Photographs: Reuters

The global economy may have just limped out of the worst recession since World War II as governments tried to spur consumer demand by lowering interest rates to record lows and pouring trillions of dollars in fiscal stimuli, but all is not yet well.

Having barely managed to survive a prolonged and debilitating bout of economic recession, the world now faces another bout of dangers that threaten growth across nations.

A Citi strategist, Guillermo Felices, in a study has enumerated eight shocks that are hitting, or are soon going to hit, the global economy.

Check out what are the economic dangers that lurk around the corner for the world.

. . .

8 shocks that await India, global economy

Photographs: Reuters

1. Soaring food prices in Emerging Markets

Rising food prices are not just an Indian phenomenon: fuelled by rising food and property prices, food inflation is at unsustainable levels in many countries.

The world over, food inflation is rampant. Many a country's government is in danger of being dismissed due to the pressure that the populace faces when prices skyrocket. Many governments could topple -- like in Tunisia or Egypt -- following riots over high food prices.

With governments across the world affecting a hike in fuel prices, food prices have shot up even further.

Many other reasons too are being bandied about for the price rise: the vegetable vendor cites 'scanty rainfall' for the price rise.

. . .

8 shocks that await India, global economy

Photographs: Reuters

The other major reason for the rise in the prices of vegetables is more demand and less supply. One more reason, some suspect, could also be that the local vegetable vendor might be fleecing the customers.

Similarly, prices of most pulses too are high due to a supply-demand mismatch.

Climate-related changes do affect the availability of food items, but the current rise in the food bill is too steep to attribute only to the weather.

Rising food prices have put pressure on governments to act. However, demand in emerging markets has been rising due to a robust economic recovery and thus prices keep on rising.

. . .

8 shocks that await India, global economy

Photographs: Reuters

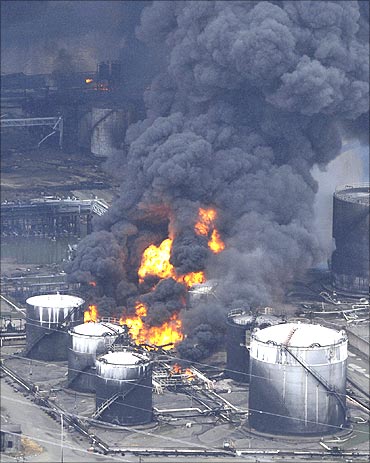

2. The disaster in Japan

The effects of the terrible disaster in Japan will be felt across the global economy, and experts feel that growth could be hurt.

Over and above the horrific destruction and the thousands of deaths caused by the killer earthquake, the following tsunami, and the nuclear crisis, Japan's economy is likely to bear the brunt of reconstruction, drop in production, supply chain issues, reduction in tourism, etc.

Japan's nuclear crisis and the devastations caused by the March 11 earthquake and tsunami could trigger a global economic crisis, if not a recession, as happened in the aftermath of the collapse of the US investment bank Lehman Brothers three years ago, according to leading economists.

However, automobile and electronic industries around the world, especially in Asia, Europe and the US, may face manufacturing delays, if the Japanese production of components remains crippled for a long period.

. . .

8 shocks that await India, global economy

Photographs: Reuters

Financial markets could suffer additional losses from spikes in investor risk aversion. These could trigger portfolio outflows from fast-growing emerging markets, causing problems for nations that are heavily dependent on foreign capital.

The study said that the shutdown of the nuclear reactors in Japan will lead to a loss of almost 10 per cent of the Asian major's electricity generation capacity, and this could result in Japan importing fuels: coal, liquefied natural gas, and oil, and this would lead to a spike in the prices of these essential commodities.

With oil prices already rising the world over, the Japanese disaster will only add to the problem.

. . .

8 shocks that await India, global economy

Photographs: Uttam Ghosh/Rediff.com

3. Rising interest rates and tight liquidity in Emerging Markets

With prices rising globally, central banks the world over are reacting harshly to curb rising inflation rates. The only way to do that is to tighten their monetary policies which results in a rise in interest rates.

The Citi study says that India, in a bid to control the inflationary fires, has been responding by continuously increasing interest rates.

China too is continuing to 'hike reserve requirements' and interest rates.

Other markets like Brazil, Korea, Russia too have responded with tightening their monetary policies.

Yet, despite these efforts, the food prices and general levels of inflation continue to rise -- like in India -- clearly demonstrating that food and commodity prices are generally not too affected by tinkering with the monetary policy.

. . .

8 shocks that await India, global economy

Photographs: Reuters

4. Political crises in West Asia

As the cry for democracy rents the air in West Asia following large swathes of population in the region resorting to protests and uprising, the instability in the volatile territory is a major cause for global worry.

What began as a movement against rising food and commodity prices in West Asia has soon snowballed into a highly dangerous situation.

With some exposes made by Wikileaks adding fuel to the West Asian fire, the rising economic problems in the region have only been fanning the flames further.

The economic and political problems that besiege oil-rich region spell danger for the entire world.

. . .

8 shocks that await India, global economy

Photographs: Reuters

5. Suring prices of oil

As touched upon earlier, the result of the political and economic instability in West Asia has led to a huge increase in crude oil prices.

Rising oil prices spell bad times for everyone, especially fast growing economies like India and China as they are already struggling to control runaway inflation.

However, emerging markets and developing nations are not the only ones that have been hurt by rising oil prices, even the developed world markets in the United States and the Euro zone have been badly hit.

These developed nations, which have already been reeling under the debilitating effects of a global recession, rising unemployment, drop in production, etc, are being put to the sword following a rise in global oil prices.

The study said that high oil prices redistribute incomes from oil consumers to oil producers within countries and between countries. But the cross-country effects are likely to be more complex than a simple 'winners and losers' analysis based on oil consumption and production.

Quite a few emerging markets are likely to use fiscal policy to cushion the impact of high fuel prices on the economy, limiting the adverse effects on growth and real incomes at the expense of weaker fiscal balances.

. . .

8 shocks that await India, global economy

Photographs: Reuters

Moreover, some countries will gain from the recycling of petrodollars into spending, especially countries with high export exposure to oil producers.

First, the adverse effects of higher oil prices on economic activity and potential growth appear to be greater in major emerging markets than the G7, because emerging market economies in general are more energy intensive and oil intensive.

Second, an increase in oil prices redistributes income between countries (from net oil importers to net oil exporters) and within countries (from oil consumers to oil producers and from those short oil to those long oil).

The United States is the world's largest net importer of crude oil and studies tend to find that oil price shocks have their most pronounced effects on the US economy through their effects on demand, in particular for consumer durables and residential investment.

Relative to GDP, net imports of crude oil are much larger than in the US in India and South Korea, but are slightly higher in China.

Oil production is concentrated in relatively few countries. The world's major oil net exporters in 2009 were Saudi Arabia, Russia, Iran, Nigeria and the United Arab Emirates. But it is important to recognise that income is also redistributed between producers and consumers of oil within a country.

This holds true for the largest net oil exporters listed above, but it is also true for the US which, despite being the world's largest net oil importer, remains one of the largest oil producers in the world.

. . .

8 shocks that await India, global economy

Photographs: Reuters

6. Increasing interest rates in Developed Markets

With emerging market economies already having taken up the cudgels against the rising inflationary trend by tightening their monetary policies, developed nations too are soon likely to follow suit.

Soaring costs of food, commodities and fuels are now pinching the industrialised nations like never before and they too are now seriously beginning to respond by raising interest rates.

Ever since the financial tsunami ravaged the global economy in September 2008, the hardest hit developed markets pumped in trillions of dollars to revive their dying economies and eased access to money by reducing interest rates.

Many of these nations have at least partially recovered from the financial crisis now but rising food and fuel prices are playing havoc with them.

Thus many a European nation has already begun to tighten its monetary policy and is raising interest rates.

. . .

8 shocks that await India, global economy

Photographs: Reuters

7. The end of US's Quantitative Easing 2 plan

When normal monetary policy measures do not provide the desired results, governments sometimes turn to unconventional monetary policy methods to rekindle a flagging economy. This is called quantitative easing. The nation's central bank then takes steps to increase the money supply like buying government bonds and other financial assets.

In June 2011, the American government's quantitative easing 2 (QE2) programme will end. When that happens, that would spell the end of the monetary policy tightening measures for the United States.

When the US Federal Reserve's second round of quantitative easing ends in June, experts feel that bond yields might continue to rise. Apart from that the US stock market could take a hit, as financial assets would have become more valuable due to low interest rates.

The US's second round of quantitative easing programme had helped the commodity markets to rise. Now the fear is that the rally in commodities could slow down.

This could affect the US economy further and consequently the global economy too.

. . .

8 shocks that await India, global economy

Photographs: Reuters

8. Cuts in spending and rising fiscal deficits

With global interest rates rising and money policies tightening, governments are cutting down on expenditure as fears of fiscal deficits ballooning beyond controllable levels rise.

Cutting back on government expenses -- as has been the case in many European and Asian nations -- will have a telling impact on many countries as this will reduce stimulus spending even before many a nation has yet to fully recover from recessionary winds that buffeted them.

High fiscal deficit restricts the government's ability to fund development projects, retards growth, does not propel employment-generation and leads to higher interest rates.

. . .

8 shocks that await India, global economy

Photographs: Reuters

Fiscal deficit is essentially the difference between what the government spends and what it earns. It is expressed as a percentage of the gross domestic product. Higher the fiscal deficit, weaker the economy.

Also, government spending on social welfare, education, health, poverty alleviation is severely hampered due to high fiscal deficit.

If a developing country's resources are deployed properly, deficits are not necessarily a bad thing.

But if the revenues keep dropping due to mismanagement and a profligate government lets its expenses get out of hand, disaster is a given. Argentina, Ireland and Greece are just a few cases in point.

article