Photographs: Reuters. John C Gonsalves and V M Prabhune in Mumbai

In a departure from big gains in the past two years, investors saw around Rs 20 lakh crore of their wealth eroded as Indian equities tanked in 2011 because of inflation, high interest rates and the uncertain global growth environment accentuated by the euro zone debt crisis.

In addition, the rupee fell to historic lows against the US dollar, hitting the country's import bill.

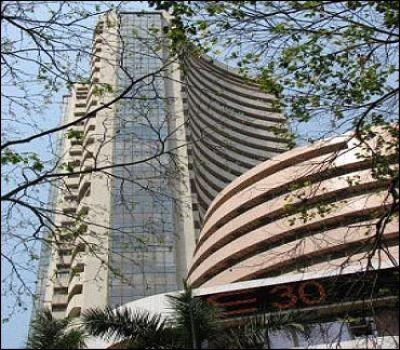

The bellwether indices of the Bombay Stock Exchange as well as the National Stock Exchange fell by over 26 per cent during the course of the year, touching new lows.

...

Investors lost Rs 20,000,000,000,000 in stocks

Image: Investors remain cautious on India.Photographs: Reuters.

The 30-scrip BSE Sensex was down by 5,334.01 points, or over 26 per cent, at 15.175.08 on December 20, against last year's close of 20,509.09.

Similarly, the 50-share Nifty witnessed a hefty fall of 1,590.30 points, or 25.92 per cent, to 4,544.20 on December 20 from last year's close.

There has been some recovery since then, with the Sensex closing at 15,873.95 and the Nifty at 4,750.50 yesterday, but market experts say investors remain cautious on India.

...

2011: Investors lost Rs 20,000,000,000,000 in stocks

Image: FIIs turned negative on Indian equities.Globally, the deepening European debt crisis and a historic downgrade of US creditworthiness hit the economic growth sentiment. Besides, political turmoil in the Middle East pushed up global crude oil prices, adding to inflationary pressures and pushing up the country's import bill.

FIIs, the main drivers of the market, turned negative on Indian equities this year and after having injected a record Rs 1,33,266 crore, or over $29.36 billion, in 2010, pulled out Rs 2,497.50 crore, or $318.00 million, from equities till December 19.

...

2011: Investors lost Rs 20,000,000,000,000 in stocks

Image: A bad year for the markets.Meanwhile, as per Sebi data, they pumped in Rs 39,637.50 crore, or over $8.2 billion, into the debt market till December 19.

The Sensex had gained 7,817.50 points, or 81.03 per cent, in 2009 -- the highest rise in any one year in absolute terms -- while it spurted by another 3,044.28 points, or 17.43 per cent, in 2010.The Nifty also had soared by 2,241.90 points, or 75.76 per cent, in 2009, followed by 933.45 points, or17.95 per cent, last year.

...

2011: Investors lost Rs 20,000,000,000,000 in stocks

Image: Falling rupee made investors cautious in 2011.Photographs: Reuters.

Aggressive offloading resulted in 12 of the 13 sectoral indices closing in the red, with some of them hitting 52-weeklows during 2011.

Only the BSE-FMCG gained, but just about 9 per cent up to last week.

...

2011: Investors lost Rs 20,000,000,000,000 in stocks

Image: Investors apprehensive.Photographs: Reuters.

It also cut the GDP growth forecast for the current fiscal to 7.6 per cent from 8 per cent projected earlier.

However, in the mid-quarter monetary policy review on December 16, the RBI left the lending rate unchanged to support faltering economic growth amid hopes that inflation will begin to fall after hovering close to double digits most of the year.

...

2011: Investors lost Rs 20,000,000,000,000 in stocks

Image: Rate-sensitive realty, banking and auto stocks suffered a sharp setback.Photographs: Reuters.

Rate-sensitive realty, banking and auto stocks suffered a sharp setback. The metal sector, too, was at the receiving end due to a big fall in commodity prices in the absence of demandin global markets.

article