Photographs: Leonhard Foeger/Reuters

Halo of a Nobel Prize no longer seems to adorn Dr Muhammad Yunus's head.

The burden of controversy rests heavy on the shoulders of this legendary name of microfinance, the latest one being his challenging in court the Grameen Bank decision to sack him as its managing director.

A day after he was shown the door, on March 3, the Nobel Laureate challenged his removal in the high court.

On March 2, Bangladesh Central Bank removed Yunus as head of the bank, which he founded, citing that he had violated country's retirement age.

The government owns 25 per cent stake in the Grameen Bank, while the rest is held by borrowers.

What really happened that dragged one of the most respected names of Bangladesh into dire controversy?

Why is the father-figure of microfinance into so much trouble? Here are some of the ups and downs of Yunus' career.

. . .

Source: PTI and Agencies

Why Yunus was sacked as Grameen Bank MD

Image: Bangladeshi Prime Minister Sheikh Hasina speaks to her supporters in Dhaka.Photographs: Rafiqur Rahman/Reuters

Sheikh Hasina government not happy with Yunus

"It is a legal affair and I have come to discuss it," Yunus told newsmen late on March 2 after he consulted the Supreme Court lawyer Kamal Hossain on receiving the order of his removal.

Ace lawyer Hossain would appear on behalf of the 70-year old Yunus.

A Central Bank official had said, he had been stripped off his position as his appointment violated the Grameen Bank Ordinance 1983 that stipulates a managing director must be appointed with prior approval of the central bank.

According to the ordinance, Yunus was serving as a whole-time officer and the chief executive of the bank.

Prime Minister Hasina and Yunus recently had a verbal dual when the micro-financier suggested that he should form his own political party.

Following this tiff, Hasina accused the Nobel Laureate of treating the Grameen Bank as his personal property and claimed that the group 'was sucking blood from the poor'.

. . .

Why Yunus was sacked as Grameen Bank MD

Image: Muhammad Yunus greets borrowers at a Grameen America open house at St John's University in New York.Photographs: Eric Thayer/Reuters

Allegation of fund embezzlement

In December 2010, a documentary, Fanget i Mikrogjeld or Caught in Micro Debt aired on the National Norwegian Television, NRK, brought allegations that Grameen Bank had transferred about $100 million it received from donors to Grameen Kalyan in 1996 and got back the money as loan in breach of the agreement with the donors.

This led to a spat between the Norwegian government and Grameen Bank.

Yunus, however, refuted the charges and stated, "Allegations might be raised against someone, but no one should be deemed guilty until it is proven".

He said the issue that gave rise to the allegations against the bank was resolved years back.

"But since the matter was brought up again, it seems that the Norwegian minister absolved the institution from the allegations recently."

The Bangladeshi media could have verified the issue before publishing the report of a Danish journalist aired by a Norwegian television, Yunus said.

However, soon after this, Norwegian minister for environment and international development clarified that Grameen Bank had not embezzled the fund or used the money for unintended purposes.

Norway also gave a clean chit to Yunus, saying it found no evidence of donor fund embezzlement by his bank.

. . .

Why Yunus was sacked as Grameen Bank MD

Image: Muhammad Yunus addresses a press conference in New Delhi.Photographs: Dijeshwar Singh/ Saab Pictures

What had Yunus actually done?

The documentary and subsequent media reports alleged that Yunus had diverted $100 million meant for microcredit lending of Grameen Bank to its sister venture Grameen Kalyan, also a non-profit welfare company breeching Bangladesh's financial laws and agreements with the donor.

Bangladesh Prime Minister Sheikh Hasina had then said that 'there should certainly be a thorough investigation to find out what actually happened'.

. . .

Why Yunus was sacked as Grameen Bank MD

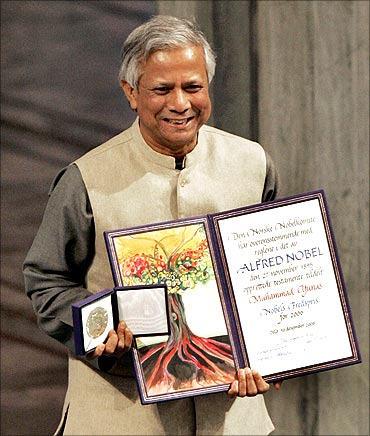

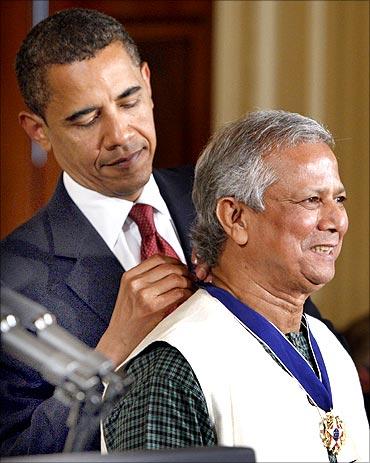

Image: US President Barack Obama presents the Medal of Freedom to Muhammad Yunus.Photographs: Jim Young/Reuters

Yunus welcomed the probe proposed by Hasina

Yunus, who was then on a tour abroad, in a statement had immediately welcomed the Bangladeshi prime minister's initiatives for investigation saying, "I am confident that this (investigation) will resolve the matter and bring the truth to the citizens of Bangladesh as soon as possible."

Bangladeshi Finance Minister AMA Muhith, however, had come in defence of Yunus.

"I see no fault in the transfer of the fund, if their (Grameen Bank) claim (of doing so under an understanding with the Norwegian government) is true," Muhith had said.

Grameen Bank in a statement alleged that the media reports gave the impression that these transactions or transfer were somehow 'secretive' but there was nothing secretive about.

"There was no wrong doing in the agreement between Grameen Bank and Grameen Kalyan (to transfer the amount)," it had said.

. . .

Why Yunus was sacked as Grameen Bank MD

Image: Muhammad Yunus at a special session organised by Ficci in New Delhi.Photographs: Sondeep Shankar/ Saab Pictures

Yunus and the Yoghurt controversy

In January, a Bangladeshi court granted bail to Yunus, amid allegations that a sister concern of his Grameen Bank marketed contaminated yoghurt.

Food inspector of Dhaka City Corporation Kamrul Islam had filed the case in January, alleging that the 'Shakti Doi', the brand of yoghurt produced by Grameen Danone Foods, was found adulterated in a laboratory test.

The court granted him bail and also exempted Yunus from personal appearance during the next hearing of the case.

"I prayed for my bail and I got justice. . .the case is now under trial process," Yunus had told reporters while coming out of court.

His lawyers told the court that the Nobel Laureate did not have any relation with the overall management of the Grameen Danone Foods.

. . .

Why Yunus was sacked as Grameen Bank MD

Image: Dr Muhammad Yunus carries a bouquet of flowers presented at Ficci in New Delhi.Photographs: Sondeep Shankar/ Saab Pictures

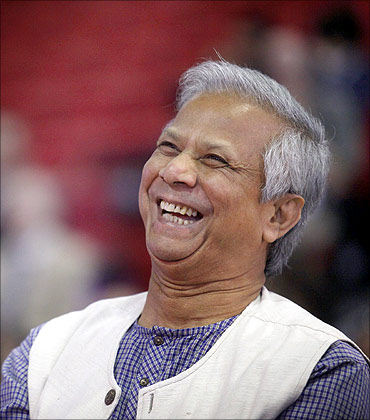

Muhammad Yunus: A brief history

Dr Muhammad Yunus is a Bangladeshi economist and founder of the Grameen Bank, an institution providing microcredit (small loans to poor people possessing no collateral) to help its clients establish financial self-sufficiency.

In 2006, Yunus and Grameen Bank received the Nobel Prize for Peace.

Yunus has several national and international accolades to his credit.

Earlier, he served as a professor of economics where he developed the concepts of microcredit and microfinance.

Yunus is the author of Banker to the Poor and a founding board member of Grameen America and Grameen Foundation.

In early 2007, Yunus showed interest in launching a political party in Bangladesh named Nagorik Shakti (Citizen Power), but later discarded the plan.

He is one of the founding members of Global Elders.

Yunus also serves on the board of directors of the United Nations Foundation, a public charity created in 1998 with entrepreneur and philanthropist Ted Turner's $1-billion gift.

. . .

Why Yunus was sacked as Grameen Bank MD

Image: Muhammad Yunus listens at a Grameen America open house at St. John's University in New York.Photographs: Eric Thayer/Reuters

Formative years

The third of nine children, Yunus was born on June 28, 1940 to a Muslim family in the village of Bathua, Chittagong, then in Bengal Province of British India (now in Bangladesh).

His father was Hazi Dula Mia Shoudagar, a jeweller, and his mother was Sufia Khatun. His early childhood years were spent in the village.

In 1944, his family moved to the city of Chittagong.

In 1957, Yunus enrolled in the department of economics at Dhaka University and got his Bachelor of Arts degree in 1960 and Masters in 1961.

Following his graduation, Yunus joined the Bureau of Economics as a research assistant to the economical researches of Professor Nurul Islam and Rehman Sobhan.

In 1961, he was appointed as a lecturer in economics in Chittagong College.

He obtained his PhD. in economics from Vanderbilt University in the United States.

From 1969 to 1972, Yunus was an assistant professor of economics at Middle Tennessee State University in Murfreesboro, TN.

. . .

Why Yunus was sacked as Grameen Bank MD

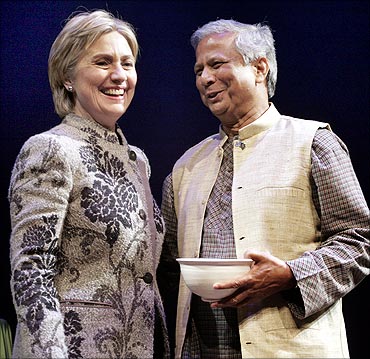

Image: US Senator Hillary Rodham Clinton with Muhammad Yunus of Bangladesh.Photographs: Yuri Gripas/Reuters

Yunus and the Liberation War

During the Liberation War of Bangladesh in 1971, Yunus founded a citizen's committee and ran the Bangladesh Information Center, with other Bangladeshis living in the United States, to raise support for liberation.

He also published the Bangladesh Newsletter from his home in Nashville.

After the War, Yunus returned to Bangladesh and was appointed to the government's Planning Commission headed by Nurul Islam. He, however, resigned to join Chittagong University as head of the Economics department.

He became involved with poverty reduction after observing the famine of 1974, and established a rural economic programme as a research project.

. . .

Why Yunus was sacked as Grameen Bank MD

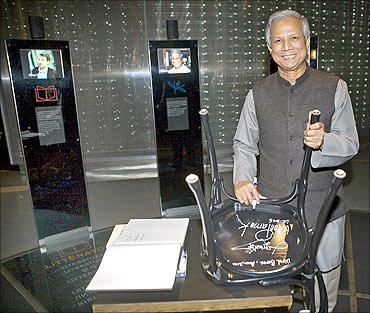

Image: Muhammad Yunus signs the bottom of a chair whilst visiting the Nobel Museum in Stockholm.Photographs: Mark Earthy/Scanpix

Origin of Grameen Bank

The origin of Grameen Bank can be traced back to 1976 when Yunus, a Fulbright scholar at Vanderbilt University and Professor at University of Chittagong, launched a research project to examine the possibility of designing a credit delivery system to provide banking services targeted to the rural poor.

In October 1983, the Grameen Bank Project was transformed into an independent bank by government legislation.

As the first step, Yunus offered a loan of $27 from his own pocket, to 42 rural women, who made a net profit of Taka0.50 ($0.02) each on the loan.

Dr Akhtar Hameed Khan, founder of the Pakistan Academy for Rural Development (now Bangladesh Academy for Rural Development), is credited along with Yunus for pioneering the idea.

From his personal experience, Yunus, an admirer of Dr Hameed, realised that the creation of an institution was needed to lend to those who had nothing.

Yunus was of the opinion that given the chance the poor will repay the borrowed money and hence microcredit could be a viable business model.

Yunus finally managed to secure a loan from the government Janata Bank to lend it to the poor in Jobra in December 1976.

The institution continued to operate by securing loans from other banks for its projects.

By 1982, the bank had 28,000 members.

In October 1983, the pilot project began operations as a full-fledged bank and was renamed the Grameen Bank (Village Bank) to make loans to poor Bangladeshis.

article