Job fears and financial concerns are a thing of the past for Indians.

They have been replaced by concerns over increasing food prices, with 14 per cent of Indians citing this as their biggest concern in the first quarter of the 2011 calender year, according to a survey by consultancy firm Nielsen.

The Reserve Bank of India, in its monetary policy for 2011-12 released earlier this month, had said that international commodity prices are a major area of concern.

It had projected headline inflation to average 9 per cent during the first half of the fiscal, before moderating to about 6 per cent by year-end.

. . .

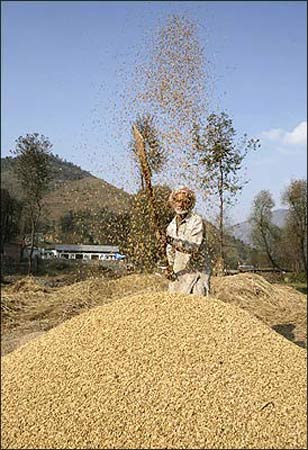

The No. 1 concern for Indians: Rising food prices

Photographs: Reuters

Headline inflation has been above 8 per cent since January 2010.

As per latest data, it stood at 8.66 per cent in April this year.

Nielsen conducted its global survey through online poll found that India topped the global consumer confidence level for the fifth straight quarter, out of the 28,000 people

who participated from 51 countries, and 500 people in India, Nielsen India managing director (consumer) Justin Sargent told reporters in Mumbai.

Asked how the consumers were buying things, given the high inflation, he said, "The general expectation of a consumer is that inflation is going to continue for a while.

So why not buy things now when you can afford it."

. . .

The No. 1 concern for Indians: Rising food prices

Photographs: Reuters

"People are trying to preserve their lifestyle by spending on home improvements and decoration," Sargent added.

According to the report, 39 per cent of Indians spent on home improvements and decoration.

However, Sargent expects people to change the consumption pattern if inflation is not controlled.

The typically savings-oriented people in India loosened their purse strings to buy technology products, new clothes or spend on vacations.

The survey said 65 per cent of Indians saved their spare cash during the quarter.

Sargent added that high bank interest rates could have prompted the move from the consumers.

. . .

The No. 1 concern for Indians: Rising food prices

Photographs: Reuters

The biggest drop in in spare cash investment was in mutual funds, as only 36 per cent preferred to invest in the sector, compared to 45 per cent in the previous quarter.

"Indian consumers have seen no moderation in inflation during the start of the year. Rising food and fuel prices are likely to alter household expenditures," Sargent said.

The survey mentioned that 72 per cent of Indians changed spending habits to save on household expenditure, with 53 per cent trying to save on gas and electricity expenditure.

. . .

The No. 1 concern for Indians: Rising food prices

Photographs: Reuters

With high inflation impacting borrowing costs, 16 per cent of Indians said they wanted better deals on home loans, insurance and credit cards.

According to the Nielsen Global Consumer Confidence report, 91 per cent of Indians were optimistic about their job prospects in the next 12 months.

However, he said the performance by India was flat on a quarter-on-quarter basis, as the index maintained the same level of 131 points as the last quarter (October-December, 2010).

"India's consumer confidence has remained consistent over the last five quarters driven by strong economic growth and optimistic job market.

. . .

The No. 1 concern for Indians: Rising food prices

Photographs: Reuters

"If confidence levels among consumers have remained flat over the last quarter, it is largely because of the global factors of weaker equity markets, higher commodity prices and overall weaker global recovery compounded by rising domestic infaltion," Sargent said.

Indians were also the most optimistic about the state of their personal finances in the next 12 months, as nearly 87 per cent of Indians are optimistic about their personal finance and 61 per cent think it is a 'good' time to make purchases.

. . .

The No. 1 concern for Indians: Rising food prices

Photographs: Reuters

The typically savings-oriented people in India loosened their purse strings to buy technology products, new clothes, or spent on vacations.

The survey said 65 per cent Indians saved their spare cash during the quarter.

Sargent added that the high bank interest rate could have prompted the move from the consumers.

The biggest drop in in spare cash investment was in the mutual funds, as only 36 per cent preferred to invest in the sector, when compared to the previous quarter's 45 per cent.

article