Photographs: Reuters Rajesh Rai & Prakash Chawla in New Delhi

India received increased foreign direct investment in 2011 than the previous year, but lack of big ticket policy announcements belied high expectations leading to gloomy mood among investors.

It is said that figures speak for themselves. Not in the case of the data relating to the foreign direct investment.

On the face of it, the country attracted FDI worth $22.52 billion between January and September, 2011 against $15.97 billion in the same period last year.

The rise in the inflows should have cheered the investment climate.

Click on NEXT for more...

FDI flow soars but policy inertia spoils party in 2011

Photographs: Reuters

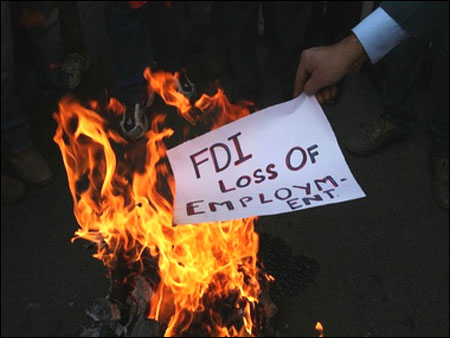

Instead, the mood is gloomy, especially after the government was forced to put on hold the big bang policy of opening multi-brand retail to foreign investment.

"...going ahead, it may face a slowdwon mainly because of global economic uncertainties. The government needs to work more on improving investment climate of the country," CRISIL principal economist D K Joshi said.

Industry and policy planners expected the window of FDI to get widened at a time when the global financial markets went into a tailspin following the European debt crisis and the flows from the foreign institutional investors (FIIs) not only dried but took a reverse turn.

The Sensex reflecting the sagging confidence of the FIIs, has declined from 20,561.05 on January 3, 2011 to 15,175.08 on December 19, 2011.

Click on NEXT for more...

I flow soars but policy inertia spoils party in 2011

Photographs: Reuters

The FIIs have withdrawn Rs 2,497.50 crore (Rs 24.97 billion) between January and December 20, exerting pressure on the rupee which has seen a drop in value against the US dollar by 16 per cent since July.

It was exactly in this backdrop that the policy makers and the industry looked towards the political leadership to take some big steps and liberalise the country's FDI regime, so that overall overseas resources are robust.

But then, the "political compulsions", as Prime Minister Manmohan Singh said, led to halt in the reforms process.

While the Department of Industrial Policy and Promotion (DIPP) did take several initiatives to boost the investment climate, it is felt that not enough preparations were done at the political level to get the UPA allies on board.

In the end, the key UPA allies Trinamool Congress and Dravida Munnettra Kazhagam were not enthusiastic about opening the FDI for multi-brand retail.

Click on NEXT for more...

FDI flow soars but policy inertia spoils party in 2011

Photographs: Reuters

Reforms in pensions and insurance by liberalising FDI in these areas, could also go a long way in encouraging global investors.

However, the Opposition parties, especially the BJP whose support is crucial for passage of certain bills in Parliament, are not on the same page with the government. The UPA is in minority in the Rajya Sabha.

On the positive side, major tie-ups were announced in the initial few months of the year which helped improve the inflows.

Reliance Industries' $7.2 billion mega deal with British major BP Plc is seen as the biggest the foreign direct investment into India so far.

Japanese pharma major Daiichi Sankyo's buyout of Ranbaxy Laboratories for $4.5 billion was the second biggest FDI.

article