BankBazaar.com

India (NRIs included) goes crazy about gold jewellery.

With the World Gold Council aggressively marketing social and religious functions as gold buying events, the demand has shot up in the recent years to record levels.

Research shows that over 16,000 tons of gold is there in Indian households predominantly in the form of jewellery.

The value of this as per market price is a whopping Rs 27.2 lakh crore ($591 billion). That is close to twice the foreign exchange reserves held by the Reserve Bank of India.

Let's consider the factors one needs to be aware of and the know how of investing in gold.

. . .

Investing in gold? MUST READ this!

Image: A goldsmith poses with gold bangles in his jewellery shop.Photographs: Reuters

Forms of Buying Gold

Any investor has to be aware of the different forms of buying gold. Jewellery, the most traditional and the dominant form of buying gold in India is in fact not an investment idea.

The reason is that there are heavy losses in the form of wastage and making charges. This can vary from a minimum of 10 per cent to as high as 35 per cent for special and complex designs.

Bank Coins again not an investment idea as the premium that banks charge for their coins is anywhere between 5 and 10 per cent.

. . .

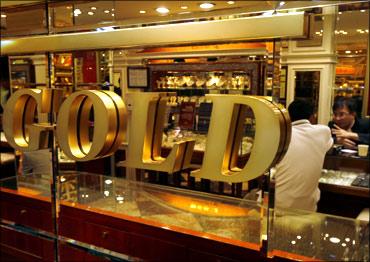

Investing in gold? MUST READ this!

Image: A jewellery shop in Hyderabad.Photographs: Krishnendu Halder/Reuters

Also the bank coins have lesser liquidity as they are not bought back by the banks.

World Gold Council Coins, these are coins issued by jewelers who are part of the WGC network.

They have lesser premium over the market price (1 per cent to 2 per cent) and are redeemed at the market price when one takes them for selling off.

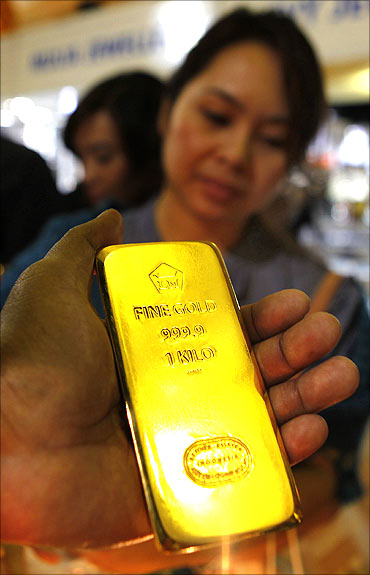

Bullion Bars, are good modes for investment but the minimum investment here is much higher than a common investor can think of.

Gold Exchange Traded Funds are a hot option these days.

These are like mutual funds that invest only in gold.

They are proving to be an easier and safer mode to buy gold.

The charges are very less and the gold can be accessed electronically.

The disadvantage is that one never gets to 'see' one's holdings.

. . .

Investing in gold? MUST READ this!

Image: Gold souvenirs are displayed at jewellery shop.Photographs: Majed Jaber/Reuters

Current Income

Gold in any form does not give any current income.

The only exception is the dividend option in the Gold ETFs. If held in the physical form, there is only outflow of cash for the maintenance of lockers.

Capital Appreciation

Historically, gold has been the perfect hedge for inflation. This is based on data right from the year 1800 AD.

Since last 10 years, Gold has been hitting new levels. The pace accelerated after S&P downgraded US credit rating a few days ago.

The downgrades by S&P which makes investment in US treasury more risky, inflation in India, general slowdown in economy, and the weakening dollar have made Gold prices soar.

. . .

Investing in gold? MUST READ this!

Image: A gold statue of a lion is displayed at a jewellery shop.Photographs: Tyrone Siu/Reuters

The question is should you still go for Gold at the current high prices.

To answer this, you have to look at the alternatives available to you.

Both alternative investment options which have historically given better returns than gold due to their sheer capital appreciation are equities and real estate.

Currently both these segments look highly unfavourable due to current market conditions.

So should you still start investing or continue to invest in gold, when prices are so high. Well, it might still be a good option if you go for it now --

Experts (such as JP Morgan analyst John Bridges) have been predicting gold prices to rise 10 per cent to 20 per cent from the current level by the end of this year.

. . .

Investing in gold? MUST READ this!

Image: A jeweller shows a gold bar to costumers.Photographs: Beawiharta/Reuters

In the short run when market conditions for other investments especially equities and realty are turbulent gold is a very strong bet.

The idea for gold investment will be to use it at times when the markets are falling and when the inflation is very high -- which makes the current conditions ideal for this.

A 5 per cent of the overall investment portfolio can be considered for gold investments (bullion, WGC coins, Gold ETFs).

Jewellery is not an investment as far as personal finance goes. It is only an expense for pleasure, symbolizing wealth.

. . .

Investing in gold? MUST READ this!

Image: Gold turtles on display at a jewellery shop.Photographs: Reuters

Risk

Gold does not carry much risk at least in India, as we hardly see deflation in the real sense.

Even when the official figures where showing negative inflation (deflation) during the last year, the actual prices of food items were increasing.

This was reflected in the gold prices too.

The real risk with buying gold is in the opportunity cost of investing in other avenues that can actually give higher returns.

. . .

Investing in gold? MUST READ this!

Image: A gold necklace creation.Photographs: Reuters

Liquidity

Gold scores the highest in terms of liquidity, compared to all other investments.

At anytime of the day and any day gold could literally be converted to cash. Banks would give you a jewellery loan.

(Remember though that many banks do not give loans on coins, including their own). So would your friendly neighborhood pawn shop.

They can also be sold in some pawn shops, though many are cautious to purchase in these outlets for fear of 'stolen jewellery'.

Gold jewellers would exchange your gold possessions for other gold jewels.

But the problem here is that there is going to be making and wastage charges involved again.

Here we lose the value (to the extent of 10 per cent to 35 per cent) of gold jewels.

An unfortunate social aspect in most families in India related to liquidity is that, gold has sentiments attached and is the last item to leave the house in case of financial difficulties.

This negates the entire purpose of gold having liquidity.

. . .

Investing in gold? MUST READ this!

Image: Gold bars.Photographs: Reuters

Tax Treatment

Gold suffers capital gains tax as per the IT act.

So it is better to ask your jeweller for the bill.

Close to 90 per cent of the gold jewellery traded in India is unbilled.

This is a serious problem for those who look at gold as an investment.

Only the branded jewellers would automatically give you a bill.

At other places, ask for one.

We can make use of indexation benefits when calculating the capital gains of gold. So the tax payable will not be much.

Gold does not have any other tax benefits.

. . .

Investing in gold? MUST READ this!

Image: A visitor looks at a chapel, made of gold, silver and amber.Photographs: Reuters

Convenience

Gold scores very high here.

But with the per gram price rising, the smallest single investment is becoming higher.

With the emergence of Golf ETFs the convenience to hold gold for the short term has increased many folds.

Instead of holding cash for the short term, one can today make investments in Gold ETFs.

Conclusion

Gold has proved itself time and again to be the perfect hedge for inflation.

But to look at it as a hedge avenue, Indians are yet to consider this market actively as the purchases continue to be dominated by jewellery.

Gold only beats inflation.

It fares poorly when compared to real estate or shares when compared on the basis of real inflation adjusted returns in the very long term.

Any serious investor however is advised to have a certain percentage of investment in gold to hedge inflation.

article