India, the world's fastest growing telecommunications industry with 688.38 million telephone (landlines and mobile) subscribers and 652.42 million mobile phone connections (as of July 2010), is a tough battleground for biggest mobile handset makers.

As sales zoom, there is more reason to cheer for companies as well as customers. The shipments of mobile handsets in India grew by 6.3 per cent (QoQ) in the second quarter of 2010, ending June 30, to touch an all-time high of 38.63 million units in a single quarter, market intelligence and advisory firm IDC India.

Compared to the second quarter of 2009, there has been a 60.1 per cent rise in terms of unit shipments in the second quarter of 2010.

The dual and triple-SIM card slot phones have grown to touch as much as 38.5 per cent of the total India mobile handset shipments, from less than 1 per cent during the April-June 2009 quarter.

"In the recent quarters several new players successfully launched their own devices at significantly lower Average Selling Values (ASVs) in the price sensitive India market.

Such handsets found ready acceptance amongst first time buyers, especially from small towns and villages," Anirban Banerjee, associate vice president-research, IDC India.

Click NEXT to find out the top 5 mobile handset players in India...

The Finnish handset maker Nokia retained its No.1 spot with a market share of 36.3 per cent in terms of units shipped.

India is the second largest market for the company globally. The company which started its India operations in 1995, offer over 40 handsets. Nokia has research and development facilities in Bangalore and Mumbai, a manufacturing plant in Chennai and a design studio in Bangalore.

Over the years, the company has grown manifold with its manpower strength increasing from 450 people in the year 2004 to over 15000 employees in March 2008 (including Nokia Siemens Networks).

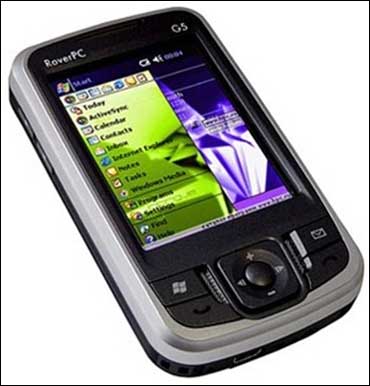

The influx of new brands led to a spurt in overall market and saw 'emerging vendors' corner as much as 33.2 per cent of total India mobile handset shipments in the second quarter in 2010, IDC said.

Click NEXT to read on . . .

The number of emerging vendors in India's burgeoning mobile handsets market grew to 35 in the second quarter of 2010. Together, they garnered 33.2 per cent of total shipments for the first time during the April-June 2010 quarter.

This represented a manifold increase from five new vendors representing a 0.9 per cent combined share of units shipped in the January-March 2008 quarter.

Click NEXT to read on . . .

Chinese brand G'Five is the third biggest mobile handset player in India, with a market share of 7.3 per cent in terms of units shipped.

Founded in 2003, G'Five focuses on the international market, especially emerging markets. Its products are mainly sold in South Asia, Southeast Asia, Middle-east, Africa, and South America.

G'Five has factories and assembly lines in Shenzhen, one operation centre in Hongkong, and sales teams and offices in India, Dubai, Egypt, and Peru.

According to Naveen Mishra, lead telecom analyst, IDC India, "The India mobile market saw a unique trend of multi SIM phones capturing 38.5 per cent of the market. This could be attributed to several new service providers responding with highly competitive tariff plans to a price sensitive mobile telephony user market."

Click NEXT to read on . . .

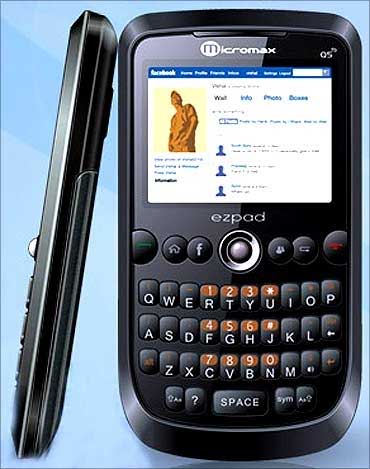

Indian brands are now giving a tough competition to foreign brands in terms of price, handset models and services.

The Rs 50,000 crore (Rs 500 billion) handset market in India has seen new vendors rise to 28 from only five players in January-March 2008 quarter.

Micromax plans to sell six million units this year. About 80 per cent of companies' sales is driven by rural India. The company has presence in Sri Lanka, Hong Kong, Dubai and Nepal.

Click NEXT to read on . . .

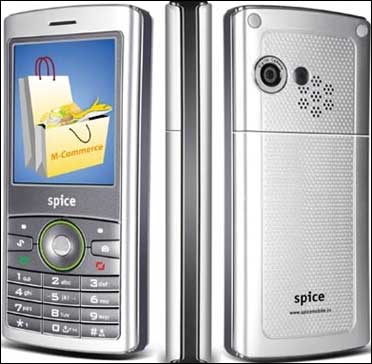

The company with 25 handset models is targeting 1 million handset sales per month. Spice Mobiles is the first Indian handset manufacturer to begin its local production at Baddi, Himachal Pradesh in March 2010.

Spice Mobiles has also enhanced its presence outside India with entry into Bangladesh and Nepal, now plans to enter the African market.