Photographs: Rupak De Chowdhuri/Reuters. N Sundaresha Subramanian in New Delhi

Having seen reinforcement from North Block, analysts have begun to see the silver

lining in the Indian markets.

Falling crude oil prices and a weak rupee are beginning to look positive to many.

While crude prices well below the $100 per barrel mark are expected to have a favourable impact on inflation, a weak rupee is seen as an opportunity to improve the Balance of Payment scenario.

...

Analysts see silver lining in India's growth story

Image: Bombay STock Exchange.Photographs: Reuters

On Thursday, Deutsche Equities' Ajay Kapur and Ritesh Samadhiya wrote, "Markets

and our indicators are implying a world close to recession – there is a flight to the

safety of bonds and defensive sectors. We think this despondency is now stretched and we should move toward the opposite stance."

According to them, the growth outlook is not as gloomy as the markets suggest.

"Such positive divergences between weak markets and robust leading indicators are rare, and are normally resolved by risk/growth assets doing well. We think investors should take advantage of the current miasma and buy some risk and cyclicality," they added.

...

Analysts see silver lining in India's growth story

Image: Indian rupee notes.Photographs: Reuters.

Deutsche estimates showed that on an EV/Ebitda (enterprise value to earnings before interest, taxes, depreciation and amortisation) and EV/sales basis, the Indian market is close to its cheapest in two decades.

"We think the liquidity environment is about to get easier – the yield curve is no

longer negatively sloped, and the weak currency should help the BoP and expand reserves and the monetary base," Kapur and Samadhiya said.

...

Analysts see silver lining in India's growth story

Image: A worker fills diesel in containers at a fuel station during a rain shower at Noida.Photographs: Parivartan Sharma/Reuters.

JP Morgan analysts also upgraded India to overweight last Thursday. A Macquarie Securities report said the fall in crude prices will help India and China.

"Key oil price indices have fallen below key levels as concerns over slower economic growth are leading to unwinding of still-elevated speculative positions and in response

to the highest inventories and production levels since 1990 and 1999, respectively, in

the US. There will be a general positive impact on inflation, leaving room perhaps,

where it didn't exist previously, to use monetary policy less guardedly. This is good, especially for China and India," the Macquarie report said.

...

Analysts see silver lining in India's growth story

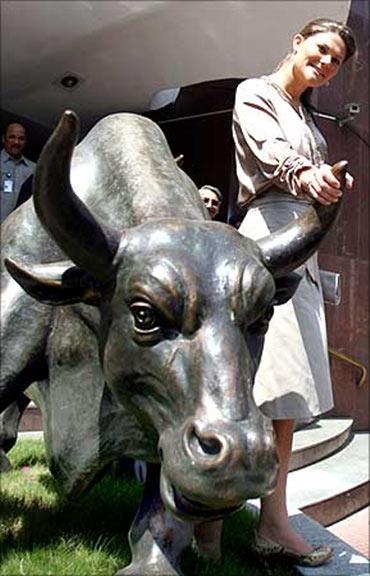

Image: Sweden's Crown Princess Victoria during her visit to the BSE.Photographs: Punit Paranjpe/Reuters.

Barclays, in a report titled 'Mid summer madness', also argued for staying invested.

"The overall suggested investment strategy is that investors should continue to hold fully diversified portfolios of different asset classes, with a strong focus on valuation – the latter may serve as a basis for any near-term marginal portfolio adjustments."

While Barclays foresees a risk from the situation unfolding in Spain, where the banks are seeking a recapitalisation bailout, it sees gains down the lane.

...

Analysts see silver lining in India's growth story

Image: A labourer carries onions at a wholesale market in Mumbai.Photographs: Danish Siddiqui/Reuters.

"Despite our short-term caution, in the medium term, we maintain a constructive view

of global equity markets as valuation, in general, is not excessive and investors' perceptions, which will largely be influenced by recent market volatility, may have underestimated the resilience of the global economy," it said. It even suggested short-term risks could provide bargain hunting opportunities.

Some brokerages like Credit Suisse continue to remain cautious. A Credit Suisse report titled 'Deficits: Stickier than you think', focused on the deficit situation and expressed doubts on the government's ability to handle it.

...

Analysts see silver lining in India's growth story

Image: A woman speaks on her phone as she walks past the Bombay Stock Exchange (BSE) building in Mumbai.Photographs: Danish Siddiqui/Reuters.

"Government sources of income are constrained by the cyclicality in tax collection,

and falling returns on government-owned assets. Moreover, political developments in

the past few weeks have sharply increased the possibility of an early general election, thus removing any window the government may have had to take some tough decisions to get out of the fiscal mess," it said.

Kotak Institutional Equities found the fall in crude prices an opportunity, but stayed cautious.

...

Analysts see silver lining in India's growth story

Image: A Indian national flag is pictured in a street in Dharavi, one of Asia's largest slums, in Mumbai.Photographs: Danish Siddiqui/Reuters.

"The universe is conspiring for India to do well but the country remains reluctant. The recent sharp correction in global crude oil prices and 'postponement' of unconventional monetary policy actions by the US Fed and ECB will likely ease pressure on India's CAD (current account deficit) and external finances, leading to some respite on the currency," said Kotak analysts led by Sanjeev Prasad.

Adding: "However, we need signs of more sensible governance that will address slowing economic growth and high fiscal deficit in the short term; fuel price rationalisation is the biggest catalyst, in our view. Politics remains quite dysfunctional, stymying India's growth prospects and entrepreneurship culture."

The report found positives in the lower current account deficit, weaker currency and progress on the Goods and Services Tax.

article