Photographs: Courtesy, ET NOW

Private Equity is not quite on the fairway in this economic environment?

Our existing investments are already on the fairway so we just keep at them everyday and be focused.

It's not easy to find new deals. Getting good quality management, valuations and more - it's all getting very difficult. It's more because the growth in the economy itself has slowdown so people don't quite need the money at the moment.

Are you getting concerned about a GDP growth between 6-7%? Would this lower your own returns?

That is true. If you take a five to six year view, we will revert back to the good growth rates. The secular trends have not quite changed. The short term does look uncertain. It's still a good time to invest as you get better opportunities and better valuations.

Private equity has a much longer term horizon so that's a positive. The larger point now is that our growth story is facing a structural issue. Investment spending and savings are down.

Click on NEXT for more...

Powered by

'Our debt to GDP ratio is not too bad'

Photographs: Courtesy, ET NOW

Is restructuring of assets going to be the new focus at companies? What themes look good for investment?

Yes, we expect them to rationalise a lot more now. Companies will attack their cost lines consciously. Among the themes that are strong, I think consumptions are good, which are the India competitive advantage and Infrastructure Enablers as well.

How are companies reacting to this slowdown? Are they getting risk-averse?

They are focusing on productivity and working cap management. Profitability vs. growth is what they are watching. Much more focus on restructuring of assets. Look at Pantaloon, Biyani has managed to shed assets like Pantaloon and Future Capital quite effectively.

Are we making too much of the fiscal deficit at 5.6%? There are global economies which are fostering double digit deficits. Should India be so worried given its ability to grow?

I think you are right. It needs to be taken in perspective. We should talk of deficit as an opportunity on where the revenue can be improved. Our debt to GDP ratio is not too bad. So we need to attack the revenue side now.

There are so many opportunities available with the government such as taxation, GST, Government assets; there is so much the government can do. It's not so easy for the government to cut subsidies and the goodies given away - it's unrealistic and that's where the government now needs to find new avenues of revenue given our tax to GDP ratio itself is not great.

Click on NEXT for more...

Powered by

'We don't have deep enough capital markets'

Photographs: Courtesy, ET NOW

In terms of lifting the mood in the economy, are over estimating the impact of opening up some sectors? Will FDI in retail, opening up insurance and banking do the trick?

In the short term, you do need a few confidence boosting measures. For that, we need the Goods & Services Tax (GST) done, a few announcements on the FDI front, some short term issues on power etc - just these can help change the sentiment.

Long term, you have got to have revenue and fiscal focus. You need to work on the land reforms and you need to work on similar stuff on the financial sector.

What are the fund raising options for companies in this environment and is the IPO market dead?

I think the key issue is that India has not focused on creating long term investors such as pension funds. These will only develop when we bring in financial sector reforms.

We don't have deep enough capital markets. We don't have a strong investor base in India as yet. I think in that respect the IPO market will not be strong enough to help the capital needs of companies.

Click on NEXT for more...

Powered by

'The secular growth in this country is yet untouched'

Photographs: Courtesy, ET NOW

What are KKR India's plans over the next five years?

We are long term players. I think the secular growth in this country is yet untouched. Once we see a turnaround in sentiment and Indian businesses begin to invest again, there will be opportunity.

Indian PSU banks don't have enough money to support both infra and private sector spending as a results India is going to be very short of capital. That's where private equity will play a big role and I think KKR India participating in that story.

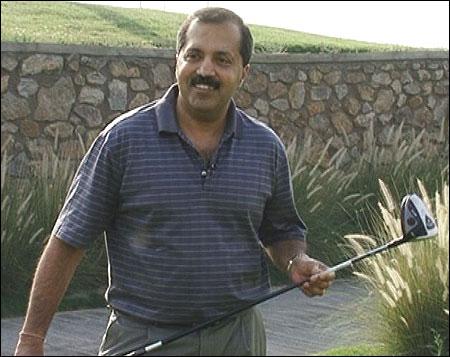

When did you start golfing and who introduced you do the game?

I started playing in the mid-90s in the US - my colleagues at Citi got me hooked on to it.

To date, what is your proudest golf accomplishment?

Hole in one(ace) at Delhi Golf Club

What's your business motto?

Think for the customer.

Powered by

article