Photographs: Vivek Prakash/Reuters Shivani Shinde in Mumbai

When Vineet Nayyar, vice-chairman, CEO and managing director, Tech Mahindra and now Chairman, Mahindra Satyam, flashed the victory sign after having emerged as the highest bidder in the race to acquire Satyam Computer Services, many within the industry were not so sure that there was any reason to feel triumphant.

The buzz within corporate corridors was that Nayyar and Anand Mahindra had paid a hefty premium for a company rife with uncertainties.

The difference between the bid price of Tech Mahindra and the second highest price was Rs 12 per share, making Tech Mahindra shell out Rs 2,900 crore (Rs 29 billion) - that too for a company which did not reveal how many skeletons it could still have hiding in its closet, thanks to the shenanigans of its erstwhile owner, Ramalinga Raju.

...

Mahindra Satyam ready to take on big boys of IT

Image: Anand Mahindra.Photographs: Danish Siddiqui/Reuters

Three years down the line, it looks like Nayyar is having the last laugh. The recently announced merger boasts an entity with a revenue of $2.4 billion, making it India's fifth largest IT services company (excluding Cognizant).

It also reduces Mahindra & Mahindra's IT arm Tech Mahindra's dependence on telecom from 100 per cent to 57 per cent. Crucially, it establishes a presence in sectors like manufacturing, hi-tech, life sciences, retail and others. The merged entity will be among the few in the industry to have an almost equal revenue break from the US and Europe.

If that weren't enough, it will also be a cash surplus firm with Rs 1,800 crore (Rs 18 billion) in its kitty.

...

Mahindra Satyam ready to take on big boys of IT

Image: File photo of Satyam.Photographs: Krishnendu Halder/Reuters

Most importantly, the major legal problems that once crippled the firm have been mostly resolved, while ironically the big daddy of the industry, Infosys, is mired in several of its own.

"At least now we can say, we have been thoroughly educated in the US legal system," said Nayyar, remembering the negotiations and the army of lawyers the company had to invest in.

Nayyar, who oversaw the entire legal defence, managed to resolve three crucial hurdles - class action lawsuits, Unpaid's lawsuit (which was an intellectual property rights dispute) and litigation from regulatory body SEC - for just about $200 million, a bargain, considering how steep that tab could have risen to.

...

Mahindra Satyam ready to take on big boys of IT

Image: Ramalinga Raju in a file photo.Photographs: Krishnendu Halder/Reuters

For instance, in the initial days of litigation, Upaid was claiming damages of $1 billion. Plus, "this was the time when anti-outsourcing sentiment was at its peak in the US. The class action lawsuits made us very vulnerable," said Nayyar.

Other than the legal hurdles there were other operational challenges. This included a huge real estate problem. Raju had entered into agreements to get space in various real-estate projects, majority of which were not used.

"On a monthly basis we were paying Rs 40-50 crore (Rs 400-500 million) on such real-estate deals. Getting out of them was a nightmare," said Nayyar.

...

Mahindra Satyam ready to take on big boys of IT

Image: Infosys is facing legal problems.Photographs: Handout/Reuters

Immediately after acquiring Satyam, Vice-Chairman Anand Mahindra, Mahindra & Mahindra Group, had told analysts that the company aspires to be among the top three Indian services providers and that this acquisition forms a part of that strategy.

Today, Nayyar sounds a little more pragmatic. "We can be a tier-I player in our chosen area. One of them is telecom for sure. No large request for proposal is issued anywhere in the world without our participation.

In case of Mahindra Satyam too we will have chosen areas - like manufacturing and engineering services," he adds.

...

Mahindra Satyam ready to take on big boys of IT

Image: A view of Securities and Exchange Commission in the US.Photographs: Jonathan Ernst/Reuters

"Our story to clients and investors is that we will be a dominant and significant players in networking, mobility, analytics, cloud and security services. In certain vertical segments like life sciences, manufacturing, telecom, media and entertainment, we will be the big boys," said C P Gurnani, CEO Mahindra Satyam.

Analysts are convinced that if the current management invests in innovation and creates some more management bandwidth, the company would become a serious contender in certain segments.

"There are a few areas in which the management needs to take some action. One is the need to rejig their sales organisation. They need an experienced and senior person at that position.

...

Mahindra Satyam ready to take on big boys of IT

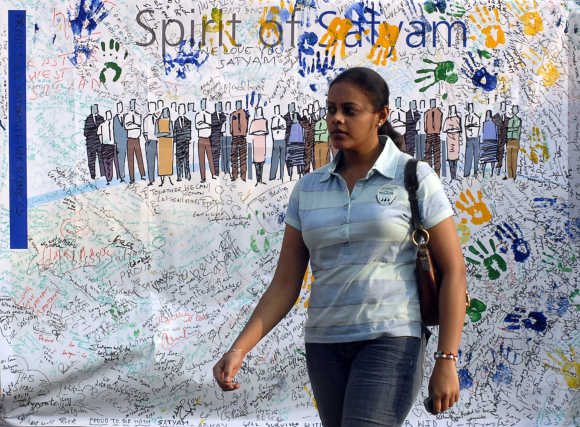

Image: Mahindra Satyam should do acquisitions that will allow them entry into new domains, says analyst.Photographs: Vivek Prakash/Reuters

"Two, while the company has spoken about new solutions and a non-linear focus, it has not been backed by equivalent lateral hiring. They need to plan for quick ramp-ups for which they need more experienced hands and do acquisitions that will allow them entry into new domains," points out Sudin Apte, principal analyst and chief executive officer of Offshore Insights.

Hansa Iyengar, senior analyst, Tools and Insights Ovum, believes the company already has systems and processes that it should now start leveraging.

"Tech Mahindra already has worked on the mobility segment, they can now use Mahindra Satyam's expertise in front-end systems of enterprises.

...

Mahindra Satyam ready to take on big boys of IT

Image: A view of a call centre.Photographs: Vivek Prakash/Reuters

Tech Mahindra was a crucial vendor of BT, a British telecoms operator, when the latter built its cloud platform. With such expertise they can just use that for other sectors as well," she said.

Iyengar also elaborates that because of their association with Fifa they are well known in markets like Latin America. They recently also made an acquisition in that geography.

"So while others have used Latin America as a near-shore centre, the merged entity can mine the domestic market because they already are a local brand there," points out Iyengar. Tech Mahindra also has CanvasM - a leading player in the mobile VAS space - which will also get merged.

...

Mahindra Satyam ready to take on big boys of IT

Image: It does not have an over-dependence on the US. A file photo.Photographs: Krishnendu Halder/Reuters

The company seems to be working to launch a few hundred new, indigenously developed applications for mobile phones.

Another major advantage: It will be perhaps the only company in the $1 billion bracket that does not have an over-dependence on the US, while Europe's contribution will be almost 34 per cent with rest of the world's share clocking in at 24 per cent.

"Having a big balance sheet helps in getting business in Europe, and the merged entity will be close to a $1 billion entity. As of now, it is the UK that constitutes almost 50-55 per cent of the revenue break-up from Europe.

...

Mahindra Satyam ready to take on big boys of IT

Image: An analyst thinks the BT account is a huge draw. A file photo.Photographs: Krishnendu Halder/Reuters

But unlike many, we have a big business and good references that will be key in this market, said Vikram Nair, head of Europe Mahindra Satyam.

Nair also thinks that the BT account is a huge draw when talking to prospective clients in Europe. Moreover, the company has launched a supersizing initiative wherein 80 of the top 100 clients have been handpicked for service line bombarding, points out a Citigroup Global Markets report.

Management expects this to be a huge vehicle of growth, with existing clients accounting for around 95 per cent of FY13 revenues. Mahindra Satyam also has significantly increased its Ebitda margins over the past two years, indicating that the turnaround of the company is on track.

...

Mahindra Satyam ready to take on big boys of IT

Image: Anand Mahindra with Vineet Nayyar.Photographs: Arko Datta/Reuters

This has been largely driven by a steady increase in its gross margins from around 24 per cent in FY09 to 39 per cent in Q3FY12.

However, while there's lots to cheer at, Nayyar still has a few battles to fight. One of them involves a dispute with the Income Tax authorities which slapped an order on the company to pay taxes of over Rs 600 crore (Rs 6 billion).

Then, there are damages of around $150 million plus interest that a group of investors led by Scottish investment house Aberdeen Asset Management has recently claimed in relation to the Satyam fiasco.

Relatively speaking, that's far from catastrophic for a firm that was written off as dead not so long ago.

article