Photographs: Reuters Ashish Rukhaiyar & Chandan Kishore Kant in Mumbai

The mutual fund industry has reason to hope for some relief soon from the various strict guidelines of the Securities and Exchange Board of India.

U K Sinha, new Sebi chairman had, in an interaction with its MF division, made his view clear on the need for some moves to spur overall development for the sector, persons familiar with the development said.

Relaxations related to caps on the usage of funds or even a reduction in regulatory or compliance costs could be announced soon.

Officials have been told to look at areas where the costs of asset management companies can be lowered, without diluting prudency norms for safeguarding the interest of investors.

This would be welcomed by the MF industry. It has been keeping its fingers crossed since Sinha assumed office in mid-February.

. . .

MFs expect more sympathy from new Sebi chairman

He is aware of the nuances in operating an AMC, having managed Rs 65,000 crore (Rs 650 billion) worth of assets under management of UTI Mutual Fund as its chairman and managing director.

He was also chairman of the Association of Mutual Funds in India, the umbrella body of 40-odd fund houses.

"Increasingly, we are getting a hint that whatever regulation had to be done has been done.

"Now, Sebi is focusing on development of the mutual fund industry," said the chief marketing officer of a domestic AMC with assets of well over Rs 40,000 crore (Rs 400 billion).

. . .

MFs expect more sympathy from new Sebi chairman

What to do

Amfi has also planned to take up this issue with the regulator. "We will go and meet the Sebi chairman in the first week of April," says H N Sinor, chief executive officer.

"At the moment, he (Sinha) is reviewing what things are there internally. We cannot expect a series of measures from his side, as he is settling down. How to grow the market is the key focus now. By and large, the regulation part has been taken care of."

Industry players, interestingly, feel the regulator should reward performance. They feel if the fund management fee could be linked to performance of the fund, then it would make managers work harder.

"Internationally, it is an established practice but in India, the industry cannot charge such fees from investors. Fund houses have internally thought about this but the regulator has some issues with it. If the regulator comes up with this kind of change, it would help industry grow and will also be good for the investors," said Sinor.

. . .

MFs expect more sympathy from new Sebi chairman

Image: (Inset) U K Sinha, the new Sebi chairman.Photographs: Reuters

Another fund manager, speaking on condition of anonymity, said the regulator should look at doing away with caps or limits that, at times, hamper the growth of innovative products.

"For instance, the regulator has put caps on derivatives-based products. If these caps are removed, I believe industry can function aggressively, which will help us grow and develop the industry further," he says.

. . .

MFs expect more sympathy from new Sebi chairman

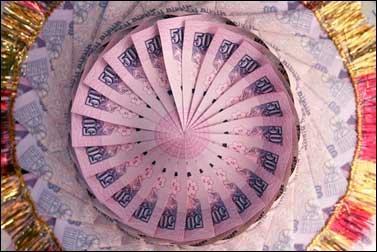

Image: Indian currency notes are stapled to form garland at market in Jammu.Photographs: Mukesh Gupta/Reuters

It is believed that Sebi is also revisiting the know your customer) regulatory norms that must be met before a person can start trading in MFs.

Industry players feel there is still a lot of room to rationalise the costs involved in following the KYC norms.

Early this month, the regulator clarified on how AMCs could utilise the money in the load account.

The balance can now be used by the fund houses for marketing and selling expenses, including distributor and agent commissions. There is a catch, however.

"Not more than one-third of load balance as on July 31, 2009, shall be used in any financial year, including the current financial year," said the Sebi note.

article