Business Standard

How freeing the savings bank rate will help

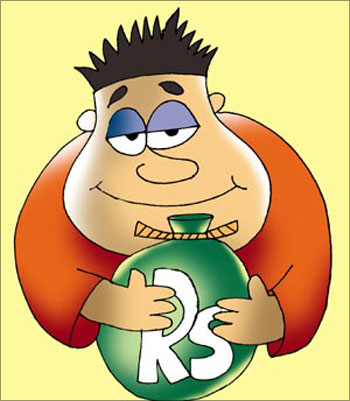

Image: RBI Governor D Subbarao.The chief concern of the regulator in contemplating the move is whether it will put greater pressure on weak banks and, thus, create avoidable trouble for the regulator and the banks' significant owner, the government.

How freeing the savings bank rate will help

Image: More competition likely.With banks competing for deposits both on price and quality of service, weak banks, which lag behind in service quality, will have to rely largely on paying more, which will further weaken them.

How freeing the savings bank rate will help

Image: Good for small depositors.Long-neglected small depositors should look forward to the freeing of the savings bank rate because it will give them a chance to get a bit more of their money's worth.

There is, of course, a chance that a splurge of liquidity will cause the rate to go down and not up.

How freeing the savings bank rate will help

Image: Take inclusive banking forward.The main concern of the regulator should be twofold: protecting the interests of small depositors and using the deregulation to take inclusive banking forward.

How freeing the savings bank rate will help

Image: Government can give an interest subsidy to small deposits.One way of doing that can be for the government to give an interest subsidy to small deposits, maybe by limiting it to the first Rs 10,000 in a savings bank account.

How freeing the savings bank rate will help

Image: Value of savings should not godown.It is not as though the government is not bailing out weak banks and their stakeholders.

How freeing the savings bank rate will help

Image: National savings rate to rise.Most importantly, modestly attractive interest earnings for small depositors, made possible by deregulation and subsidy, will significantly raise the national savings rate in the long run.

article