Photographs: Reuters Subir Ghosh and Paranjoy Guha Thakurta in New Delhi

Did Berkshire Hathaway, one of the largest insurance companies in the world, resort to a back-door entry into India in order to circumvent the caps on foreign direct investment in the insurance industry?

A close look at certain facts indicates that there are enough grounds for suspicion.

Berkshire India Private Limited is a majority owned non-direct subsidiary of Berkshire Hathaway Inc., incorporated in India, with 100 per cent FDI in paid-up capital.

It is a licensed corporate agent of Bajaj Allianz General Insurance Company Limited and sells BAGICL's products directly to retail consumers through the Internet and through call centres.

. . .

Did Warren Buffett firm try back-door entry into India?

Photographs: Reuters

According to Indian laws, there can be three types of intermediaries in the insurance sector: brokers, agents and TPAs, or third party assistants.

The second category has a sub-category, namely, corporate agents (that are distinct from individual agents). Berkshire India falls into this sub-category.

The FDI limit in insurance companies, intermediaries and TPAs is 26 per cent. By this measure, the FDI cap for corporate agents should be the same.

However, as per clauses 2(f) and 2(k) of the Insurance Regulatory and Development Authority (Licensing of Corporate Agents) Regulations, 2002, nothing has been mentioned with respect to FDI limits applicable to the sub-category of corporate agents.

. . .

Did Warren Buffett firm try back-door entry into India?

Photographs: Reuters

Any company incorporated under the Indian Companies Act, 1956, can act as a corporate agent. But unlike Clause 10 of the IRDA (Insurance Broker) Regulations, 2002, under which there is a restriction both on the amount of capital as well as the proportion of FDI, there is no such clause in the regulation of corporate agents.

It is here that the loophole in the law lies.

Berkshire India was formed with BHG Structured Settlements Inc. (based in Missouri, US) owning close to 80 per cent of the company's paid-up share capital. Allianz SE (based in Munich, Germany) owns 20 per cent.

In other words, Berkshire India -- despite its name -- is not really an Indian company.

. . .

Did Warren Buffett firm try back-door entry into India?

Photographs: Reuters

"The FDI cap rule cannot be different for one class of intermediaries when there is a 26 per cent limit for other intermediaries like brokers and TPAs," says a highly-placed source in the insurance industry.

"Since Berkshire Hathaway cannot operate in India as a full-fledged foreign entity, it has entered the Indian market as a corporate agent."

There are other questions that have been raised about this kind of arrangement.

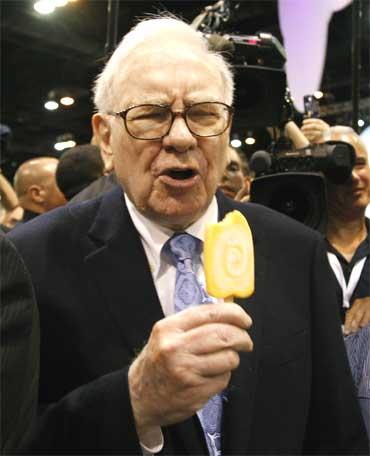

Berkshire India had advertised in all major newspapers that anyone who bought a policy from them would get to meet Berkshire Hathaway CEO and philanthrope-investor Warren Buffett during his visit to India, albeit on a first-come-first-served basis.

. . .

Did Warren Buffett firm try back-door entry into India?

Photographs: Reuters

"This," insurance industry sources allege, "did not match the advertisement and disclosure norms of regulation 2.2 of IRDA. This amounted to inducing customers, which is not permitted."

Complaints were filed with IRDA, but none yielded any response from the insurance industry regulator. A right to information (RTI) application was filed to ascertain and verify the facts, but the application elicited the response from the IRDA that "no steps" had been taken against Berkshire India Private Limited.

The industry source quoted earlier alleged that the then IRDA chairman even went to New Delhi and attended the function with Warren Buffett in spite of the controversy surrounding the advertisement issued by Berkshire and the issue of whether corporate agents could have more than 26 per cent FDI. "There are newspaper reports to this effect," he said.

An RTI enquiry was made about the facts of the case, but the IRDA replied saying: "No such complaints were received by the Consumer Affairs department (of the Authority)."

. . .

Did Warren Buffett firm try back-door entry into India?

Photographs: Reuters

The IRDA-Berkshire relationship seems too cozy for comfort. According to the source, "the time taken for Berkshire India's application -- from filing for the corporate agency licence, which was on February 19, 2011 to it being granted, which was February 25, 2011, was a mere five days, including a weekend, so effectively four days -- was rather quick. Normally it takes months for licences to be granted. The IRDA worked in great haste in the case of Berkshire."

The IRDA allegedly overlooked another aspect -- the Articles of Association and Memorandum of Association of Berkshire India say that the primary objective of the company is insurance sales.

A corporate agent is usually a company having some other activity as its main object and selling insurance is a secondary object. "The IRDA, therefore, went out of its way to oblige Berkshire ignoring this rule," the source said.

But wait! The story gets stranger still.

. . .

Did Warren Buffett firm try back-door entry into India?

Photographs: Reuters

A complaint filed with the IRDA had alleged that a particular official held positions in both BAGICL and Berkshire India Private Limited when the latter was approved to obtain a licence as a corporate agent of the former in February 2011.

The complaint, filed by Lucknow-based insurance activist and lawyer Dhruv Kumar, alleged that Kamesh Goyal was the chief executive officer of BAGICL and at the same time, was also a promoter director in Berkshire India at the time of approval of its licence as corporate agent.

Since Goyal held positions in both the insurance company as well as its corporate agent, there was allegedly a conflict of interest. This was because being the CEO of an insurance company, he was supposed to be unbiased and expected to act without prejudice towards all policy holders and as well as agents.

Since Goyal was a director with the agent, this would have been detrimental to the interest of a large number of policy holders, the complainant alleged.

. . .

Did Warren Buffett firm try back-door entry into India?

Photographs: Reuters

Kumar filed the complaint on May 2, and is yet to receive any response from IRDA.

Bajaj Allianz denied the charges made by Kumar. Santosh Balan, head, corporate communications with the company, said in an e-mail to rediff.com: "Mr Kamesh Goyal was neither the director of BIL (Berkshire India) nor CEO of BAGICL at the time of application to IRDA for approval of Corporate Agency licence. He was also not the director of BIL at the time of solicitation of insurance by BIL."

"It is evident that the alleged compliant to IRDA is baseless and seems to be motivated with malicious intentions. Furthermore, IRDA has not sought any clarifications from us nor raised any concerns on the said matter. It is obvious that there is no question of any conflict of interest and hence makes your queries redundant," Balan added.

Balan further said: "Goyal ceased to be CEO of BAGICL from September 30, 2007, and he had resigned from directorship of BIL on February 11, 2011."

. . .

Did Warren Buffett firm try back-door entry into India?

Photographs: Reuters

BIL applied to IRDA for approval of corporate agency licence of BAGICL on February 19, 2011 and the application was approved by IRDA on February 25, 2011.

Goyal, in fact, was the CEO of sister concern Bajaj Allianz Life Insurance Company Limited at the time of the event.

The reason for this confusion is that another company called Berkshire Hathaway Services Private Limited (BHSPL) had been incorporated around the same time.

A copy of the articles of association of BHSPL with the Registrar of Companies clearly mentions Kamesh Goyal as one of the five first directors of the company.

Why this company was at all incorporated, is anyone's guess.

article