Photographs: Ajay Verma/Reuters. Ananth Narayan

The Reserve Bank of India (RBI) heads into it's mid-term quarterly policy review on Monday, against a fairly challenging domestic and global economic backdrop.

The big domestic economic challenge today is the slowdown in growth and infrastructure investments.

The FY12 Q4 gross domestic product print at 5.3 per cent was depressing, as has been the slowdown in gross fixed capital formation. Over the years, our growth and investment story has been the cornerstone of our macroeconomic strength.

This growth story has attracted capital flows that have buoyed our balance of payments and forex reserves. It has also helped our fiscal position with increased tax revenues.

...

How to rebuild India's economic story

Image: A bank employee counts currency notes at a cash counter in Agartala.Photographs: Jayanta Dey/Reuters.

This growth theme is now in question and this has impacted our external and fiscal position. The rupee has weakened an incredible 25 per cent since July last year, and still looks wobbly.

Banks are facing prospects of increased non-performing asset and asset restructures - which in turn could make them reluctant to lend further. The delicate global environment, with headlines from Europe dominating news wires, has only accentuated the weakening India sentiment.

International coverage of India's economy, whether from a rating agency or from leading economic periodicals, has painted a gloomy picture. We need to break out of this temporary spiral of negativity.

...

How to rebuild India's economic story

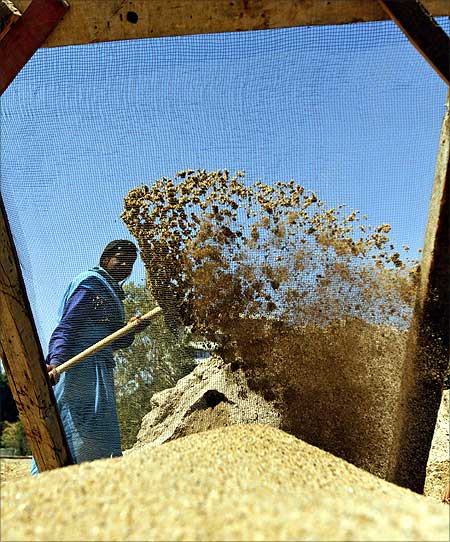

Image: Farmers at work.Photographs: Reuters.

The fundamental economic story of India remains strong. Our demographics, our entrepreneurial skills, our working population remain our core strengths. And in the short run, the slowdown in global growth has a silver lining - lower commodity and, particularly, oil prices.

One does hear the argument that the weakening growth story has little to do with monetary policy. However, I do hope RBI does what it can to improve sentiment. A system perennially short of liquidity in such an economic backdrop is not desirable.

Perhaps RBI could take steps to ease the liquidity shortfall - with a cash reserve ratio cut or using other tools.

...

How to rebuild India's economic story

Photographs: Reuters.

Further, a meaningful cut in headline policy rates, that could be passed on to borrowers if accompanied by easing liquidity, could help nudge corporates make the fresh investments that they've delayed making thus far.

My wish list, therefore, is for a strong 50 bps cut in repo and reverse repo rate, followed by liquidity-easing measures, designed to bring the system liquidity closer to neutrality than deficit.

And, perhaps considering a more gradual implementation of Basel-III norms, when the economic recovery is more in place.

...

How to rebuild India's economic story

Photographs: Reuters.

Will all this spur inflation? After all, while headline wholesale price index has eased over the past few months, it is still over 7.5 per cent, and the consumer price index rise is in double digits.

However, core inflation remains below five per cent. In addition, I don't really believe our inflation has a strong monetary basis, as consumption oriented credit offtake has been fairly muted - perhaps our inflation is more a result of fiscal spending and supply-side constraints.

And, investments into infrastructure is what can help ease these constraints in the long run.

...

How to rebuild India's economic story

Photographs: Reuters.

Still, if the policy makers are worried about eventual inflation, then maybe we could pursue a two-step monetary policy. One, allow banks to refinance their lending to critical infrastructure investments at attractive rates, say the bank rate or the repo rate.

That could ensure funds flow into much needed investments, at meaningfully lower rates. Two, they could continue to keep the rates and risk weights high for other consumption-led loans.

All in all, these are challenging times, globally and domestically. We do need a concerted effort from all stakeholders - the industry, financial system, regulators and policy makers - to rebuild the India economic story.

Ananth Narayan is MD, global markets and regional co-head, wholesale banking, South Asia, Standard Chartered Bank.

article