Photographs: Reuters Shonalee Biswas

Gold has given a return of 19.6 per cent per year since 2002.

To give the readers a sense of proportion, if you would have invested Rs 1 lakh (Rs 100,000) in gold back in 2002, it would have been worth Rs 5.6 lakh (Rs 560,000) by now!

But basic question is why do people buy gold? To know the answer, we will have to get into a little bit of history.

In the book What Has Government Done To Our Money, economist Murray Rothbard writes: 'Clearly, Robinson Crusoe (a fictional character who was marooned on an island) had no need for money. He could not have eaten gold coins. Neither would Crusoe and Friday (his helper and from whom the term Man Friday comes into the English language), perhaps exchange fish for lumber, need to bother about money. But when society expands beyond few families, the stage is already set for the emergence of money.'

. . .

Why people hoard gold and buy it during crises

Photographs: Reuters

So when humans got to a stage where they could not produce everything they wanted to consume, they had to exchange things. The system that evolved was known as the barter system of direct exchange.

But the barter system had two problems: a) indivisibility and b) lack of coincidence of wants.

Let us try and understand these problems through examples. A farmer, who grows wheat, has a cow and is ready to exchange the cow for goods that he wants. The trouble is he wants rice, eggs and a new plough.

So how does he divide the cow into three parts so that he can get rice, eggs as well as a new plough? This is the first problem with the barter system.

. . .

Why people hoard gold and buy it during crises

Photographs: Reuters

Let us take the case of the same farmer who wants to exchange his wheat now for eggs. The trouble is he is unable to find someone who is willing to exchange wheat for eggs. This is lack of coincidence of wants.

So this led to the invention of money, which was basically a commodity that was acceptable to everybody and was used as a medium of exchange. Thus the farmer, who needs rice, eggs and a new plough, could have sold his cow for money and used that money to go buy rice, eggs and a new plough. So the question of dividing the cow never arose.

Similarly, the farmer could sell his wheat to someone, get money for it and then use that money to buy eggs. So money ensured that even without coincidence of wants, people could get what they wanted to.

Over the years, various commodities have been used as money. These include, 'tobacco in colonial Virginia, sugar in the West Indies, salt in Abyssinia, cattle in ancient Greece, nails in Scotland, copper in ancient Egypt and grain, beads, tea, cowrie shells and fishhooks.'

. . .

Why people hoard gold and buy it during crises

Photographs: Reuters

In Britain, even slaves and cattle were used as money. Cigarettes were also used as money in Germany during World War II. But over the years, gold and silver emerged as the premier form of money.

Why did this happen? 'Gold has clear advantages as money. Unlike cowrie shells, which were the main form of money for centuries in parts of Asia, gold is remarkably durable and does not easily fragment,' writes Peter Bernstein in The Power of Gold.

But durability was just one factor. What also helped was the 'uselessness' of gold. As Bernstein writes, '. . . gold, in contrast, has always been useless for most practical purposes that call for metal, because it is so soft. With only 125,000 tonnes (the book was published in 2000. Now the number is around 165,000 tonnes) of it in existence, gold is also too scarce to have many uses.'

Other metals like silver and copper have lots of industrial uses. Gold can be used for a lot of industrial purposes given that it is highly malleable (can be beaten easily into thin sheets) and ductile (can be easily rolled into a wire).

. . .

Why people hoard gold and buy it during crises

Photographs: Reuters

As Berstein points out, '. . . you could draw an ounce of gold into a wire fifty miles in length, or if you prefer, you could beat that ounce into a sheet that would cover one hundred square feet.'

Almost all of gold ever mined is still around. Gold is chemically inert and that explains why its radiance is forever. It s also the best conductor of electricity.

But the fact of the matter is gold is available in an extremely limited quantity and hence is too expensive to be used industrially.

Also gold is very dense: a cubic foot of gold weighs around 500 kg, which ensures that very little of it is required to carry a lot of money around, or to store a lot of value.

. . .

Why people hoard gold and buy it during crises

Photographs: Reuters

'The density of gold means that even very small amounts can function as money of large denominations,' writes Bernstein.

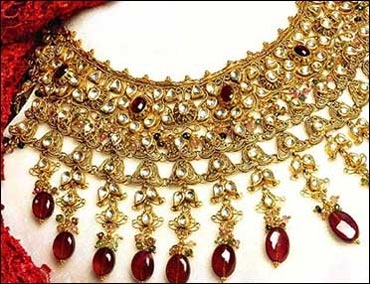

Given these reasons, it made a lot of sense to use gold as money. There was very little competition from other uses. The only significant use of gold was to make jewellery for women.

But even with gold as a currency there were some problems. As James Turk and John Rubino point out in The Collapse of the Dollar, 'Metal coins were too noisy and . . . also wore out over time eroding a small but significant part of an economy's wealth.'

The Bank of England had this idea in the 1690s where it locked up all the gold and silver coins and issued paper money against those coins.

. . .

Why people hoard gold and buy it during crises

Photographs: Reuters

'Much of England's money, in the form of gold and silver, sat in the Bank of England's vault, while its currency, now a liability (or IOU) of the Bank, circulated as bits of paper,' the authors point out.

For the next three years the system ran very well. The citizens were happy that they did not need to carry with them the rather bulky coins. Also, they could exchange the paper currency for real gold and silver at the bank, whenever they wanted to.

But then the Bank of England started debasing the currency. As the authors point out, 'The honeymoon lasted for about three years, during which time the citizenry was happy to carry around light pound notes, but it soon became clear -- in a process destined to be repeated many times in later centuries -- that the monetary authorities were issuing more paper than was backed by gold and silver in their vaults.'

This was not the first time that the government had debased currency. Nero, the King of Rome, was the first one to do it. 'The usual method of debasement was to mint coins with an unchanged face value but smaller in size and with a reduced metallic content, thereby stretching the available supply of metal to produce a larger number of coins,' writes Bernstein.

. . .

Why people hoard gold and buy it during crises

Photographs: Reuters

'Debasement worked best when people were fooled into thinking that nothing untoward had occurred with the newly issued coins, but you can't fool all of the people all of the time," adds Bernstein. The gold that was 'left over' went into the King's personal account or was used to finance wars.

So as citizens of England found out that banks was debasing currency, they started to turn up at the bank demanding their gold back in exchange for currency.

Of course the bank had issued more paper money, than the gold it had. And so there was a crisis. Sir Isaac Newton, the resident genius of King William III, was called in to handle the crisis.

But that is history. Over the years, the link between paper currency and gold (or silver for that matter) has broken down completely.

. . .

Why people hoard gold and buy it during crises

Photographs: Reuters

Governments now need not back their paper currency with gold and silver. Most of the central banks around the world sold major portions of the gold they had around a decade back.

Also, with no gold required behind paper currency, governments can issue as much paper currency as they want. And this is what they have been doing over the last three years.

Central bank governors all around the world, under pressure from politicians, have been printing money left, right and center, in order to revive their moribund economies.

The idea being that the more money they print and pump into their financial system, the more banks will lend to people, and the more people will go out and buy goods and services.

. . .

Why people hoard gold and buy it during crises

Photographs: Reuters

This will help companies report good sales and thus they will hire people, who will in turn go out and buy more goods and services. This loop will help revive their slowing economies.

Of course, things haven't happened as planned. Also as more and more paper currency gets dumped into the financial systems around the world, the more the danger that the paper currency will lose its 'value'.

So earlier when people thought that the central bank was up to some hanky-panky they turned up at its doorstep and demanded gold in exchange for their paper money which they had the right to have.

Now whenever they see paper currencies losing value, they simply go out there and buy gold.

. . .

Why people hoard gold and buy it during crises

Photographs: Reuters

Unlike paper money or electronic blips on computer screens that are the modern world's most common forms of money, gold cannot be created out of thin air.

Also, hoarding gold is not a natural infringement on the rights of others. As a blogger, FOFOA, wrote in a piece titled The Value of Gold, 'And because it is not used for many things other than mere hoarding, the act of hoarding gold is not an infringement on the natural rights of others.'

So if you were to hoard foodgrains like rice or wheat, so as to preserve the value of your wealth, it wouldn't go down well in a world which adds 79 million people every year.

If you hoard a metal like copper, you will be taking it away from its genuine industrial users. So in the end people hoard gold, whenever there is crisis of confidence on the paper currency.

The author can be contacted at shonalee.biswas@gmail.com

article