Photographs: Reuters. Harsh Roongta

Though the annual light & sound show anchored by Finance Minister (called the budget) made a lot of sound but the light was not enough to show the way where the Indian economy is heading.

If the Finance Minister sticks to his words, we are soon going to see an increase in fuel prices and combined with the all round increase in Service tax and excise duty will lead to a general rise in prices.

This way a quick respite from inflation is unlikely and interest rates are unlikely to drop in a hurry.

...

Budget 2012: Small clauses make life tougher for taxpayers

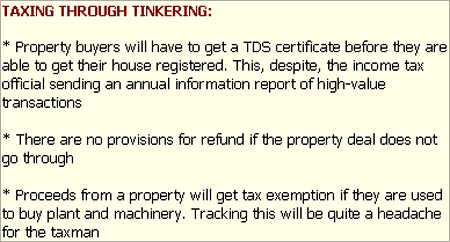

Image: Tax on high value properties.If this is not enough, the most regressive move came in the form of requirement to deduct tax at the rate of 1 per cent from the sale consideration of high value properties (Rs 50 lakh in major cities) after October 1, 2012.

This is clearly a move to check tax evasion rather than a tax collection tactic. This is logically not needed since the registrars are supposed to file an Annual Information Report with the tax department, giving full details of the high value transactions.

Of course, the tax department has very little control over the registrars who are state government employees and they may be either not filing these returns on time or perhaps not filing at all.

...

Union Budget 2012-13: Complete coverage

Budget 2012: Small clauses make life tougher for taxpayers

Image: Taxing times.For this singular failure, look at the amount of complication that the government is subjecting property buyers to.

An individual is required to deduct and pay this tax before the property can be registered and there is no provision for refund if the deal does not go through for any reason.

Thankfully, the individual is not required to get a Tax deduction account number and will be required to file only a simple challan for this amount.

...

Budget 2012: Small clauses make life tougher for taxpayers

The existing provision requiring purchasers to deduct tax at source where the seller of a flat is a NRI has already resulted in purchasers avoiding buying a flat from a NRI.

Instead of removing this irksome and painful process for NRI sellers the government has tagged on this requirement for purchase from resident individuals as well.

Clearly a regressive move considering the fact that the tax information network was created to free us from such process.

...

Union Budget 2012-13: Complete coverage

Budget 2012: Small clauses make life tougher for taxpayers

Talking of life insurance, the exemption for the maturity proceeds of life insurance policies will now be available only if the insurance cover is at least 10 times the yearly premium.

Thankfully, the wordings seem to be clear that it will apply only to policies issued after April 1, 2012 and exemptions of existing policies till March 31, 2012 have been clearly protected.

This is a step in the right direction (the DTC provides for minimum 20 times protection) though the life insurance industry is unlikely to agree.

...

Budget 2012: Small clauses make life tougher for taxpayers

There is a rather convoluted clause providing exemption of capital gains arising from the sale of residential property, provided you invest the proceeds in a company that invests in plant and machinery.

This is supposedly to provide a fillip to entrepreneurs who start a manufacturing unit after selling off residential property.

The process seems to be quite convoluted so the impact of any such clause remains to be seen.

In an excellent step the Finance Minister announced the setting up of the Credit Guarantee Funds for ensuring flow of credit to consumers buying affordable homes and students for higher and vocational education.

...

Budget 2012: Small clauses make life tougher for taxpayers

Image: Reuters.Finally, it has dawned on the government that what consumers are looking at is access to credit rather than cheap credit.

This Credit Guarantee Fund makes the affordable home buyer and the students taking education loans bankable and they may actually be perfectly willing to pay market rates for the loans.

Let's hope that these guarantee funds are capitalised adequately and are set up quickly.

...

Budget 2012: Small clauses make life tougher for taxpayers

Image: Finance Minister Pranab Mukherjee.Photographs: Reuters.

Moreover, it is important that the process of providing guarantees to the banks/lenders is streamlined for these important sectors get a big boost.

Given the prevalent socio economic conditions, industry and ordinary citizens were expecting a lot from this year's budget, but that was not to be.

Pranab babu could have done much more, but this year's budget has turned out to be case of missed opportunities.

The writer is CEO, Apnapaisa.com.

article