Finance Minister Pranab Mukherjee presented the Union Budget 2012-13 in Parliament on Friday.

While the finance minister made the tax payers slightly happy by raising the individual tax exemption limit to Rs 200,000, he made many others unhappy.

So what has been the impact of this Budget on your daily life?

Find out how what's cheaper and what's costlier after the Budget. . .

Union Budget 2012-13: Complete coverageBudget 2012: What is cheaper, what is costlier

Image: Vehicles are seen in a traffic jam during rush hour in Mumbai.Photographs: Danish Siddiqui/Reuters

1. Cars

If you plan to buy a car, be prepared to cough up more money as cars will attract ad valorem rate of 27 per cent post Budget.

Large cars' duty has been raised from 22 per cent to 24 per cent.

Luxury cars will become more expensive by up to Rs 300,000 as disappointed automakers such as Mercedes Benz and Audi deciding to pass on increased duties imposed in the Budget to consumers.

The premium car makers usually bring in advanced technology into the country and this step will be very counter productive, feel analysts.

. . .

Union Budget 2012-13: Complete coverageBudget 2012: What is cheaper, what is costlier

Image: A woman speaks on a phone inside a jewellery shop in Hyderabad.Photographs: Krishnendu Halder/Reuters

2. Gold and platinum

Gold and platinum jewellery prices are set to rise post Budget as customs duty on standard gold has been raised from 2 per cent to 4 per cent.

Branded silver jewellery, however, is set to see a fall in prices as it will be fully exempted from excise duty post Budget.

. . .

Union Budget 2012-13: Complete coverageBudget 2012: What is cheaper, what is costlier

3. Eating out

If you are a foodie, be careful as every visit to the restaurant now is sure to cost you more.

. . .

Union Budget 2012-13: Complete coverageBudget 2012: What is cheaper, what is costlier

4. Air travel

The Budget failed to cheer those bitten by the travel bug as airfares are all set for another rise post Budget.

. . .

Union Budget 2012-13: Complete coverageBudget 2012: What is cheaper, what is costlier

5. Cancer, HIV drugs

Cancer and HIV patients got a breather this Budget with the Finance Minister announcing a cut in medicine prices for these deadly diseases.

. . .

Union Budget 2012-13: Complete coverageBudget 2012: What is cheaper, what is costlier

6. Solar power lamps, LED bulbs

LEDs (light-emitting diodes) to cost less. Perhaps some electronic goods that require LEDs will cost less as well.

. . .

Union Budget 2012-13: Complete coverageBudget 2012: What is cheaper, what is costlier

7. Iodised salt

Fond of adding that extra teaspoon of salt to your food?

Try the iodised salt from now as this particular item is set to be cost less post Budget.

. . .

Union Budget 2012-13: Complete coverageBudget 2012: What is cheaper, what is costlier

8. Cigarettes

Are you a smoker desperate to quit?

Well, post Budget, kick the habit to save your health and some money as well.

For, certain cigarettes and bidis will attract higher excise duty from now.

. . .

Union Budget 2012-13: Complete coverageBudget 2012: What is cheaper, what is costlier

9. Soya products

Are you a health freak, a vegeterian or allergic to lactose?

Then this Budget definitely has some good news for you.

All soya products are going to cost less post Budget.

Therefore, the next time you shed a few kilos, don't forget to thank Finance Minister Pranab Mukherjee.

. . .

Union Budget 2012-13: Complete coverageBudget 2012: What is cheaper, what is costlier

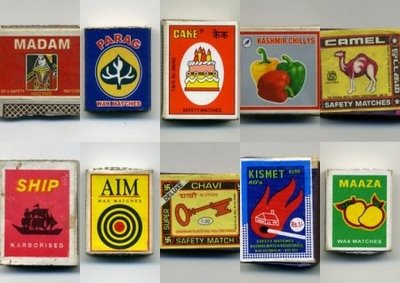

10. Matchboxes

Though the finance minister raised excise duty on certain cigarettes and bidis, matchboxes will cost less.

. . .

Union Budget 2012-13: Complete coverageBudget 2012: What is cheaper, what is costlier

11. Hotel accommodation

Budget did not bring good news for the lovers of luxury as hotel accommodation will become even more expensive after a steep hike in tax rates proposed.

. . .

Union Budget 2012-13: Complete coverageBudget 2012: What is cheaper, what is costlier

Image: A labourer talks on his mobile phone at a construction site in New Delhi.Photographs: Adnan Abidi/Reuters

12. Mobile phones

Have you been eyeing the latest mobile handset that your neighbour bought.

Here's a piece of good news for you: mobiles are set to cost less post Budget.

For, mobile phone parts will become cheaper as excise duty has been cut to 2 per cent from the existing 10 per cent.

. . .

Union Budget 2012-13: Complete coverage

Budget 2012: What is cheaper, what is costlier

13. Imported bicycles

Imported bicycles will become more expensive post Budget as customs duty has been hiked to 30 per cent from 10 per cent.

The same for bicycle parts has been increased to 20 per cent from 10 per cent.

. . .

Union Budget 2012-13: Complete coverageBudget 2012: What is cheaper, what is costlier

14. Consumer electronics

Prices of consumer electronics like LCD TV, LED TV, air-conditioners, refrigerators, washing machine and microwave ovens are going to go up by 2-4 per cent, posing a major headache for white goods companies who are fighting a slowdown in demand for the last one year.

. . .

Union Budget 2012-13: Complete coverageBudget 2012: What is cheaper, what is costlier

Image: Models display new dresses during the opening of a new fashion botique for women in Kolkata.Photographs: Sucheta Das/Reuters

15. Branded garments

Branded garments will become cheaper despite hike in its excise duty as a result of the government raising the abatement from 55 per cent to 70 per cent under the budgetary proposals for 2012-13.

This would mean the levy would not be imposed on 70 per cent of the cost of the product as against the present exemption of 55 per cent.

Thereby the effective excise duty would stand reduced to 3.6 per cent from 4.5 per cent.

Union Budget 2012-13: Complete coverage

article