R Murali Krishnan

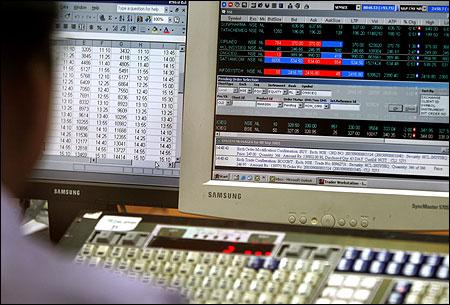

The recent rally in Indian markets was more or less missed by many of us.

Institutional buying/selling activity shows domestic institutions were aggressively selling, whereas foreign institutional investors were seen lapping up stocks.

The Sensex went above the highly-tracked 200-Day EMA on January 27, but that didn't alter fund activity significantly.

Why? Simply because participants had seen the Sensex faltering after breaking above the 200-Day EMA on more than one occasion in year 2011 and that was playing on the minds of investors.

All the other signals of revival were ignored when the Sensex rallied from 15,000 to 18,500 in eight weeks.

Now, everyone is asking whether or not this is the beginning of a new bull market.

Some say they would look to enter at slightly lower levels of 16,500-17,500.

Will the FM raise tax exemption limits? Will he manage to keep both industrialists and common people happy? To know all about Union Budget 2012-13, . . .Bull rally missed: Sour grapes?

We fear labelling the upmove a 'bear market rally'.

Such statements are often misleading, in the sense that one may be confused whether the person is bearish, bullish or doesn't have a view at all.

Banks, real estate and infrastructure stocks were the worst hit in 2011 and it wasn't surprising to see these stage an ultra-strong recovery.

Indicators and oscillators used on the charts were of short duration, e.g. 14-Day RSI or 5-Day Stochastics.

But we forget, these were default parameters, which can't be giving the true picture, especially near points of reversal.

Not surprising, then, that banks, real estate and infrastructure stocks were the biggest No-Nos in December, when the rally began.

At that time, participants were more than happy to own healthcare and FMCG stocks in their portfolio, as these were perceived to be safe havens.

But the very perceived safe havens ended as stark underperformers when the Sensex rallied from 15,000 to 18,500.

Will the FM raise tax exemption limits? Will he manage to keep both industrialists and common people happy? To know all about Union Budget 2012-13, . . .Bull rally missed: Sour grapes?

Why? Because defensives are not meant to push markets upwards; they are meant to stop the markets from going into a downward spiral.

Sentiment can be gauged using such data and real life observations and can be put into use into investing principles as surrogate indicators.

The economic conditions haven't changed much, compared to those prevailing in December, and it won't be prudent at this point to announce the beginning of a bull market.

Aberrations in prices are a more normal phenomena compared to aberrations in economic conditions, and, therefore, investors should wait for signals of revival in economic conditions and not get swayed by sharp price movements.

The author is head , institutional broking Karvy Stock Broking

article