Abhishek Vasudev in New Delhi

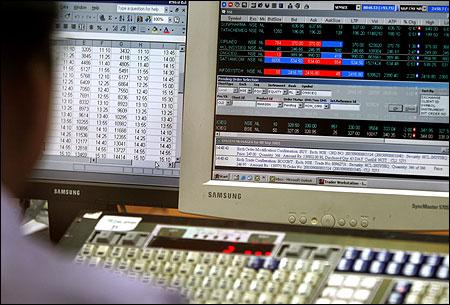

Markets ended over 2.3% lower on Thursday recording their second highest fall in 2012, amid weak European cues, on concerns of muted fourth quarter earnings growth.

The fall was led by index heavyweight Reliance Industries along with bank shares.

The Sensex ended at 17,196 slipping 2.3% or 405 points and the 50-share Nifty lost 136 points or 2.5% to close at 5,228 levels.

On February 27, 2012, the Sensex had ended down 478 points and the Nifty fell 148 points.

China's weak manufacturing growth forecast and Germany's PMI survey dampened the overall market sentiment.

. . .

Markets slump on weak global cues

German PMI survey showed the manufacturing sector shrinking for the first time this year in March.

European stocks slipped on Thursday, keeping the benchmark world equity index below recent 8-month highs, while the dollar was weaker against the yen as data showing China's factory activity shrank renewed concerns about global growth.

The HSBC flash PMI, the earliest indicator of China's industrial activity, fell to 48.1 in March from February's four-month high of 49.6, with new orders sinking to a four-month low.

The European markets were trading lower by 1.5% each. CAC 40 index was down 57 points at 3,470, DAX slipped 99 points to 6,975 and the FTSE was down 50 points at 5,841 levels.

. . .

Markets slump on weak global cues

The Asian markets ended on a subdued note.

Hang Seng ended at 20,901, up 45 points, Nikkei added 40 points to close at 10,127, Taiwan also jumped 78 points at 8,059 levels.

However, Shanghai ended marginally lower at 2,376 levels.

Among Sensex shares, DLF, Tata Steel, Tata Power, index heavyweight Reliance Industries, ICICI Bank, Larsen & Toubro, SBI, BHEL, Hindalco, Bharti Airtel, HDFC Bank, Bajaj Auto and NTPC also ended lower by 2.3-5% each.

Realty, power, banking and capital goods stocks were amongst the worst hit in trades on Thursday.

. . .

Markets slump on weak global cues

The BSE Realty index tanked 4.25% or 78 points to close at 1,762 levels. HDIL, Unitech, Anant Raj Industries, DLF, Oberoi Realty and Godrej Properties are among the top losers from this space.

Power index ended lower by 3.6% or 79 points at 2,115 and the Bankex also slipped 3.4% at 11,712 levels.

Capital Goods, Metal, oil & Gas, Auto, PSU, FMCG, IT and Healthcare indices ended lower by 1.2-3.4% each.

Jindal Steel was the top loser among the Sensex stocks, down 7.3% to Rs 546 on the back of huge volumes.

. . .

Markets slump on weak global cues

As many as 5,35,000 shares changed hands on the BSE compared to its two-week average of 1,39,00 shares.

However, Coal India and Hero MotoCorp were among the only gainers.

Among the individual stocks, Aanjaneya Lifecare ended up 1.2% at Rs 544 on news that the board is considering a preferential issue.

Indoco Remedies surged nearly 2.7% to end at Rs 395 after the company said it board will consider bonus issue and stock split of equity shares.

The broader markets also ended lower. The BSE mid-cap index lost 2.3% or 147 points at 6,312 levels and the small-cap index ended lower by 112 points at 6,599.

The overall breadth was extremely negative as 2,019 stocks declined while 879 stocks advanced.

article