With a view to reining in high inflation, the Reserve Bank of India on Tuesday raised its key short-term lending and borrowing rates by 0.25 per cent each with immediate effect.

The short-term lending (repo) rate has been hiked to 6.50 per cent and the borrowing (reverse repo) to 5.50 per cent, a move that will make funds expensive for banks and may lead to a hike in interest rates.

On the basis of the current assessment and in line with the policy stance as outlined in Section III, the following monetary policy measures are announced.

Bank Rate: The Bank Rate has been retained at 6.0 per cent.

Repo Rate: It has been decided to increase the repo rate under the liquidity adjustment facility (LAF) by 25 basis points from 6.25 per cent to 6.5 per cent with immediate effect.

Reverse Repo Rate: It has been decided to increase the reverse repo rate under the LAF by 25 basis points from 5.25 per cent to 5.50 per cent with immediate effect.

Cash Reserve Ratio: The cash reserve ratio (CRR) of scheduled banks has been retained at 6.0 per cent of their net demand and time liabilities (NDTL).

The Reserve Bank of India, however, projected GDP growth at 8.5 per cent with an upside bias. It also warned that inflation is a matter of concern and revised its projection for FY'11 to 7 per cent from 5.5 per cent earlier.

Why did RBI increase interest rates?

. . .

Why RBI raised rates; how this impacts you!

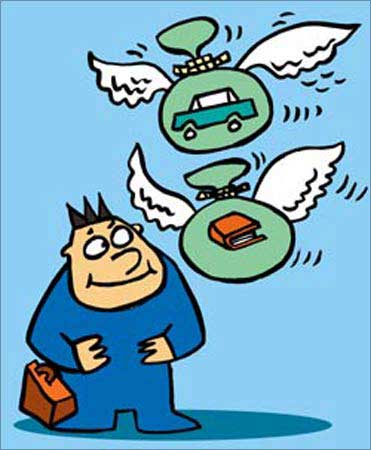

Image: Loans to be costlier.The RBI said that the monetary policy stance for the remaining period of 2010-11 has been guided by the following considerations:

First, since the Second Quarter Review of November 2010, inflationary pressures, which were abating until then, have re-emerged significantly.

Primary food articles inflation has risen again sharply after moderating for a brief period. Non-food articles and fuel inflation are already at elevated levels. Importantly, non-food manufacturing inflation has remained sticky.

There are, therefore, signs of rapid food and fuel price increases spilling over into generalised inflation. As it is, there is some evidence of rising demand side pressures which are reflected in rapid bank credit growth, robust corporate sales and rising input and output prices, and buoyancy in tax revenues.

The need, therefore, is to persist with measures to contain inflation and anchor inflationary expectations.

Second, global commodity prices have risen sharply which has heightened upside risks to domestic inflation.

Third, growth has moved close to its pre-crisis growth trajectory as reflected in the 8.9 per cent GDP growth in the first half of 2010-11, even in the face of an uncertain global recovery.

Fourth, the global economic situation has improved in the recent period. The uncertainty with regard to global recovery, which was prevailing at the time of the Second Quarter Review, has reduced with the US economy showing signs of stabilising.

Although uncertainty continues in the Euro area, there is an overall improvement in the global growth prospects.

To sum up, the current growth-inflation dynamics in the last few weeks suggest that the balance of risk has tilted towards intensification of inflation.

. . .

Why RBI raised rates; how this impacts you!

Image: Banks to hike rates.What are the expected outcomes of the rate hike?

The Reserve Bank will constantly monitor the credit growth and, if necessary, will engage with banks which show an abnormal incremental credit-deposit ratio.

What will the rate hike achieve?

The Reserve Bank of India said that its actions are expected to:

(i) Contain the spill-over from rise in food and fuel prices to generalised inflation.

(ii) Rein in rising inflationary expectations, which may be aggravated by the structural and transitory nature of food price increases.

(iii) Be moderate enough not to disrupt growth.

(iv) Continue to provide comfort to banks in their liquidity management operations.

. . .

Why RBI raised rates; how this impacts you!

Photographs: Reuters

How will this rate hike impact you?

After a rate hike, commercial banks normally increase their lending rates: meaning, they hike interest rates for home loans, car loans, personal loans, etc.

Experts meanwhile feel that banks are unlikely to hike lending rates in the short term even though the RBI hiked interest rates more than expected. But one more round of increase in key rates by the RBI will lead to a hike in home loan, personal loan, car loan, etc rates.

However, currently this means that there will be no impact on home loan/personal loan EMIs in the short term.

What about long-term impact?

Interest rate hikes adversely affect the long-term payments of the loans as they have a direct impact on your equated monthly installments (EMI).

For example, repayments may increase by over Rs 3.5 lakh (Rs 350,000) over a 20-year period on a Rs 20 lakh (Rs 2 million) home loan, if the bankers hike interest rates by up to 1 per cent.

. . .

Why RBI raised rates; how this impacts you!

Photographs: Reuters

This means that consumers may have to fork out up to Rs 1,500 more every month for a home loan of Rs 20 lakh, as bankers say that interest rates could go up by 0.5-1 per cent after RBI's hawkish policy aimed at containing inflation.

Car loan and personal loan rates too are likely to be similarly impacted in the longer term.

So this is how RBI move to hike rates could affect you in the long term; especially if inflation does not come down and the central bank is forced to increase key policy rates again.

Home, auto, personal and corporate loans are likely to become expensive if the Reserve Bank hikes rates again.

A rate hike can also have a negative impact on interest sensitive sectors like consumer durables.

Floating home loan borrowers will end up paying more on their EMIs.

The rise in auto loans will be a double whammy as car manufacturers have already hiked prices.

The interest rates on personal loans are likely to rise too, as banks will pass on the burden to the consumers.

RBI's prime concern has been to tame inflation and suck out the excess liquidity from the system so that it does not trigger inflation.

Although food inflation based on wholesale prices fell to 15.52 per cent for the week ended January 8, high prices of vegetables continues to hurt the common people.

Experts, however feel tightening of rates cannot bring down rates as food inflation is a result of an inefficient food supply system and hoarding by unscrupulous traders.

. . .

Why RBI raised rates; how this impacts you!

Photographs: Reuters

What risk factors influenced RBI move?

The growth and inflation projections as outlined above are subject to several risks.

i) Food inflation has remained at an elevated level for more than two years now. It is not only that the moderation in food price inflation as expected during a normal monsoon year has not occurred to the extent expected, but also that there has been sharp unusual increase in prices.

It is also significant that food inflation is not confined to a few items which were affected by unseasonal rains in some parts of the country but is fairly widespread across several food items. The inflation rates for primary articles and fuel items have risen sharply.

Inflationary expectations remain at elevated levels. As high food inflation persists, the prospect of it spilling over to the general inflation process is rapidly becoming a reality.

ii) Non-food manufacturing inflation is persistent and has remained sticky in recent months as several industries are operating close to their capacity levels. Imports as a means to supplement domestic availability for many commodities will become less of an option as global growth consolidates and capacity utilisation increases. This may accentuate demand side pressures.

. . .

Why RBI raised rates; how this impacts you!

Photographs: Reuters

iii) India's CAD has widened significantly. Although recent trade data suggest moderation of the trade deficit in the latter part of the year, overall CAD for 2010-11 is expected to be about 3.5 per cent of GDP.

A CAD of this magnitude is not sustainable. Further, commodity prices, which rose sharply even when the global recovery was sluggish, may rise further if the global recovery is faster than expected.

This has implications for both the CAD and inflation. There is, therefore, a need for concerted policy efforts to diversify exports and contain the CAD within prudent limits.

iv) Apart from the level of CAD, financing of CAD also poses a risk. Global growth prospects have improved significantly in the recent period.

Should global recovery be faster than expected, it may also have implication for the financing of CAD. Capital flows, which so far have been broadly sufficient to finance the CAD, may be adversely affected.

Faster than expected global recovery may enhance the attractiveness of investment opportunities in advanced economies, which may impact capital flows to India.

This may increase the vulnerability of our external sector. Hence, the composition of capital inflows needs to shift towards longer-term commitments such as FDI.

v) The recent improvement in the fiscal situation has been mainly the result of one-off revenue generated from spectrum auctions. The government also had the benefit of disinvestment proceeds, which may continue to occur for some more time.

However, fiscal consolidation based on one-off receipts is not sustainable. As emphasised in the Second Quarter Review of November 2010, fiscal consolidation is important for several reasons, including the fact that monetary policy works most efficiently while dealing with an inflationary situation when the fiscal situation is under control.

Apart from this, the commodity price developments that have been referred to earlier pose significant risks for fiscal consolidation in the year ahead. Rising oil prices will impact prices of both petroleum products and fertilisers.

. . .

Why RBI raised rates; how this impacts you!

Photographs: Reuters

If the government chooses to restrict the pass-through to consumers and farmers, it will have to make adequate budgetary provisions, which will constrain its ability to reduce the fiscal deficit.

If it does not, either fiscal credibility will be undermined or inflationary expectations will be reinforced by the likelihood of higher prices of these key inputs, both of which will further complicate inflation management.

vi) The combined risks from inflation, the CAD and fiscal situation contribute to an increase in uncertainty about economic stability that consumers and investors will have to deal with.

To the extent that this deters consumption and investment decisions, growth may be impacted.

While slower growth may contribute to some dampening of inflation and a narrowing of the CAD, it can also have significant impact on capital inflows, asset prices and fiscal consolidation, thereby aggravating some of the risks that have already been identified.

. . .

Why RBI raised rates; how this impacts you!

Photographs: Reuters

What is Bank Rate?

Bank Rate is the rate at which RBI allows finance to commercial banks. Bank Rate is a tool that RBI uses for short-term purposes. Any upward revision in Bank Rate is an indication that banks should also increase lending and deposit rates.

What is CRR?

Cash reserve Ratio (CRR) is the amount of funds that the banks have to keep with the RBI. If the RBI increases the CRR, the available amount with the banks comes down. The RBI uses the CRR to drain out excessive money from the system.

What is Reverse Repo rate?

Reverse Repo rate is the rate at which the RBI borrows money from commercial banks for a short-term. Banks are happy to lend money to the RBI since their money is in safe hands and they get good interest.

An increase in reverse repo rate can prompt banks to park more funds with the RBI to earn higher returns on idle cash. It is also a tool which can be used by the RBI to drain excess money out of the banking system.

. . .

Why RBI raised rates; how this impacts you!

Photographs: Reuters

What is a Repo Rate?

The rate at which the RBI lends short-term money to commercial banks is called repo rate. It is an instrument of monetary policy. Whenever banks have any shortage of funds they can borrow from the RBI. A reduction in the repo rate helps banks get money at a cheaper rate, while an increase in repo rate means that banks will have to borrow at higher rates.

Going forward, what will drive RBI's stance?

Current growth and inflation trends warrant persistence with the anti-inflationary monetary stance.

Looking beyond 2010-11, the Reserve Bank expects domestic growth momentum to stabilise, though the GDP growth rate may decline somewhat as agriculture reverts to its trend (assuming a normal monsoon). Inflation is likely to resume its moderating trend in the first quarter of 2011-12, but several upside risks are already visible in the global environment and more may surface domestically.

The monetary stance will be determined by how these factors impact the overall inflationary scenario. For the fiscal consolidation process to be credible and effective, it is important that apart from augmenting revenue, the composition and quality of expenditure improves.

. . .

Why RBI raised rates; how this impacts you!

Photographs: Uttam Ghosh/Rediff.com

Any slippage in the fiscal consolidation process at this stage may render the process of inflation management even harder.

The frictional liquidity shortage is expected to ease as government balances adjust to the expenditure schedule. However, banks need to focus on the underlying structural cause of liquidity tightness arising out of the gap between the credit and deposit growth rates.

The next mid-quarter review of Monetary Policy for 2010-11 will be announced on March 17, 2011. The Monetary Policy for 2011-12 will be announced on Tuesday, May 3, 2011.

What are the RBI's projections and outlook?

Domestic Outlook

On the domestic front, the 8.9 per cent GDP growth in the first half of 2010-11 suggests that the economy is operating close to its trend growth rate, powered mainly by domestic factors.

The kharif harvest has been good and rabi prospects look promising. Good agricultural growth has boosted rural demand. Export performance in recent months has been encouraging.

With the risks to growth in 2010-11 being mainly on the upside, the baseline projection of real GDP growth is retained at 8.5 per cent as set out in t he Second Quarter Review of Monetary Policy of July 2010 but with an upside bias.

. . .

Why RBI raised rates; how this impacts you!

Photographs: Reuters

Inflation

The moderation in headline inflation observed between August and November 2010 was along the projected trajectory of the Reserve Bank. This trend, however, reversed in December 2010 due mainly to sharp increase in the prices of vegetables, mineral oils and minerals.

While the current spike in food prices is expected to be transitory, structural demand-supply mismatches in several non-cereal food items such as pulses, oilseeds, eggs, fish and meat and milk are likely to keep food inflation high.

Non-food manufacturing inflation also remains significantly above its medium-term trend of 4 per cent. The Reserve Bank's quarterly inflation expectations survey, conducted during the first fortnight of December 2010, indicates that expectations of households remain elevated.

Going forward, the inflation outlook will be shaped by the following factors. First, it will depend on how the food price situation -- both domestic and global -- evolves. Domestic food price inflation has witnessed high volatility since mid-2009 due to both structural and transitory factors.

A significant part of the recent increase in food price inflation is due to structural constraints. This is reflected in the less than expected moderation in food price inflation even in a normal monsoon year.

There has also been a sharp increase in the prices of some food items due to transitory supply shocks. What is more worrying is the substantial increase in pr ice s of sever a l food items even though their production has not been affected.

As a result, the usual moderation in vegetable prices in the winter season has not materialised.

Notably, high food pr ice inflation is not unique to India. Food prices have spiked in many countries in the recent period.

. . .

Why RBI raised rates; how this impacts you!

Photographs: Reuters

India is a large importer of certain food items such as edible oils, and the domestic food price situation could be exacerbated by the increase in global food prices. This, therefore, poses an additional risk to domestic food price inflation.

The second factor that will shape the inflation outlook is how global commodity prices behave. Prices of some commodities rose sharply in the recent period even as the global recovery was fragile. Should these trends continue, they will impact inflation, domestically and globally.

The third factor is the extent to which demand side pressures may manifest. This risk arises from three sources, viz., the spill-over of rising food inflation; rising input costs, particularly industrial raw materials and oil; and pressure on wages, both in the formal and informal sectors.

The rise in food inflation has not only persisted for more than two years now, the increase has been rather sharp in the recent period. This cannot but have some spill-over effects on generalised inflation, particularly when the growth momentum is strong and both workers and producers are likely to have pricing power.

There are indications that, in the corporate sector, the share of wages in total costs is increasing. The indexation of the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) wages will also raise the wage rate in the agricultural sector.

Further, besides oil, the prices of some primary non-food articles have risen sharply in the recent period. Since these are inputs into manufactured products, the risk to headline inflation is not only from the increase in non-food items but also because the increase in input costs will ultimately impact output prices.

As the output gap closes, corporates will also be able to sustain higher output prices. In the absence of commensurate increase in capacity, there is the risk of demand side pressures accentuating.

. . .

Why RBI raised rates; how this impacts you!

Photographs: Rediff.com

Global Outlook

With advanced economies showing firmer signs of sustainable recovery, global growth in 2010 is expected to have been less imbalanced than before.

While growth in advanced economies may improve, growth in EMEs, which have been the main engine of global economic growth in the recent period, may moderate due to tightening of monetary policy to address rising inflationary concerns and the waning impact of the fiscal stimulus measures taken in the wake of the global financial crisis.

Inflation

Even as a large slack persists, inflation has edged up in major advanced economies owing mainly to increase in food and energy prices. Inflation in the Euro area exceeded the European Central Bank's (ECB) medium-term target for the first time in more than two years in December 2010.

Similarly in the UK, the headline inflation has persisted above the target of the Bank of England. In the US, the headline CPI rose to 1.5 per cent in December 2010 from 1.1 per cent in November 2010.

Whereas signs of inflation in the advanced countries are only incipient, many EMEs have been facing strong inflationary pressures, reflecting higher international commodity prices and rising domestic demand pressures.

Significantly, food, energy and commodity prices are widely expected to harden during 2011, driven by a combination of supply constraints and rising global demand, as the advanced economies consolidate their recovery. This suggests that inflation could be a global concern in 2011.

article