Photographs: Lucas Jackson/Reuters Shonalee Biswas

The unexpected rains caught us on the wrong foot. There we were taking a walk along the sea front one moment and all wet and running around looking for cover, the next.

"Rains in October!" my roommate said. "What's the world come to."

"Well, funnier things have happened before and are still happening," I remarked, as we found shelter at a bus stop.

"You know, you keep talking about all the problems that the United States has all the time."

"Yes I do."

"But what I don't understand is that if the United States has so many problems, how has the US dollar appreciated in value against other currencies? At the beginning of September 100 dollars could buy 70 euros, now they can buy 72.5 euros.

The same is the case with rupee dollar exchange rate as well. At the beginning of September one dollar was worth around Rs 46, now it's worth around Rs 49. I mean, if a country has problems, then people who hold should getting out of that country's currency na and moving into other currencies.

And that would mean the currency losing value instead of appreciating against other currencies."

Click on NEXT for more...

Why the US dollar is still in demand

Image: A worker counts US dollar bills at a money changer in Manila.Photographs: Romeo Ranoco/Reuters

"Well, if you go by conventional economic theory then yes," I said, as we got stuck in a traffic jam, with the rain water flooding the roads.

"If you don't, then?"

"Then you need to have some patience and listen to me."

"Oh, right now, we are stuck in the jam, so just go on with whatever you have to say."

"Hah. Show me some respect madam!"

"Please, Shonalee," she pleaded. "And I will make some gajar ka halwa for you once we are back home."

"Yeah. I like that!"

"So?"

Click on NEXT for more...

Why the US dollar is still in demand

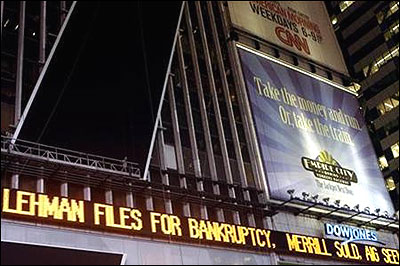

Image: Lehman Brothers name moves across a news ticker in New York's Times Square September 15, 2008.Photographs: Joshua Lott/Reuters

"So, we will have to go back in time like we always do. After the investment bank Lehman Brothers went bust in September 2008, the Federal Reserve of US, the American central bank, and the government, decided to keep interest rates pretty close to 0%.

Other than that they also decided to print money, flush it into the financial system, in the hope that banks will lend that money and people will spend it and that in turn will help revive the economy."

"Yeah, all this you have told me before."

"Since then the US has printed around $2.3trillion and interest rates have been at almost 0%," I said.

"Hmmm."

"Also, American banks were reluctant to lend to the American borrowers and the American borrowers were also reluctant to borrow. Having borrowed big-time since the turn of the century, they were now in the mood to repay, instead of borrow more."

"So what happened?"she asked.

Click on NEXT for more...

Why the US dollar is still in demand

Photographs: Reuters

"The financial system was slush with money and it led to the advent of the dollar-carry-trade."

"What's that?" she asked.

"The original carry trade was the yen-carry-trade."

"And what was that?"

"Interest rates in Japan were very low for a very long period of time after the stock market and the real estate bubble burst in the late eighties. So investors used to borrow in yen and invest in markets and assets across the world."

"And that was the yen-carry-trade?"

"Yup. The dollar-carry-trade was similar. The interest rates were close to 0% in America, so investors borrowed in dollars and those dollars found their way into assets and markets around the world."

"And the markets around the world rallied."

"So did commodities," I said.

"And then what happened?"

Click on NEXT for more...

Why the US dollar is still in demand

Image: Protesters raise their hands to the parliament in an offensive gesture during an anti-austerity rally in Athens.Photographs: Panagiotis Tzamaros/Reuters

"The financial crisis had started in the United States, where the borrowers and the government had gone on a borrowing binge. Then the world started to realise that the situation in Europe is not any different.

The euro was adopted as a currency by various countries in Europe towards the turn of the century. That made interest rates lower, which made borrowing easier."

"So?" she interrupted.

"So the world at large came to realise that the situation in Europe is grimmer than in America."

"And?"

"And, countries like Greece are now on the verge of defaulting on their debt."

"Yeah, that you have told me in the past," she said, as the cab finally started to move forward.

"There are other countries like Portugal, Spain, Italy, Iceland, Ireland etc which are also in big trouble."

"So, what are you suggesting?" she asked.

Click on NEXT for more...

Why the US dollar is still in demand

Image: Australian one dollar coins surround a US one dollar note.Photographs: Tim Wimborne/Reuters

"The risks in Europe has led to a situation where the investors around the world are coming to the conclusion that it's best to have their monies in cash. "

"And so they have been selling out of stock markets and commodities around the world."

"Yes."

"But what's all this got to do with the US dollar?"

"I was just coming to that. Let's say a big hedge fund sells its investments in India. When it sells, it gets rupees in the process.

This money has to repatriated outside India to wherever the hedge fund is based. Most hedge funds in the world are based in the US. So the money is repatriated to the US."

"So?"

Click on NEXT for more...

Why the US dollar is still in demand

Image: A shopkeeper counts rupee notes inside his shop in Jammu.Photographs: Mukesh Gupta/Reuters

"Well you cannot repatriate rupees to the US. So you need dollars for it. And in the process the demand for dollars goes up.

That's why one dollar was worth Rs 45.9 at the beginning of September, but is now worth Rs 49, as the demand for the dollar has gone up, thus leading to an increase in its value. It works the same way when investments from other parts of the world are sold and the money is converted into US dollars."

"Hmmm. But why convert the money into US dollars? I mean, there are so many economic problems in the US and on top of that they have created so much money out of thin air, by printing dollars."

"Well there is an acronym known as TINA. Ever heard of it?" I asked.

"Nope."

"Well, it stands for there is no alternative."

"What do you mean?"

Click on NEXT for more...

Why the US dollar is still in demand

Image: A Chinese 100 yuan banknote is placed under a $100 banknote.Photographs: Petar Kujundzic/Reuters

"Europe is in a bigger mess than the US, so converting money in euros doesn't make sense. Japan hasn't gone anywhere for20 years, so yen is ruled out. And there are limits to the amount of money that can be converted into Chinese Yuan," I explained.

"So that leaves them only with the dollar."

"Yes. In fact, what also helps is the fact that the US bond market is the most liquid bond market in the world."

"What is a bond market?" she asked.

"Bond market is a market where bonds issued by governments and private sector are traded."

"What are bonds?"

"You are asking very basic questions," I said, as we reached home, and were getting out of the cab.

"Yup, I am. Now please answer my question," she remarked, while paying the cab driver.

Click on NEXT for more...

Why the US dollar is still in demand

Image: A bank clerk starts a money counter to count 100 dollar banknotes in a Bank in Bern.Photographs: Pascal Lauener/Reuters

"Bonds are basically financial securities issued by the government to meet the gap between what they earn i.e. their income and what they spend i.e. their expenditure."

"So?"

"So, the dollars that are repatriated to the US are huge in value and cannot be exactly kept by investors under their pillows. They need to be invested somewhere. And so they are invested to buy US government bonds."

"Now I kind of get it."

"Great."

"What you are basically saying is that money is repatriated to the US because the US bond market is the most active bond market in the world, and buying and selling their is very easy. In comparison, other bond markets are neither as big nor as liquid."

"Yes ma'm, you are right."

"And investing money in US bonds requires dollars, and that's why the US dollar continues to be in demand, despite all the troubles."

"Yup," I said, opening the flat. "Now go to the kitchen and start making that gajar-ka-halwa that you promised!"

The author can be reached at shonalee.biswas@rediffmail.com

. You are also welcome to write car and bike reviews. And, yes, kindly keep your articles between 800 and 1,000 words. Happy writing!

article