benchmark indices raced past important levels, thanks to the continuing wave of liquity, heavyweight sectoral indices such as banking, oil and metals ended in the red. And the larger market space continued to lay low, with the midcap indec shedding 0.9% at 8078 and the smallcap index losing 1.3% at 10,176.

And the market breath was negative; out of 3113 stocks traded on the BSE, there were 883 advancing stocks as against 2118 declines.

The day clearly belonged to the IT pack. TCS ended at Rs 952, stronger by 4.6%, on the BSE. Wipro ended at Rs 435, higher by 3.4% and Infosys ended at Rs 3058, up 1.7%. Tata Power and Tata Motors were the other major gainers.

ITC succumbed to profit-booking after the gains registered in the recent past. The FMCG major ended at Rs 172, weaker by 2.1%, to emerge as the top loser on the BSE. Jaiprakash Associates shed 1.3% at Rs 123 and DLF lost 1.3% at Rs 358. And index heavyweight RIL edged lower by 0.6% at Rs 1032.

The market breath was negative; Out of 3113 stocks traded on the BSE, there were 883 advancing stocks as against 2118 declines.

Click NEXT to read further. . .

Sensex on Mount 20k; Nifty scales 6000

4 sectoral indices hit all-time high: Amid a bull run in the market, four of the 13 sectoral indices reached their all-time highs, while two others touched a one-year peak in the early trade on Tuesday on the BSE.

Witnessing a smart move at the start of the session, Bankex, Healthcare, FMCG and Auto indices touched their respective lifetime highs on the Bombay Stock Exchange.

Out of the 14 scrips, 11 were trading in the positive, while three others were trading in the red.Bankex rose to 13,993.32.

HDFC Bank was up 1.46 per cent, Axis Bank 1.27 per cent but SBI was trading 0.15 per cent lower on the BSE.

Meanwhile, the 30-share benchmark Sensex topped the 20,000 mark and zoomed 183 points to 20,088.96 in the early session.

In line with the rally, the Auto index hit its all-time high at 9,469.02, led by gains in Hero Honda, Tata Motors and Maruti Suzuki, which rose 1.49 per cent, 0.55 per cent and 0.47 per cent, respectively.

Click NEXT to read further. . .

Sensex on Mount 20k; Nifty scales 6000

Another index that saw a smart move in the early session was healthcare that soared to a new high of 5,920.04, led by an upsurge in Ranbaxy Laboratories, which was up 3.16 per cent and Sun Pharma that was up 1.50 per cent.

FMCG index too shot-up to its all-time high at 3,729.39 in the start of the trade.

However, later it fell 16.47 points, driven by a fall in the heavy-weight ITC which plunged 1.16 per cent.

Among the other sectoral indices, Capital Goods index and Technology Index started the day on a strong note and touched their respective year-highs in the early trade.

A spurt in the engineering giant L&T drove the Capital Goods index to its 52-week high of 16,071.33, with a gain of a whopping 244.23.

L&T emerged as the volume buzzer in the Sensex pack and soared 3.58 per cent to trade at Rs 2071.10.

Power major BHEL too was quoting higher by 2.05 per cent at Rs 2,490.75.

Similarly, the technology index too witnessed an upmove and hit one-year high at 3,723.41.