BS Reporters in Mumbai

India Inc's results for the first quarter of this financial year are likely to throw up negative surprises, with revenue growth of companies, excluding banks and oil companies, expected to touch new lows.

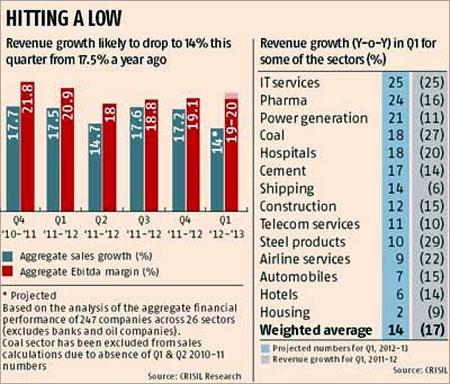

According to CRISIL Research, India Inc's revenue growth is likely to drop to 14 per cent in this quarter from 17.5 per cent a year ago. Revenue growth of less than 15 per cent would be the lowest corporate India has seen in six quarters.

CRISIL's projections are based on an analysis of the aggregate financial performance of 247 companies across 26 sectors (excluding banks and oil companies).

The revenue projection for the first quarter shows demand significantly fell compared to last year. In the first quarter of 2011-12, there was a marginal fall in revenue growth compared to the year-ago period."

...

India Inc's revenues at 6-qtr low in Q1

Photographs: Reuters.

Despite all the macro-economic concerns, consumption has held on. But as inflation remains sticky, this, too, could be hit. "We believe demand growth will continue to remain weak, as interest rates are likely to remain high longer than anticipated. The deceleration in fixed capital investments growth may lead to further slowing of consumption demand," said Mukesh Agarwal, president, CRISIL Research.

Unless investments pick up, deceleration in revenue is expected to continue. Corporate India's gross fixed asset growth, at 13 per cent, is the lowest in five years. Given the economic uncertainty around the world and continued delays in approvals and clearances at the ground level in India, CRISIL does not expect investments to pick up in the near term.

The Reserve Bank of India deferring further interest rate cuts would also impact investment sentiment. High interest rates are adding to cost pressures on companies that have low interest coverage ratios.

...

India Inc's revenues at 6-qtr low in Q1

Photographs: Reuters,

The adverse effect of high interest rates, coupled with the slowdown, is visible on the books of not just companies, but also banks.

Slippages (companies defaulting on payments) might escalate and gross non-performing assets may rise to 3.2 per cent by March 2013, compared with 2.8-2.9 per cent at the end of March 2012.

Slowing growth would also hurt operating profits of the companies CRISIL analysed.

While aggregate earnings before interest, tax, depreciation and amortisation margins of these companies are projected to be 19-20 per cent, 15 of the 26 sectors would see a drop in margins.

For the current quarter, rupee revenues of information technology firms are expected to rise about 25 per cent year-on-year and three-four per cent sequentially.

...

India Inc's revenues at 6-qtr low in Q1

Photographs: Reuters.

A persistent fall in the rupee would also aid revenue growth, with dollar revenues expected to rise 9-10 per cent compared to the corresponding quarter last year.

The sharp depreciation in the rupee would also see an improvement in margins, which are likely to rise 250-300 basis points, compared to the year-ago period.

However, some sectors are likely to see pressure on margins, owing to seasonal weakness and higher capacity. Service sectors segments with high operating leverage, like hotels and airlines, may see pressure on margins due to seasonal weakness.

Occupancy rates for hotel properties, currently 60 per cent, may fall to 55 per cent in remainder of the year. The housing sector, too, may see pressure on margins due to weak demand.

article