| « Back to article | Print this article |

How to make banking accessible to all

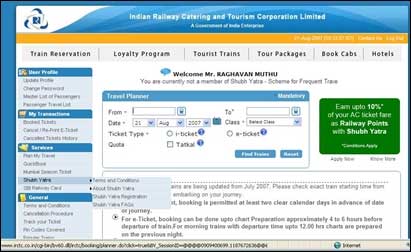

The largest e-commerce company in the Asia-Pacific, including Japan, is an Indian one. This first rank is on the basis of number of transactions, not value. But even in value terms, it is pretty big. Its projected e-commerce turnover this financial year is about Rs 9,000 crore (Rs 90 billion).

It handles close to half a million transactions daily. It has won several awards, including the best e-governance site, and is a mini-ratna public sector company. It is a young company born in 1999. Heck, it is also responsible for delivering one million hot meals daily.

Yes, this company is the Indian Railway Catering and Tourism Corporation (IRCTC), a public sector enterprise under the Ministry of Railways.

Click NEXT to read on...

How to make banking accessible to all

They neither have credit nor debit cards, they do not have a bank account, nor do they have internet access from home.

That is the most remarkable feature of this Indian e-commerce company. In a way, at least in terms of providing a payment solution, this company has done tremendously well as far as financial inclusion is concerned.

Click NEXT to read on

How to make banking accessible to all

So, based on its payment solution outreach performance, should IRCTC be a candidate to become a bank? This question may sound senseless and provocative, but it is deliberate. There is talk of awarding new banking licences, and those licences may be given largely on the basis of potential for financial inclusion.

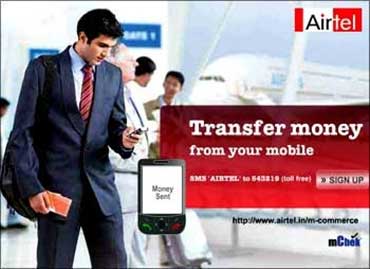

These days, it is impossible to encounter a sentence about financial inclusion which does not contain the word telecom.

Click NEXT to read on . . .

How to make banking accessible to all

In the coming years, that promise might very well translate into a tangible reality, with mobile banking becoming mainstream. But for now, it is important to distinguish between a payment outreach and the spread of banking.

How to make banking accessible to all

The achievement of FMCG companies as also that of modern telephony reflects the genius of a distribution model. To be able to sell products in sachet sizes (whether shampoo or talk-time) in millions of small units and recover those small payments all the way back to the head office is a victory of business model innovation.

Click NEXT to read on...

How to make banking accessible to all

Think of the complex and widespread ecosystem of wholesalers, distributors and retail outlets working together smoothly. In telephony, unlike in FMCG, the payments are actually advance payments, since the service is "consumed" over the next two months or longer.

This pretty much describes India's telephony, since 90 per cent is pre-paid business. This might also be true across most emerging market economies. A consumer just buys a SIM card (or top-up) like toothpaste or soap, and walks away.

The fact that telecom consumers are willing to pay in advance (that's why it is called pre-paid) means that there is a trusting relationship with the telecom company.

Click NEXT to read on

How to make banking accessible to all

Of course, in this era of stiff competition, the fear of churn and the arrival of the dreaded number portability, the relationship with the customer need to be enduring, whether pre-paid or post-paid. Hence the need for developing a trustworthy brand. A banking relationship is entirely different. It is based on trust.

It is about accepting deposits and savings, and providing credit. Banks create credit based on deposits received from trusting depositors. The depositors can withdraw at will, but recalling the credit (loans) is not possible at short notice.

Click NEXT to read on

How to make banking accessible to all

That is why banks have to subject themselves to rigorous regulation and supervision, and pass several litmus tests. These tests are getting tougher in the wake of the financial crisis, and new Basel norms will make banks behave even more conservatively. Even their credit-creation capacity will be capped.

So, to expect banking services to spread as rapidly as telecom is inappropriate for two reasons. First, because they are more dissimilar than popularly portrayed. One is largely FMCG business, while the other is about building long-lasting relationships. And secondly, soundness and stability call for greater caution in rapid spread of banking services.

Click NEXT to read on

How to make banking accessible to all

The KYC (know your customer) check of banks is usually stronger than that of telecom (e.g. the Jama Masjid bomber's SIM card turned out to have a fake name and address).

The challenge of financial inclusion will require joint efforts of banking and telecom, just like computerisation of two decades ago. Incidentally, it was computerisation of railway ticketing which led to the eventual birth of IRCTC.

Click NEXT to read on

How to make banking accessible to all

In the past five years, we have tried innovations like no-frills bank accounts and enabling banking correspondents to work as appendages to bank branches. But we have made no dent in the larger problem.

The introduction of Adhaar universal ID will help. But doorstep banking and last-mile delivery to the remotest village is a bridge still too far. A phone call will not help.

The author is chief economist, Aditya Birla Group.