Despite headline inflation showing signs of easing, the wait for a reversal of the central bank's policy stance may be prolonged.

Economists said the Reserve Bank of India may wait for a substantial downtrend, maintaining the same repo rate when it meets to review the monetary policy on January 24.

India's inflation indicator, the wholesale price index, fell to a two-year low of 7.4 per cent in December, compared with 9.7 per cent in November, while the annual rate of food inflation fell to 0.74 per cent from 8.54 per cent in the same period.

Why RBI rate cut may be delayed

However, core inflation, or non-food manufactured goods inflation, rose 0.5 per cent sequentially, though on a year-on-year basis, the inflation rate eased marginally to 7.7 per cent from 7.9 per cent a month ago.

Stubborn core inflation, coupled with comments from the Prime Minister's Economic Advisory Council chairman, C Rangarajan, did not allow yields to ease.

Yields on the 10-year benchmark government bonds also rose three basis points to 8.22 per cent on Monday, reflecting dampened hopes of a cut in the policy rate this month.

. . .

Why RBI rate cut may be delayed

Rangarajan said Reserve Bank of India would do well to take into account not only the decline in overall inflation and food inflation, but also the inflation in manufactured goods.

"The drop in headline inflation was significant, but ultimately distorted by the large food-related base effect.

"Inflation accelerated in sequential terms and core inflation remains high.

"A rate cut is, consequently, not just around the corner," said economists Leif Eskesen and Prithviraj Srinivas at HSBC Global Research.

. . .

Why RBI rate cut may be delayed

Though inflation has eased, it is still above the comfort zone of the central bank, which is 4.5-5 per cent.

Economists said inflation may remain above Reserve Bank of India's comfort zone for the next few months, though it may decline from its current level.

The rupee, which depreciated around 18 per cent in 2011, would add pressure to inflation, as the country depends heavily on oil imports.

The WPI had touched double digits in September, after which it started easing, primarily because of a high base effect.

. . .

Why RBI rate cut may be delayed

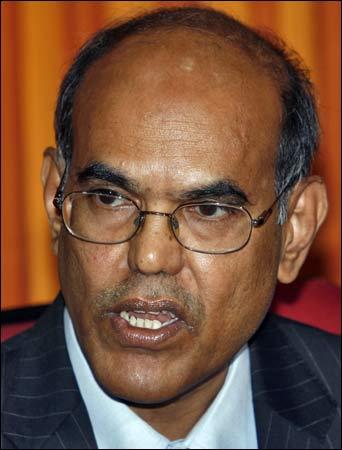

Image: Reserve Bank of India Governor D Subbarao.Photographs: Reuters

RBI expects headline inflation to cool to seven per cent by the end of March.

In the mid-quarter policy review announced last month, the central bank had said inflation risks were high and inflation could quickly recur as a result of both supply and demand forces.

"We expect food inflation to climb in the first quarter of 2012.

"Even if the index remains constant, food inflation would be around six per cent by mid- February.

"A spell of unseasonal rains in various parts of the country in early-January can potentially complicate matters on this front," said Siddhartha Sanyal and Rahul Bajoria at Barclays Capital.

. . .

Why RBI rate cut may be delayed

There are expectations of a cut in the cash reserve ratio, on account of the tight liquidity conditions.

Banks have been borrowing close to Rs 1 lakh crore (Rs 1 trillion) on an average daily from RBI's repo window for a month.

The central bank has also infused about Rs 60,000 crore (Rs 600 billion) through bond purchase in open market operations since November.

"Excessive usage of OMOs to infuse liquidity into the system can be construed as monetisation of the deficit.

. . .

Why RBI rate cut may be delayed

"We feel RBI should go for a judicious mix of a CRR cut and OMOs. We expect a cut of 50 basis points in the CRR in the January policy review," said Samiran Chakraborty, regional head of research, India, Standard Chartered Bank.

Today, banks borrowed Rs 1.47 lakh crore (Rs 1.47 trillion) from RBI's repo window.

The central bank has raised the policy rate by 375 basis points since March 2010, as it pursued an anti-inflationary stance.

Rates were kept unchanged in the December policy review.

. . .

Why RBI rate cut may be delayed

Growth, as indicated by the index of industrial production, rebounded to 5.9 per cent in November from negative 4.7 per cent in October.

Economists Dennis Tan, Taimur Baig and Kaushik Das at Deutsche Bank said in a report that growth needed to remain depressed and well below the trend for a sustained period to define it as a 'hard landing', a phenomenon last seen in 1997-2001.

"RBI officials also tend to believe the sharp drop in the October IIP seems to be exaggerating the extent of the growth slowdown and is not consistent with the level of economic activity that is evident on the basis of circumstantial evidence," they said in a report.

article