Photographs: Reuters Sanjaya Baru

Has it taken nearly two decades after the introduction of economic reforms and liberalization, including wide ranging industrial decontrol and delicensing, for India's manufacturing sector to revive itself?

It would seem so looking at who's at the top among Indian companies.

The BS 1000, which ranks Indian companies in terms of market capitalisation, has shown an interesting trend over the past two decades.

On the eve of economic liberalization, the top 100, and indeed even the top 20, was littered with manufacturing companies.

While Tata Steel occupied the pride of place at the very top (it does not figure in the top 20 in 2010), Tata Motors was at No.3 (it slipped out of the top 50 in 2000 and has just slipped back in to the top 20 in 2010 -- a tribute to Ratan Tata's leadership).

. . .

How India's top 20 firms by market cap have changed in 20 years

Image: ONGC rig.Photographs: Rediff Archive

At least six textile companies figured in India's top 20 in 1990, by 2010 not one!

Apart from the Tatas, Reliance and a few textile companies the other big manufacturing firm in the top 20 in 1990 was Larsen & Toubro, almost at the very bottom, and it too has experienced an impressive revival of growth by 2010, having slipped out of the top 20 in 2000.

The composition of the top 20 tells a story. If on the eve of liberalization traditional industries and a couple of multinationals were at the top, by 2000 the impact of the information technology revolution and the great Y2K opportunity made its mark.

| INDIA'S TOP 20 COMPANIES BY MARKET CAPITALISATION | ||

| 1990 | 2000 | 2010 |

| Tata Steel | Wipro | Reliance Industries |

| ITC | Hindustan Unilever | ONGC |

| Tata Motors | Infosys Technologies | TCS |

| Century Textiles | Reliance | Coal India |

| Hindustan Unilever | ITC | Infosys Technologies |

| Mafatlal | O N G C | SBI |

| Reliance Industries | HCL Technologies | NTPC |

| Grasim | Pentamedia Graphics | Bharti Airtel |

| G S F C | Zee Entertainment | ITC |

| ACC | M T N L | ICICI Bank |

| SIV Industries | I O C L | Larsen & Toubro |

| Colgate-Palmolive | St Bk of India | Wipro |

| Hindalco | H F C L | MMTC |

| Bajaj Holdings | Satyam Computer | BHEL |

| Saurashtra Cement | Tata Communications | NMDC |

| Uniphos Enterprises | Ranbaxy Labs. | HDFC Bank |

| Bombay Dyeing | H D F C | HDFC |

| JCT | Cipla | Indian Oil Corp |

| Larsen & Toubro | NIIT | Tata Motors |

| Nestle India | Nirma | SAIL |

. . .

How India's top 20 firms by market cap have changed in 20 years

Image: TCS office.Photographs: Rediff Archive

As many as seven of the top 20 companies, in terms of market capitalization, were firms in the information technology business.

The 1990s was the decade of restructuring for many traditional manufacturers in the top 20, and most of them slipped out of even the top 50 by 2000.

Among the survivors -- Reliance, ITC and Hindustan Lever successfully rode out the post-liberalisation storm and remained in the top 20 even in 2000 -- only Reliance was big in large-scale manufacturing.

Among the top 20 of 1990, only the Tatas tapped the IT opportunity. Indeed, if the Tatas had not grabbed the IT opportunity in the 1990s, they would not even have figured in the top 20 in 2000, with both Tata Steel and Tata Motors slipping down the list.

. . .

How India's top 20 firms by market cap have changed in 20 years

Image: Coal India workers.Photographs: Reuters

Only TCS held the flag for the Tatas in the top 20 in 2000, climbing further to the third rank in 2010.

Several interesting trends are discernible at the top from the chart provided here.

First, the shift at the top of the Indian business pyramid in the decade of the 1990s was radical. Only three firms survived the decade at the top -- ITC, Reliance and Unilever.

Equally dramatic, companies that had barely been heard of in 1990 climbed all the way to the top -- Wipro, Infosys, HCL, Pentamedia, Zee, Satyam and NIIT.

. . .

How India's top 20 firms by market cap have changed in 20 years

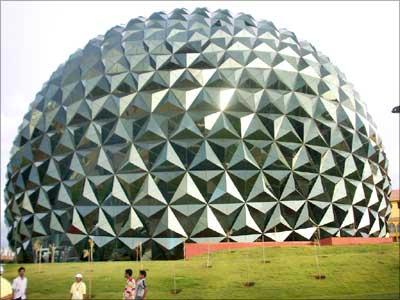

Image: Infosys Mysore campus.Photographs: Rediff Archive

Third, despite all the anxiety caused by the Uruguay Round agreement for the future of Indian pharmaceuticals, two pharma companies -- Ranbaxy and Cipla -- entered the top 20 in 2000.

Finally, a private sector bank unheard of in 1990, HDFC, was there at the top close to the famous SBI!

The changes in the list in the subsequent decade draw attention to the rising importance of resource-based companies, a phenomenon widely commented upon in recent months in the context of the growing concern about crony capitalism and the advantages conferred upon incumbents by a new licence-permit Raj.

. . .

How India's top 20 firms by market cap have changed in 20 years

Image: An SBI advertisement.Consequently, if manufacturers had a pride of place in 1990, few of them did in 2010.

Not only did information technology based firms continue to remain at the top (TCS, Infosys and Wipro in the top 20, with Satyam not surviving its moment of glory in 2000), but resource-based companies like ONGC, Coal India, NTPC, MMTC, NMDC, IOC have all climbed to the top.

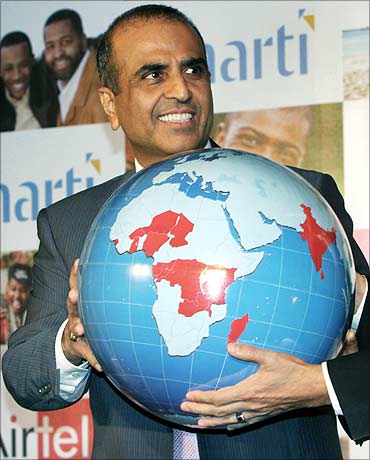

Next come the telecom giant Bharti Airtel and banks and finance companies. India's manufacturers are represented in the top 20 by L&T and the resurgent Tata Motors.

. . .

How India's top 20 firms by market cap have changed in 20 years

Image: An NTPC plant.Photographs: Rediff Archive

At the beginning of the second decade of the 21st century it is difficult to forecast what the composition of the top 20 would look like in 2020.

It is entirely possible that resource-based companies, especially in scarce commodities, will dominate the top.

It is also possible that IT and telecom companies will not remain as big as they are if competition increases the number of players and restricts the size of incumbents. It is possible that banks and financial firms will grow bigger with consolidation.

. . .

How India's top 20 firms by market cap have changed in 20 years

Image: Sunil Mittal, chairman, Bharti Airtel.Photographs: Reuters

However, if manufacturers have to return to the top, in a more competitive market, chances are that defence equipment manufacturing industries, including in the aviation sector, could rise.

If so, both L&T and the Tatas are well-placed to exploit that opportunity, and so might Reliance and Mahindra.

The defence opportunity would also help IT companies to grow. An incipient indigenous military-industrial complex could well alter the shape of the top of India's big companies.

. . .

How India's top 20 firms by market cap have changed in 20 years

Image: ITC's e-choupal.Policy planners in government, inspired by the National Manufacturing Competitiveness Council, have been talking about the need to pursue 'industrial policy' to encourage manufacturing growth.

The best way to do this without returning to the discredited policies of the past would be to put in places laws and infrastructure that would promote manufacturing sector growth.

The second best option would be to encourage the growth of a strategic industrial sector.

. . .

How India's top 20 firms by market cap have changed in 20 years

Image: ICICI Bank.Most major industrial powers have used the defence and strategic sectors to push manufacturing growth.

The United States, Russia, China, Japan, Germany, France, Britain, Italy and Sweden and, more recently Brazil and Malaysia, have promoted manufacturing through the growth of defence and strategic industries.

Perhaps India will, too, and that would play an important role in defining who will be at the top of India's business pyramid.

article