Photographs: Reuters Malini Bhupta and Kalpana Pathak in Mumbai

So far, RIL investors have not had an easy year.

Apart from operational issues in the exploration business, one of the biggest disappointments was the 9.3 per cent fall in RIL's operating profit (excluding other income) in FY12 to Rs 34,508 crore (Rs 345.08 billion).

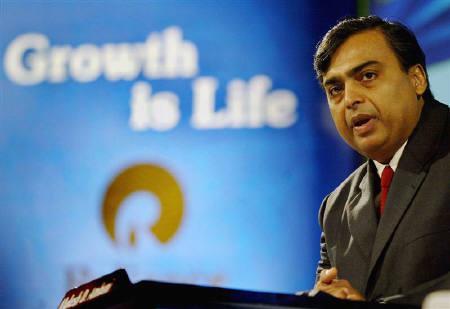

It was thus of little surprise that Chairman Mukesh Ambani tried to pep up the mood at the company's annual general meeting on Thursday, announcing the company would double its operating profit in about five years -- from Rs 34,500 crore (Rs 345 billion) to Rs 70,000 crore (Rs 700 billion) by 2017-18.

. . .

Why Ambani may be able to walk the talk

Photographs: Mick Tsikas/Reuters

Though he did not spell out how the company would achieve this, there were various indications in his speech on the levers that could deliver the goods.

First, the company is slated to double its petrochemicals capacity and cut costs in the refining business.

Deven Choksey, managing director, K R Choksey Securities, feels Ambani would walk the talk.

"Half the incremental profits would come from the three traditional business lines --refining, exploration and petrochemicals -- with telecom and retail accounting for the remaining profits," he said.

Analysts believe for each of its businesses, the company has underlined triggers that could boost profitability.

. . .

Why Ambani may be able to walk the talk

Photographs: Reuters

However, given the global slowdown and the slackening demand, it might be difficult to improve the profitability of the refining business over the next few years.

The company is thus focusing on cutting costs.

While there is no capacity addition in the refining business, the company is setting up one of the largest petroleum gasification facilities in the world to convert petroleum coke to synthetic gas.

In his speech, Ambani said: "We are making a major investment to further strengthen the competitiveness of our refinery business.

"We are building the largest gasification facility in the world to convert petroleum coke to synthetic gas, which would be used as feedstock and fuel at our integrated Jamnagar complex.

"This project will not only add value to our refining business, but also provide competitive fuel and reduce volatility of earnings."

. . .

Why Ambani may be able to walk the talk

Image: Mukesh Ambani.Photographs: Reuters

Analysts say the gasification would result in gross refining margins improving by $3, compared with the current $8.

The company also plans to double its petrochemicals capacity over the next three years, and this would add to profitability.

RIL plans to spend $8 billion on adding capacities of polyester filament yarn, polyethylene terephthalate, polyester and intermediate chemicals such as purified terephthalic acid and paraxylene, besides adding new products such as carbon black and rubber.

Though the company's oil & gas exploration business has come under pressure in the last one year, the company has plans in place for the next phase of gas production from its other discoveries.

. . .

Why Ambani may be able to walk the talk

Photographs: Reuters

Ambani has guided for a total gas production of 60 million metric standard cubic metres per day over the next three to four years.

The real game changer, however, would be RIL's telecom business, expected to generate revenues of Rs 25,000-30,000 crore (Rs 250-300 billion) and a profit of Rs 8,000 crore (Rs 80 billion) a year over the next few years.

Though RIL has big plans for the retail business, analysts said the segment would contribute only marginally to the profitability.

The company's current retail revenue is estimated at Rs 7,600 crore (Rs 76 billion) and while it may rise over the next few years, it would take at least a few more years for the business to become profitable.

RIL remained conspicuously silent on its financial services joint venture with DE Shaw.

article