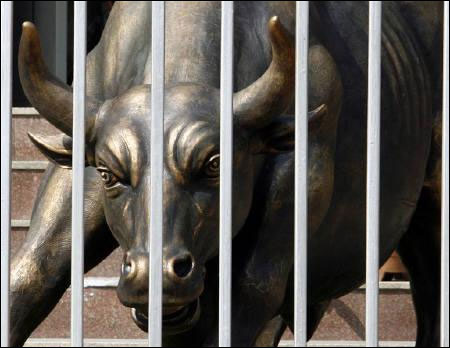

Photographs: Reuters Jitendra Kumar Gupta in Mumbai

The tussle between greed and fear could continue in favour of the latter for some more time. If market pundits are to be believed, there could be more pain for Indian equity markets though the Sensex is down almost 24 per cent from its peak of around 21,000 (made in November 2010).

Ramesh Damani, who is known for identifying market cycles and is a member of the Bombay Stock Exchange, says, "After every correction, the market is making newer lows and each negative news is helping it drift lower and lower, indicating the market is lacking strength. I do not think we are yet near the bottom of the market."

Chetan Parikh, director of Jeetay Investments, echoes the view. He says, "This is a true bear market and before the bottom formation happens there could be huge breakout at the lower side, which could be due to anything including a global event risk or domestic issues."

Most pundits see room for a market correction in the light of domestic issues, especially the falling rupee and a lack of reforms, coupled with looming global uncertainties.

Click on NEXT for more...

Markets haven't bottomed out yet, say leading players

Image: Rakesh Jhunjhunwala.Rakesh Jhunjhunwala, also known as India's Warren Buffett, said he did not expect the international scenario to improve soon.

"Once we have reform in the domestic economy, along with improvement in the international markets, I see India growing at 10-12 per cent. But, in the interim, investors need to prepare for a challenging period," he said last week, while addressing an analysts' forum organised by Equity Research Analysts Group (known as ERR).

Where is the bottom?

There is no way to know the bottom of the market, say market pundits. However, usually there are signs like investors' interest, valuations, volume, strength of the market, level of pessimism and liquidity that give clues indicating the formation of a bottom. So, what are the current indicators suggesting?

There are instances and periods when the markets have taken a long time to recover. For instance, between 1994 and 1998, the Sensex moved in a band and returns from a point-to-point basis were almost nil.Click on NEXT for more...

Markets haven't bottomed out yet, say leading players

Photographs: Arko Datta/Reuters

Again, from 2000 to 2003, the markets went nowhere. Markets have a tendency to remain sideways for a long time before they form a bottom.

"A typical bear market will take seven-eight years before bottoming out. We have seen Indian markets completing about five years of a bear phase (the current one). Maybe it could take two-three years before a new bull market starts," says Parikh. During this period, there could be a few rallies but that would not indicate the end of the bear market, he adds.

Most experts say there is pessimism in the market but the magnitude is not extreme, which is why they are anticipating more pain. In fact, they say when investors lose complete faith in equities and there is a general feeling of making huge losses, that will be the time of extreme pessimism (like the one witnessed during the 2008-09 market crash), which would indicate the markets are bottoming.

Click on NEXT for more...

Markets haven't bottomed out yet, say leading players

Photographs: Reuters

In terms of valuations, the markets are trading below historical averages but are still not reflecting some event risks. For instance, based on FY13 expected EPS of the Sensex of Rs 1,260, the PE at the current level works out to less than 13 times, marginally below the 10-year average of about 14 times.

If we take the reference of the 2008-09 financial crisis, where the global and domestic issues played major parts in bringing down the markets, the Sensex PE fell to almost 10 times based on one-year forward earnings. Applying a similar multiple, the Sensex value works out to nearly 12,600.

As of now, market pundits do not see such a possibility unless the crisis in the global markets and domestic economy becomes bigger.

On his views about the market in these uncertain times, Jhunjhunwala said, "I personally do not see the Nifty going below 4,500-4,600."The Nifty at 4,500-4,600 means the Sensex will be around 14,800-15,200. Chetan Parikh also believes in the event of a huge downward breakout it is possible the Sensex could drift near 15,000 levels, which is where the opportunity to buy will emerge.

Click on NEXT for more...

Markets haven't bottomed out yet, say leading players

Photographs: Reuters

What's in store?

As no bear markets are permanent, whenever the recovery takes place that could result in a strong bull market. "Once the new bull market is formed, it could be a mega bull market, which could take the Sensex in six digits," says Chetan Parikh.

But, experts also strongly believe that may not happen in a hurry. Jhujhunwala said for a bull market similar to the one seen during 2003-2008, it was going to take a long time.

It would need a good combination of strong earnings and GDP growth, an extremely conducive business environment and negligible uncertainties.

Click on NEXT for more...

Markets haven't bottomed out yet, say leading players

Photographs: Reuters

What should investors do?

For now, times are tough and the situation is unlikely to change in a hurry. Jhunjhunwala also made a point that the challenging market environment did not mean investors should pull out their money and put it on interest (fixed deposits).

And, if investors are planning to first sell and come back when the rally starts, he says, do not try to time the market as we are not that smart (to do it successfully).

It is thus not surprising that even as Jhunjhunwala believes the market has not bottomed yet, he and his family have been buying small stakes in companies (where they already have a holding) like Aptech, Delta Corp, A2Z Maintenance.

Click on NEXT for more...

Markets haven't bottomed out yet, say leading players

Photographs: Reuters

Though a lot of concerns are already in the price, some event risks also exist. Hence, investors could also choose to stagger their investments and more importantly, they should not try to time the market.

"I do not know if it is time to be greedy. I am not saying go and buy tomorrow. But, there is a lot of fear in the market, which could be gradually used (as an opportunity) for making a good long-term portfolio of quality stocks," says Raamdeo Agrawal, joint managing director and co-founder of Motilal Oswal Financial Services.

"I do not think the investors should rush at this point in time to buy (equities), but if there is more correction they could start buying in smaller chunks," said Damani.

Click on NEXT for more...

Markets haven't bottomed out yet, say leading players

Photographs: Reuters

What they also need to remember is that while equities carry an higher element of risk, investing in them when the markets are down is also likely to be more rewarding (though patience is a must) than when the markets are on a high.

"Good returns are seldom made on investments made in good times. Rather, good returns are typically made on investments made in adverse times," wrote Prashant Jain, executive director & chief investment officer of HDFC Asset Management Company, in a recent note to investors.

He added, "Times such as the present, when the markets are not doing well, should actually be looked upon as a window of opportunity for savers to invest more in equities, so that when the good times come, there are meaningful investments in equities.

The lower the markets are, the bigger is the opportunity and the longer the markets remain depressed, the better is the opportunity for savers."

article