Photographs: Dipak Chakraborty Manojit Saha in Mumbai

At a time when banks are facing a situation of rising interest rates threatening loan growth, managing the growth-inflation dynamics has became one of the main challenges of the Reserve Bank of India.

KC Chakrabarty, deputy governor of RBI, speaks to Business Standard on this and a host of other issues.

Edited excerpts:

Banks are saying high interest rates are hurting credit growth. How will RBI balance the growth-inflation trade-off?

If the inflation is high, interest rates will remain high.

That is why RBI insists on having low inflation so that interest rates can be low.

All efforts are to be diverted in that direction.

You cannot have a situation where inflation is high and interest rates are low.

. . .

'We can't have high inflation & low interest rate'

RBI had expressed concern on the practice of lending money that was borrowed from RBI under the liquidity adjustment facility. But banks say, since the funds borrowed from LAF are against government securities, that is not a problem.

Why don't banks liquidate the security and lend that money?

The LAF money is not meant for lending purpose on a continuous basis.

The system cannot run like that.

The LAF facility is for meeting liquidity needs arising out of mismatches of temporary nature.

New players are set to enter the banking system. What modifications RBI expects in the Banking Regulation Act to have more power?

I am not fully aware of the developments.

However, one aspect which stands out very clearly is the fact that orderly conduct of financial market with wider participation presupposes the ability of regulator to change the management and board of the institution when they are not functioning within the regulatory and contractual framework.

Legal provisions must support that stand.

. . .

'We can't have high inflation & low interest rate'

The Malegam Committee has proposed RBI to be the regulator of microfinance institutions. How will you ensure that MFIs treat their customers fairly?

Any business entity, if you consider MFI as business entity, must treat its customers fairly and properly for the benefit of the company.

So MFIs must treat their customers fairly for their own survival.

Until now, RBI was not regulating the MFIs, or you can say, it was a soft touch regulation.

We have come to the conclusion that at this stage of development, MFIs are relevant but they need to be regulated more stringently.

But one should appreciate the fact that the entire cross-section of the society also wanted the same.

Will the central bank ask all MFIs to register with RBI?

If there is somebody left out of the regulatory framework then we have to see whether it is creating a regulatory arbitrage or not and how do we tackle them.

. . .

'We can't have high inflation & low interest rate'

Some recent developments, like the loan-for-bribe scam or the fraud that happened at a branch of a foreign bank, point to lack of proper risk management practices in banks. Do you think that banks have to re-look at the risk management practices?

Absolutely, no doubt about that.

We are at a very nascent stage of risk management.

It has to mature, it has to perfect itself and we must understand that as and when business becomes more complex and global, the need for better and sophisticated risk management will arise.

This is one area where we cannot be complacent, neither the banks, nor the regulator.

Can you highlight any specific areas in risk management which need to be looked at?

First, we have to understand the risk philosophy. Risk management is not to avoid the risk.

It is about how much risk we should take for a given profit, while keeping the system stable.

That understanding has to come. We have to understand, wherever return is higher, risk is much higher.

Banks should measure the risk and price it appropriately.

. . .

'We can't have high inflation & low interest rate'

At present, there are no norms on relationship managers who offer portfolio management services in banks. Will the regulator consider norms for such activities?

Banks which are in that business must have proper norms for identifying the people for this job.

What we are saying is that banks should have a proper risk management framework which is approved by the board. Banks must understand the risks of the business and also have the responsibility of making customers aware of the same.

Many of these wealth management products are in the purview of various regulatory agencies.

That is why a combined approach is necessary.

But the cardinal principle, that don't sell the product to people who don't understand the product and the risks associated with it, stands.

. . .

'We can't have high inflation & low interest rate'

The stance of RBI was not to prescribe or cap interest rate or charges of banks. It was left to the market forces. But there seems to a departure from that practice. What has prompted this shift in stance?

We have not capped any charges as yet, it is pre-mature.

However, we must understand any market functions based on the availability of information.

If there is an asymmetry of information, no market can function efficiently.

Now-a-days, we observe that there is too much of asymmetry of information between the provider of the services and the one who is availing the services.

In any regulated activity, the issue of protecting the interest of the consumer is paramount.

Hence, this type of thinking crops up.

This is relevant not only in India, but this trend is also felt across the globe.

Those who fail to read this trend will be left behind.

When the competition is not able to take care of the price, regulatory process has to intervene to protect the most vulnerable section of the society.

. . .

'We can't have high inflation & low interest rate'

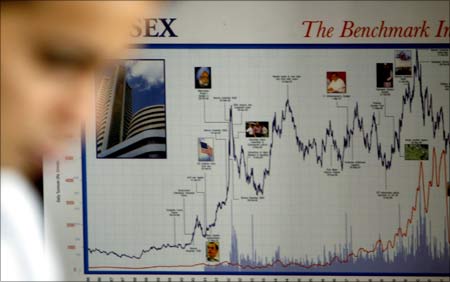

Image: Reserve Bank of India logo.Why is RBI repeatedly saying banks must cut interest margins. Interest margin is the very key operating and profitability variable. Almost all the banks are listed entities. Isn't this direction misplaced from a minority shareholder perspective?

What we are saying is that technology should bring down the operating costs of banks significantly.

It has happened in various sectors like telecommunications, aviation etc.

We are urging the banks to bring down the costs of operation and pass on the benefit to both depositors and borrowers without sacrificing return on asset and return on equity.

Banks have started implementing the financial inclusion plan during the financial year. How has been the progress so far? Is the regulator happy with the banks' efforts?

Banks have started and they have a long way to go.

It is a difficult journey.

Banks are trying, they need to try harder and every segment of the society needs to support them then only financial inclusion will become a reality.

Delivery model for financial inclusion is still a problem.

We are yet to evolve a cost effective delivery model.

. . .

'We can't have high inflation & low interest rate'

Image: KC Chakrabarty.The current phase of economic growth is largely driven by infrastructure. However, banks are having asset liability mismatch problems from infrastructure lending and some of the banks have also reached sectoral caps. What can RBI do to strengthen bank's infrastructure financing capabilities?

Infrastructure financing requirements are huge and only banks will not be able to finance those. Other types of institutions are also necessary.

All relaxations, whatever demanded and what is necessary, feasible and prudent have been given to the banks to ensure that funding to infrastructure does not suffer.

article