Photographs: Dijeshwar Singh/ Saab Pictures Sanjay Jog in Mumbai

Nobel peace prize winner Muhammad Yunus, who has been ousted as Grameen Bank managing director, tells Business Standard he hopes the bank continues to be run by the poor of Bangladesh.

As the high court has dismissed your petition (against ouster), what's your next course of action?

The high court has dismissed our petition, but we have appealed to the Appellate Division of the Supreme Court.

I am still hopeful.

Did the decision to oust you come as a shock?

Yes, we were disappointed. I was appointed by the board of Grameen Bank with prior approval of Bangladesh Bank.

I still hope for vindication in the court.

. . .

Yunus on why he was sacked as Grameen Bank MD

Photographs: Reuters

The Bangladesh government alleged you were using Grameen Bank as your personal institution. What's your take?

Grameen Bank is not my personal institution.

It is owned by the government of Bangladesh and its 8.3-million borrowers.

In a 13-member board, the chairman and two members are appointed by the government and nine are elected by the borrowers,

The managing director is an ex-officio member.

The board takes all the decisions.

I don't own a single share of Grameen Bank. I am only a non-voting member of the board.

. . .

Yunus on why he was sacked as Grameen Bank MD

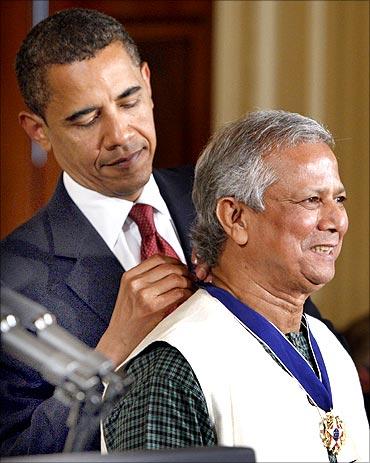

Image: US President Barack Obama presents the Medal of Freedom to Muhammad Yunus.Photographs: Jim Young/Reuters

The government also claimed that Grameen Bank was exploiting the poor. What's your comment?

Grameen Bank is owned by its borrowers.

So, there is no way it can exploit the borrowers.

Grameen Bank's profits belong to the borrowers as owners.

They get dividend.

In 2006, 2007, 2008 and 2009, Grameen Bank gave 100 per cent, 30 per cent, 20 per cent and 20 per cent dividend, respectively.

From 1997 to 2005, it did not pay any dividend due to a government directive. Accordingly, the profits were transferred to a rehabilitation fund. The money was used to help borrowers during natural disasters.

. . .

Yunus on why he was sacked as Grameen Bank MD

Image: Bangladeshi Prime Minister Sheikh Hasina speaks to her supporters in Dhaka.Photographs: Rafiqur Rahman/Reuters

Can you recall similar confrontations with the government? How did the bank and you survive that?

Grameen Bank has always appreciated the government's support.

We view the government as a partner in our battle for poverty alleviation.

This is why we structured the board to ensure 25 per cent government representation, including the chairman, who is appointed by the government.

We have never had any issues with the government in the past.

The relationship has always been a very co-operative one.

That is why I am surprised and ask as to why the present crisis could not have been resolved amicably.

. . .

Yunus on why he was sacked as Grameen Bank MD

Photographs: Reuters

What does the future hold for you and Grameen Bank? What will happen to microfinance in general?

I can only hope that the borrowers, who through their tireless efforts got the Nobel peace prize for Grameen Bank for demonstrating to the world that the poor are creditworthy and bankable, and have created a unique institution that gives hope and inspiration to the marginalised everywhere, will continue to control the bank and that the bank continues to operate smoothly and without inteference.

That is what is at stake here, the right of 8.3-million low-income women to determine their own financial destiny.

There are over 20 million microcredit borrowers in Bangladesh. Microcredit has been a key tool for alleviating poverty.

It is, in fact, an integral part of the government's poverty alleviation strategy.

Microcredit touches the lives of so many Bangladeshis that it would be a tragedy if the sector were to be undermined.

The ultimate losers would only be the poor of Bangladesh.

article