Vrishti Beniwal and Indivjal Dhasmana

The revenue department has exceeded its tax collections target this year. Revenue Secretary Sunil Mitra agrees the target for 2011-12 is ambitious but achievable.

In an interview with Vrishti Beniwal and Indivjal Dhasmana, he talks about tax reforms in the new financial year and what led to roll-back of controversial Budget proposals like service tax on health. Edited excerpts:

You have set a very ambitious target next year as well. Do you expect to meet that?

Next year, the target is 24.9 per cent higher than this year's without any increase in rates. It is certainly ambitious, but I think we will do it. What is helping us is that people are paying taxes.

...

GST set to roll out in April 2012

Image: There has been a little moderation in excise and customs.There has been a little moderation in excise and customs in February and March, but it is still much higher than what it was.

What is the revenue implication of changes made to the Budget proposals?

In respect of service tax, it is not much. It will be about Rs. 600 crore (Rs. 6 billion). In respect of garments, the easing of some of the procedures and higher abatement will lead to a loss of about Rs. 1,000 crore (Rs. 10 billion).

So, you deduct Rs. 1,600 crore (Rs.16 billion) from Rs. 11,300 crore (Rs. 113 billion) of revenue gain that was expected from the Budget proposals on indirect tax front. But these are just estimates.

...

GST set to roll out in April 2012

Image: Buoyancy in revenue will continue.But we did not have any loss. With the economy growing at nine per cent, the buoyancy in revenues will automatically get us this.

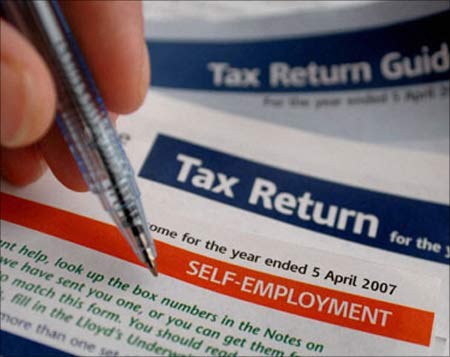

Last year, you watered down some draft proposals of Direct Taxes Code under pressure from industry. Again, some Budget proposals were tweaked to address industry concerns. Wouldn't that send a wrong signal, if you roll back your proposals every time?

We have not rolled back anything. The service tax is still there. We have just exempted it because all services have to be taxed in the Goods and Services Tax, barring a small negative list of services.

In some cases, we have only increased the abatement level and eased certain procedural requirements.

...

GST set to roll out in April 2012

Image: Certain levies have been rolled back.When we realised that this was going to impact solar panels and renewable energy, we withdrew it. This is a part of every year's Budget exercise.

We do some adjustments and that's what the Budget and post-Budget consultations are meant for. DTC is one of the finest examples of a completely consultative legislative process.

What is the point in introducing measures that remain only on paper? Our whole objective is towards voluntary compliance in taxation.

...

GST set to roll out in April 2012

Image: Focus will be on raising awareness on GST.We are sticking with what we have done. We have made a number of process simplifications, which they have perhaps not understood in full.

If the Election Commission permits us, we will put out a paid advertisement in prominent newspapers, including vernacular dailies, explaining what we have done.

Since the Constitution Amendment Bill has been tabled in Parliament, how do you plan to move ahead on GST legislation now?

This year, we will see a lot of activity on educating people on GST. We have done that in the case of DTC but not for GST.

...

GST set to roll out in April 2012

Image: Government is open for debate.As soon as we complete the model GST legislation for states and legislation for Central GST, we will take this up for public information and awareness.

We have to do that in this year. We have to educate our own people who are going to collect GST. That process has started.

I have been talking to field officials in different parts of India. But the legislation is not ready yet. We are just starting the exercise and it may take us two months.

Another thing which is mentioned in the Budget is that we will open for a debate a small negative list of services. That's why we have put tax on health services on hold.

...

GST set to roll out in April 2012

Image: Unlikely that the government will release a positive list.So, health services will not be part of the negative list?

I cannot presume that. It may be or may not be.

Is there a possibility of the government coming out with a positive list?

It's unlikely. Today we have a positive list. The experience has been that it's a much more even system if you exempt a small negative list from service tax. That's what we are committed to follow.

...

GST set to roll out in April 2012

Image: Income tax portal will roll out in June.The single portal, which is being designed, will roll out in June this year. It will be a pilot project with one window for registration, filing return and payment.

The system, called GST-N, will automatically segregate the data that needs to go to the state system. Payments will be done through RBI clearing accounts for states and the Centre.

The pilot project is being done with 11 states. Once we roll out the project in June, all we have to do is to upscale it, so that it covers the rest of the country in GST.

...

GST set to roll out in April 2012

Image: GST is expected in April 2012.This is being incubated by NSDL. In the first phase, they have asked me for Rs. 16 crore (Rs. 160 million), which I have agreed to. I don't know how much it will ultimately cost.

When is the core group working on GST legislation going to give its report?

They have completed a year's work and we have just given them another year.

Let me clarify they are not working on the legislation. They are working on clarifying the concepts.

The legislative effort has to be done by the Tax Research Unit under the Central Board of Excise and Customs.

So, when do you expect to roll out GST?

The finance minister is saying that we should try for simultaneous introduction of DTC and GST in April 2012.

We will do our best to adhere to that but it will be difficult.

...

GST set to roll out in April 2012

Image: Standing Committee will examine GST.If in the Monsoon Session all the states say yes and we get the recommendations of the Standing Committee and reintroduce the Constitutional Amendment Bill in the same session or Winter Session for voting, I still have some time for ratification.

Maybe in the Budget Session then, we can introduce the GST legislation if it is voted and ratified by that time. The GST legislation will also have to be examined by the Standing Committee.

It will then have to be reintroduced for voting. All that can't happen in the same session.

If everything goes well, we may target a date for GST introduction after the Monsoon Session next year.

But our effort will be to keep the minister's commitment and try to give it effect from April 2012.

article